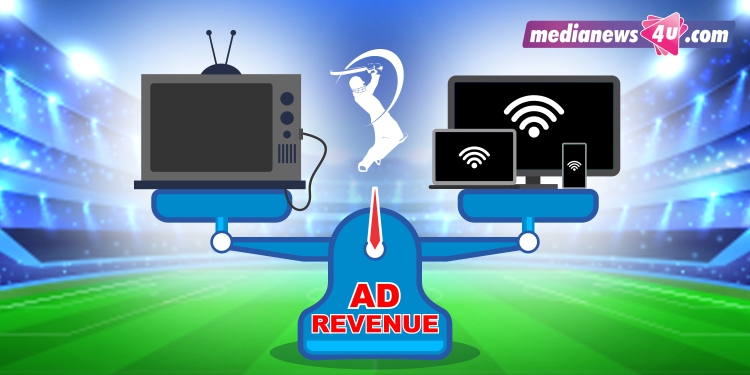

It’s Star Sports versus Jio Cinema. Or linear TV versus OTT. Whichever way one looks at it, it’s war. Indian Premier League (IPL) 2023 is the trending topic with the respective TV and digital rights holders out to snare their share of advertiser budgets.

According to media reports, Viacom18 with the digital rights is targeting Rs.3,700 crore in ad revenue in IPL 2023.

In IPL 2022, Disney+ Hotstar had reportedly earned advertising revenue of Rs.1,500 crore, while Disney Star’s live broadcast on TV earned Rs.3,500 crore.

Now, Jio Cinema is seeking mid-roll ad rates of Rs.200 to 250 per 10 seconds (cost per thousand), pre-roll ads of Rs. 225 to 300 per 10 seconds and spot rate (between overs) of Rs.6.5 lakh per 10 seconds on connected TVs (CTVs).

IPL will be streamed live on Jio Cinema for free as was the case with the FIFA WC.

With the battle gaining momentum, Medianews4u.com checked with industry experts for their views on “Will digital ad revenue overtake that on linear TV in IPL 2023? Is the FIFA WC a like-for-like comparison?”

‘Might take a little longer for the gap to be bridged’

Digital advertising will bridge the gap with TV considerably but may not overtake TV advertising in 2023. Till last year the advertising spends were 80:20 in favor of TV – but this year onwards with the split in IPL rights between TV (Disney-Star) and digital (Network 18) the competition will intensify.

Also Network 18 will use the ability of digital to target niche segments using personalisation – bringing in a lot many small advertisers into the fold.

But I would still think it might take a little longer for the gap to be bridged fully because a lot of people still watch IPL in a bit of a community – people get together with friends and family and watch.

The biggest reason for digital growth is that the content taste of audiences is becoming more regional and local. People are watching a lot of short format videos on YouTube and other TikTok-like sites and most of this is being consumed on their mobile phones. Therefore digital is attracting more eyeballs and advertisers are moving there.

TV is no longer a predominantly family platform, and viewing is becoming more individualised and personalised in nature. Also there is a lot of fragmentation of TV. At one time you could take two or three large popular TV serials and cover a large part of the country. Now it has become very fragmented, there are a lot of regional and local channels and new genres like news, sports have also proliferated.

Between 2019 and 2022, the number of brands using TV has dropped from 16,000 to 13,000, and at the same period the number of brands using digital has moved from 33,000 to 1,08,000. This is hard data that shows that a lot more advertisers can get into digital because of the low ticket size. Television requires a much larger outlay. So the smaller ticket size of digital gives them the long tail of advertisers which television does not allow.

Published numbers of Alphabet (Google + YouTube) indicate that they have accrued Rs.25,000 cr of ad revenue in India, Meta (Facebook + Instagram + WhatsApp) is at Rs.17,000 cr. These platforms have emerged as the largest media platforms in India. Then there is Amazon and Flipkart – also big attractors of ad spend because of their reach and influence on buying. By comparison, TV’s growing at a much slower pace.

For FIFA the viewership was very large because Jio made it available on Jio Cinema, therefore a lot more people could watch it. There was actually no barrier to entry as such. Secondly, football, outside of Goa, Kerala and Northeast, is still a relatively more upper social economic viewing phenomenon. It doesn’t go as deep down the population strata as cricket does, so therefore it is not a like-to-like comparison.

– Lloyd Mathias, Business Strategist and Angel Investor

‘The Indian audience has the ability to surprise in both directions’

I don’t think this is the year when digital will overtake TV. I suspect advertisers will want to wait and watch. But if digital performs as is being promised, next year could be the year it blows up big time.

The free part is the same, and of course it will draw huge eyeballs. But the properties are quite different. So my prayer is only that the load sizing has been done right.

Net of that, there’s still the question of whether people have gotten tired of the IPL. And regardless of price and platform, whether the property will continue to grow. That’s anybody’s guess. The Indian audience has the ability to surprise in both directions.

Will be very interesting to watch, of course.

– Karthi Marshan, Former CMO, Kotak

‘TV AdEx will be 2x to 5x of digital investments’

The penetration of TV viewership in India – satellite as well as cable networks in semi-urban and rural areas – is much deeper and cost effective, when compared with watching programmes on personal devices.

For a few years now, TV AdEx will be 2x to 5x of digital investments by brands. Biggies Google and Facebook have been changing algorithms so often that it leaves digital marketing managers puzzled as the RoI is never recovered.

Further, the attention span on digital devices is limited. If there is a message on Whatsapp or an e-mail, the user would leave the app and move on while TV in the background would be a passive medium to watch.

Comparing spends with FIFA WC is not justified, given the reach that IPL has (largely within India) while football is among the top three watched sports worldwide.

– S. Shriram, Management Consultant and Former VP – Sales & Marketing, Levista Coffee

‘Digital overtaking TV is still far off for events like IPL’

FIFA is not a like-to-like comparison. We are a cricket-loving nation; football is more a metro phenomenon or prevalent in a few states.

As far as ad revenues are concerned, I feel digital taking over linear TV is still far off when it comes to sporting events like this.

– Arjun Bhatia, Senior VP and CMO, Matrimony.com

‘Television media will still reign supreme’

Though there is an exponential increase in digital ad revenue, for 2023 television media will still reign supreme when it comes to mass branding initiatives leveraging the IPL.

The digital medium can be used in a more targeted and creative manner and I look forward to seeing some innovative campaigns by brands in the digital space.

In terms of history and scale, it will be difficult to compare the FIFA WC to IPL. In terms of sports also, cricket cannot be compared with football since the audience and reach metrics differ from region to region.

Over the years, we have observed the mass appeal for cricket continue to grow and the love for the game to be constant. After a gap of a couple of seasons, the games would be played with full stadiums and home grounds so the overall hype would be higher and brands would look to engage and connect with their targeted audience on a larger scale.

– Mark Titus, AVP – Marketing, Nippon Paint India