Mumbai: NielsenIQ (NIQ), a consumer intelligence company, has released the Full View of Modern Trade Retail Trends in India across the FMCG and Tech and Durables market. NIQ Market Intelligence reveals trends that highlight India’s dominant position in the Asia Pacific region. India emerges as the only market consistently delivering double-digit growth in both the FMCG (Fast-Moving Consumer Goods) and Tech and Durables (T&D) sectors, underscoring the resilience and evolving preferences of Indian consumers.

Modern Trade Remains a Preferred Channel Amid E-Commerce Growth

While online channels continue to grow, modern trade formats remain an important channel among consumers. The latest data from NIQ for the period MAT March 2024 vs 2023 shows a 2% increase in FMCG Modern Trade salience in urban India, along with a 4% rise in T&D Modern Trade, underscoring the importance of Modern Trade as a channel for marketing and sales execution.

Sonika Gupta, executive director, customer success India at NIQ, stated, “According to our NIQ Consumer Life Global study, 41% of surveyed urban Indian shoppers see a product online but choose to purchase it in-store, while 43% delay purchases until they find sales or special offers. The Modern Trade channel continues to offer a consistent and convenient shopping environment, which remains attractive to consumers, even during periods of inflation.”

Pricing Dynamics: Mass and Premium Segments in Modern Trade

Despite inflationary pressures, Modern Trade has shown resilience, with double-digit volume growth continuing regardless of price fluctuations. Interestingly, there is a growing preference for products in premium-plus pricing, which accounts for approximately 40% of FMCG sales and 30% of T&D sales, both experiencing significant growth.

“Many new product launches in Modern Trade are within the premium-plus space, reflecting a growing consumer willingness to pay up to 2X the average price for superior benefits and features”, Gupta added.

Brands may consider optimising their offerings within this segment to maintain competitiveness and meet consumer expectations.

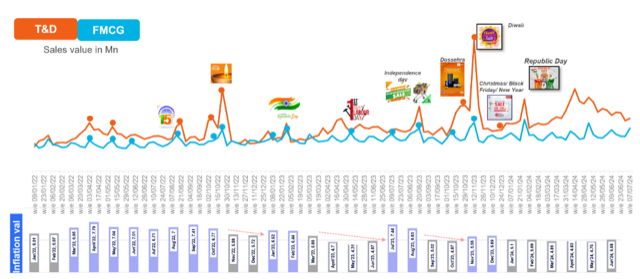

Big Days or Festive Periods Continue to Drive Sales

Festive seasons and peak shopping periods remain key for both the FMCG and T&D sectors. NIQ’s data shows that these periods contribute 20% of incremental sales for FMCG and 60% for T&D. Non-Food categories, in particular, grow 1.8 times faster than Food during these periods, driven by deep discounts and consumer preference for non-essentials.

Key categories such as toothpaste, toilet soap, and washing powder lead the charge, benefits with 20-30% incremental sales during big days.

Source: NIQ RMS Market Intelligence, GfK NIQ Market Intelligence Offline Sales Tracking

Private Labels and Small Players Disrupt the Market

The report also notes changes in the competitive landscape within Modern Trade, with private labels (PLs) and small manufacturers gaining traction. Private labels are growing at a 1.5 times faster rate than large manufacturers, particularly within the mainstream pricing segment. Small players, on the other hand, are driving 70% of new launches in MT, focusing on natural ingredients and luxury pricing that is more than 200 times of the category average price.

In the T&D sector, emerging brands are also experiencing high double-digit growth, bringing innovative features that appeal to the modern consumer. Marketers should remain vigilant as consumers increasingly explore new brands offering unique benefits and cutting-edge features.

Small Packs on the Rise

While large packs have traditionally dominated Modern Trade, there is a noticeable shift towards smaller pack sizes, which are now growing at double the rate of large sizes.

Gupta added, “The growing presence of small players, private labels, and the increasing popularity of small packs are contributing to a more competitive Modern Trade environment, placing significant pressure on shelves that now accommodate over 78,000 items. This trend is evident across both Food and Non-Food categories, offering brands the opportunity to optimize their existing assortment for higher ROI while also innovating with smaller packs to encourage consumer trials.”

To stay competitive, businesses must strategically optimize their product assortment, ensuring enhanced visibility and maximising ROI from the Modern Trade Channel. Brands can effectively leverage the channel’s consistent double-digit growth and secure a stronger foothold in this evolving market.