Ujjivan Small Finance Bank (Ujjivan), a small finance bank in India earlier this year had done a brand campaign ‘Banking Jaise Meri Marzi, Ujjivan makes it easy-easy (Bank the way you want, Ujjivan makes it easy-easy)’. The campaign looked to underscore the Bank’s dedication to giving customers the freedom to bank at their convenience, with secure and hassle-free experience.

The campaign’s jingle, ‘Banking Jaise Meri Marzi, Ujjivan makes it easy-easy,’ depicts a more easy and convenient way of banking with Ujjivan, saving time and effort. The film illustrated that banking with Ujjivan is both effortless and enjoyable, across phygital platforms. Ujjivan meets the diverse needs of its customers at their convenience, be it a working professional seeking accessibility, convenience, and personalisation or senior citizens seeking simplicity and trust in traditional banking.

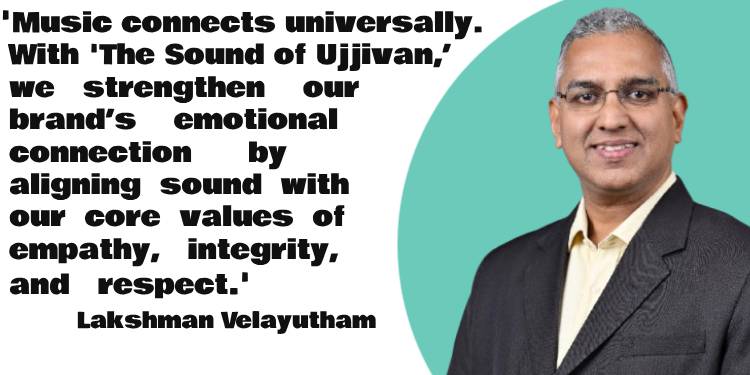

Medianews4u.com caught up with Lakshman Velayutham, CMO, Ujjivan Small Finance Bank

Q. Has the bank made recent enhancements to its website and app to make them more user friendly? How important is personalisation?

We recently revamped our website to enhance the user-friendly experience for our online visitors. We strengthened our Chatbot assistance to refine and provide more relevant information to our users. Last year, we introduced digital savings account and fixed deposit, and made it an end-to-end paperless process for customers to bank from anywhere, and anytime. Our Mobile Banking app has been designed as a one-stop destination for all banking and financial products and services.

Ujjivan caters to the mass market segment, it is imperative for us to personalise our marketing communications for a wider reach. We provide digital services like Internet Banking, Mobile Banking, Video Banking in nine languages and Phone Banking in 13+ languages with 450+ services along with Whatsapp banking.

Q. When you deal with customers who have little or no banking experience, is lots of online educational content needed in marketing and communication activities?

Small Finance Bank was established with the primary goal of furthering the Govt. of India’s mission of promoting financial and digital inclusion for the un-served and under-served populations of the country. Financial education is core to Ujjivan’s mission to give more low-income families the financial and digital tools, and resources they require to achieve security and prosperity.

Diksha+, Ujjivan SFB’s financial literacy programme, is considered as one of the best financial literacy programs in India. The project seeks to enable women from low-income families entering the formal banking system to understand the benefits of a small finance bank. It teaches them the importance of financial planning, as well as concepts and tools that help them save judiciously, borrow responsibly, and manage debt prudently based on their financial capacity. Since its inception, the bank has trained about 12.4 Lakh beneficiaries through Diksha+ Program.

For our younger audiences, we introduced ‘Chillar Bank’ – a financial literacy programme aimed at imparting financial literacy to the children of our micro banking customers, teaching them saving habits and educating them on digital frauds. The program has been creating a positive impact on their parents, enlightening them on the benefits of saving early, and making long-term investments for their future.

Q. What role is AI playing for the Bank from products to marketing activities?

AI can be of great help if we can make the appropriate use of it. We are in the stage of understanding AI, and look forward to implementing it in our upcoming marketing projects. I believe, that creating an impactful AI-integrated marketing campaign will require a combined effort from all business verticals.

Instead of asking AI about the problem, it is beneficial to ask for solutions directly when we know the opportunities or challenges. This approach may help marketing teams gain a deeper understanding of the business and develop effective strategies achieve brand goals.

I also believe that a CMO should empower their team members with AI tools, to bring agility and efficiency to the team. It will not only help them to better marketing execution but also accelerate positive business outcomes.

Q. Is conveying a feeling of trust important in marketing activities done?

Trust is the fundamental element that binds individuals, communities, and institutions together, and rests at the centre of every successful relationship. Our marketing campaign last year “Ek Doosre Pe Bharosa, Ek Dusre Ki Tarakki” has resonated deeply with our customers. We are committed to providing banking and financial services to the aspiring middle class through financial & digital inclusion, which has resulted in the development of strong bonds of trust with our clients over time.

Q. In the festive season will the bank do a lot of on-ground and digital activities to spread awareness about its offerings?

On-ground and digital activities have been an integral part of our overall umbrella marketing strategy. Last year, we orchestrated several on-ground campaigns such as ‘Band Baja Bappa’: an engaging experience with sound sensors, and ‘Any Time Modak’: a modak dispenser ATM on wheel during Ganesh Chaturthi. This year, we conducted ‘Rath Yatra’: an immersive VR technology initiative to provide an engaging experience to promote our ‘Maxima Savings Account’. We plan to run numerous digital and region-specific on-ground activities this year to spread awareness about our offerings at focussed branches and catchment areas.

Q. How did the idea of the campaign ‘Banking Jaise Meri Marzi’ come about?

Further to last year’s campaign around Trust, this year we wanted to underscore the Bank’s dedication to giving customers the freedom to bank at their convenience with a secure, and hassle-free experience. Ujjivan meets the diverse needs of its customers at their convenience, be it a working professional seeking accessibility, convenience, and personalisation or senior citizens seeking simplicity, and trust in traditional banking.

The campaign’s catchy jingle “Banking Jaise Meri Marzi, Ujjivan Makes it Easy Easy” depicts a more easy and convenient way of banking with Ujjivan, saving time and effort. Our new campaign showcases how banking with Ujjivan is both effortless and enjoyable.

Q. What are the various facets of the campaign?

This seven-week brand campaign commenced on September 02, 2024 was conducted in eleven regional languages. It was amplified across web, OTT Channels, and social media platforms through influencer engagement, and at Ujjivan SFB branches.

Q. The bank also recently launched its sonic brand identity ‘The Sound of Ujjivan’. What factors were kept in kind to ensure that it forges an emotional connect with consumers at various touchpoints?

Music is a universal language that can forge an emotional connect with anyone and anywhere. We wanted to strengthen our connection with the customers through the strategic use of sound to capture fundamental values like Opportunity and Freedom which seamlessly resonates with what Ujjivan’s core value stands for – Empathy, Integrity, Respect, Fairness.

We used ‘Geneva Emotional Music Scale’ to create Ujjivan SFB’s sonic brand identity. It works in the iteration meetings in the development process, to secure the highest possible reflection of the brand, core values, and alignment to the fulfilment of expressional objectives. The method is developed based on theories in the areas of audible semantics, semiotics and music psychology and is also used when validating among large groups of respondents. This approach makes for a strong and efficient creation process, ensuring the desired expressional profile in tune with Ujjivan’s target audience.

Q. What made the bank decide to choose Unmute, a Scandinavian sonic branding agency to do the job?

Ujjivan SFB chose to collaborate with Unmute, a Denmark-based agency to leverage their global expertise, and innovative approach in crafting brand narratives and musical identities. Unmute’s experience in diverse markets offers a fresh perspective that could help Ujjivan stand out in a competitive landscape; while their understanding of cultural nuances allowed for the creation of a brand anthem, honouring India’s rich diversity with a universal approach.

Q. The bank has also done a ‘World No Tobacco Day’ initiative. How important is it to reach consumers in unexpected and surprising ways?

Ujjivan SFB’s approach through its initiatives has always been unique, and customer centric. Breaking through advertising clutter is essential in today’s oversaturated media landscape, where consumers are bombarded with countless marketing communications daily. To stand out, campaigns must employ creative and unexpected strategies that disrupt conventional thinking and captures consumer attention. This approach not only enhances brand recall but also encourages customer engagement.