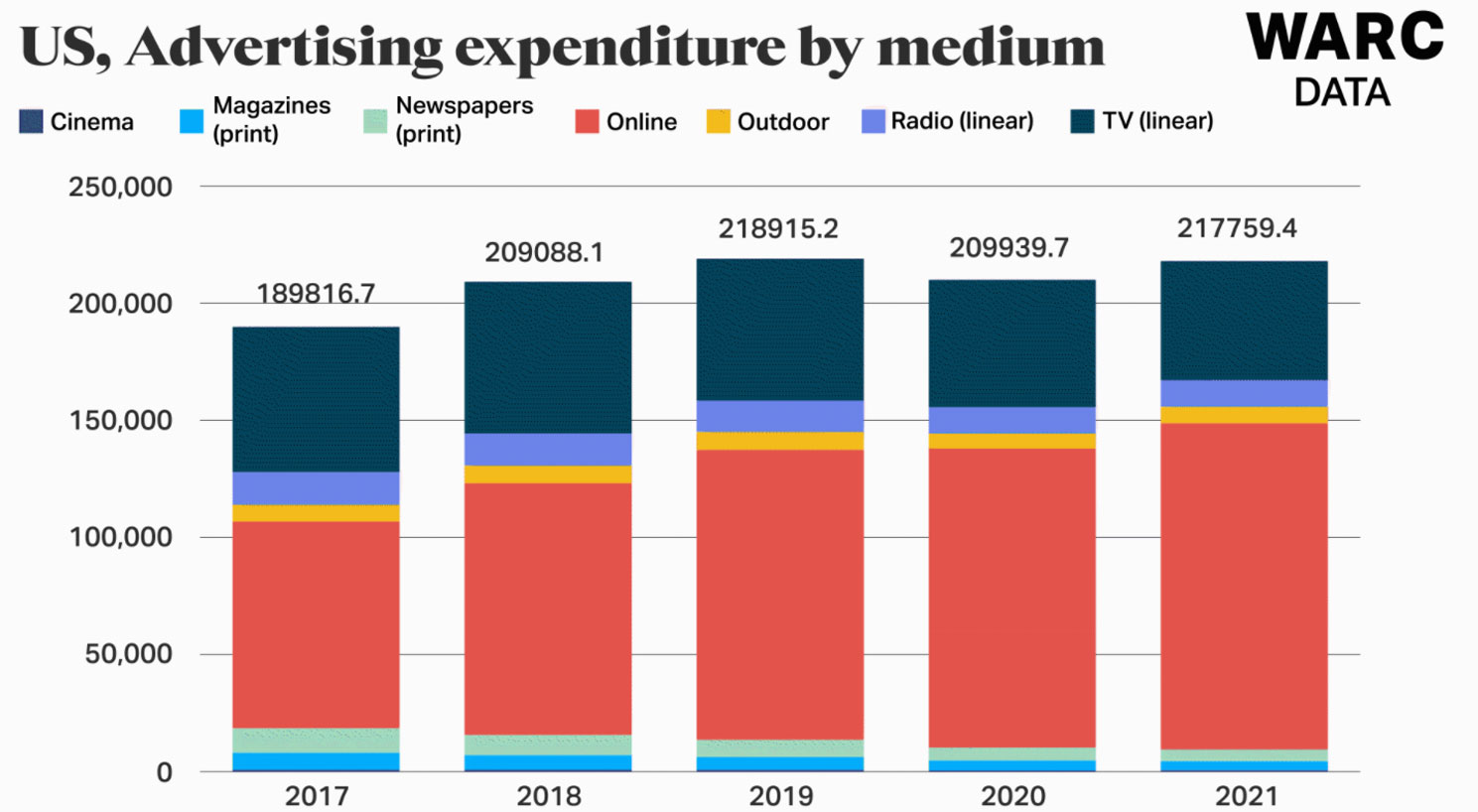

The US advertising economy is projected to be worth $218 billion this year, according to WARC Data. Since it has the largest spend in the world, the dynamic US ad market, even in a build-back year, is expected to be 15% bigger than APAC and 36% larger than EMEA.

The pandemic has accelerated changes in media consumption, which in turn has altered media allocation as consumers flock to streaming channels, but there are other major events that are shaking up the market as well.

Cathy Taylor, US Commissioning Editor, WARC, says: “In this second installment of our Spotlight US series we look at a market with so many moving parts that some of the big trends have little to do with COVID-19.

“As the industry also wrestles with systemic racism and further privacy regulation, we’ve brought together a host of expert knowledge, backed by WARC insights and data, to help guide our industry through challenges and seek new opportunities in a fast-evolving media market.”

In “Media strategies for a shifting US landscape,” WARC explores:

- Rethinking the US TV upfront ad sales to be more responsive

The COVID-19 pandemic called the annual $20 billion US TV ad sales upfront market into question, as it highlighted the need for marketers to have more flexibility in making advertising deals.

Ben Jankowski, SVP/Media for Mastercard, explains in this interview, how awareness is rising and how to move forward, and Mike Piner, EVP, Advanced TV & Media Innovation at Interpublic Group’s Mediahub, calls for pivoting the upfront to a system that is more tailored to marketer KPIs.

This Spotlight US also takes a look at how consumers have reacted to local TV advertising during the pandemic. Bill Day, SVP/strategy at Magid discusses how consumers rated good ads even more highly, and bad ads even more poorly.

Ben Speight, EVP, Director of Client Services and Strategic Initiatives at Lockard & Wechsler, assesses here how brands should rethink their approach to TV planning, especially now that the majority of new subscribers to streaming services are over the age of 40.

- The state of first-party data and new routes to targeting in a post-cookie world

Despite concerns by 50% of North American marketers on how to target going forward, according to Kantar, most marketers are not preparing for when Google phases out third-party cookies and Apple makes its IDFA (identity for advertisers) opt-in. In her article, Kantar’s Jane Ostler looks into alternatives to cookies.

And John Nardone, CEO of Flashtalking, focuses in his piece on how a company moves forward will be dependent on the current strength of its first-party data.

- How data is transforming TV advertising and opening the doors for smaller marketers

Advances in data-driven TV advertising are opening up new possibilities. Jane Clarke, Howard Shimmel, and Gerard Broussard of the Coalition for Innovation in Media Measurement emphasize that the content and advertising data coming from set-top boxes and Smart TVs is privacy compliant, making it a safe space for marketers, but first, it has to be successfully commingled.

Dave Morgan, CEO of Simulmedia, points out how data is being used in linear TV, allowing brands to start small, learn and optimize, at budgets that are higher than digital, but much lower than traditional TV.

But there’s a lot of work necessary before data-driven TV can reach its full potential, as Jim Spaeth and Alice Sylvester of Sequent Partners discuss in their article on needed data and analytics breakthroughs.

- The ways in which sponsorship is creating opportunities for a new set of brands and the move toward hybrid events

In WARC’s Marketer’s Toolkit 2021, 35% of marketers surveyed expect to decrease investment in sponsorship this year, while only 17% planned to spend more in 2021.

For some brands, this will create opportunity, says Jim Andrews, CEO of A-Mark Partnership Strategies, as affordable sponsorships, and the absence of some traditional sponsors, can help others, such as Pit Boss Grills and WHOOP, enter the market.

- The rise of the new media marketplaces that fund under-represented publishers

In a country wrestling with the effects of systemic racism, and a digital media world dominated by the triopoly of Google, Facebook, and Amazon, there’s been a concerted effort over the year by publishers and media agencies to create ad marketplaces that allow brands to invest in under-represented publishers. Samantha Skey, CEO of SHE Media writes about her company’s Meaningful Marketplaces, which allow brands to vote their values, at scale.

These new changes are allowing brands to reach Black, Hispanic, and LGBTQIA communities, who have committed audiences, and invest in these publishers at scale.