With the advent of digitization, the High Definition (HD) wave hit the Indian TV industry, and several broadcasters launched new HD channels or HD versions of their existing SD channels in order to offer a better viewing technology and enhance the TV viewing experience.

The growth of HD channels over the last 2 years has positively impacted the industry in terms of subscription & advertising revenue, and is becoming a game changer in the quality of television content that is being consumed.

The latest edition of THINK from BARC has taken a closer look at this HD phenomena by exploring various factors associated with the HD Viewership landscape:

The HD Landscape:

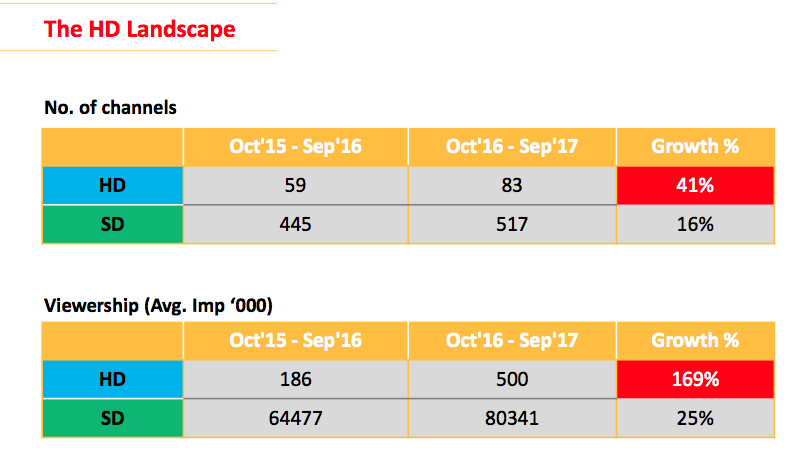

Over the 2-year period from October 2015 to September 2017, the number of active HD channels in India have risen from 59 to 83 HD in 2017. While the number of channels has gone up by only 41%, the viewership share has grown by more than 160%

Who Watch HD Channels:

Gender: HD Channel viewership in India is slightly skewed towards Male audiences, who contribute a 51% eyeball share to the overall HD channel viewership, as opposed to SD channels where no gender skew is observed.

Age: While the Kids and Youth (2-21 yrs) form the larger share of the SD viewership, the Young Adults and Adults (22-40 yrs) together comprise a majority share of HD viewership in India (35%). This audience may comprise of the new- age millennials who want to have seamless experiences and are early adopters of new technologies and innovations.

NCCS: NCCS A is the largest contributor to HD Channel viewership in India and the second highest share of eyeballs comes from NCCS CDE.

A large majority of HD eyeballs are coming from Urban India, as opposed to SD viewership where Rural India contributes the larger share of eyeballs

Viewership Trends:

The viewership of NCCS A & NCCS B are relatively stable, with minor spikes during key events.

For NCCS A, the rise in HD viewership post Wk 16 can be attributed to the growth in viewership of Sports genre HD channels due to IPL 10 (Wk16) and ICC Champions Trophy (Wk 22). The increasing trend line Wk 28 onwards is a result of massive growth of GEC Genre viewing on HD channels.

In contrast to NCCS A & NCCS B, the HD viewership for NCCS CDE seems to be highly fluctuating over time.

The HD channel viewership for NCCS CDE, has peaked in Wk12, which is majorly due to growth in viewing of the GEC and Movie genres. The upward rise between Wk 21 – Wk 26 can be attributed to ICC Champions Trophy, as Sports genre on HD channels has grown during this period.

This may be an indication of the fact that NCCS A & NCCS B are loyal / habitual viewers of HD & hence less susceptible to fluctuations. NCCS CDE, on the other hand, are driven to HD by key events.

Analysing the viewership trends by Town Class, it is interesting to note that Below 10L Urban towns contribute greater Impressions in absolute numbers (post Wk14).

The HD channel viewership is mainly driven by the GEC genre in the Below 10L urban market. A drop in the HD GEC viewership in the initial weeks led the viewership to drop, while the HD GEC viewership grew in Megacities during the same period. (Wk 10 – Wk 14)

Viewership spikes observed post Wk 21 can be attributed to the increase in HD Sports genre viewership, owing to the ICC Champions Trophy play.

An overview of the performance of the top 10 ad sectors on HD channels and how they fare, vis a vis FCT and share of Impressions reveals that the Services sector is the leading ad sector on HD channels, with the highest FCT and the largest share of views. It is primarily driven by Internet Services & Online Shopping / E-commerce categories.

F&B and Personal Care/ Personal Hygiene are among the top 3 performing sectors in terms of FCT as well as Impressions, not only on HD but on SD channels as well. These sectors seem to have competitive mass advertisers, as they are being driven by the same categories on both channels.

With respect to air-time and Impressions, the top 10 Ad sectors with highest FCT, are also the most viewed in terms of share of eyeballs. The only exception is the Personal Accessories Sector.

Genre Trends:

It is observed that GEC, Movies and Sports genres together comprise 95% of the HD channel viewership pie, of which GECs dominate a majority share that can be attributed to the supply of HD channels, which is also concentrated within these 3 genres.

The GEC genre appears to be quite popular on HD channels, as 31 out of 83 (37%) HD GEC channels contribute 62% to the viewership pie.

The channel share for Movies is 24% and for Sports is 14%

Exploring this thought further and look at the genre performance of HD channels vis a vis SD channels reveals the fact that SD channels deliver a higher reach & ATS as compared to HD channels in most cases. It is noted that GEC and Sports are the only genres to deliver better ATS as compared to their SD counterparts, indicating better engagement.

In terms of Reach and ATS of genres within HD, it is observed that while HD GEC channels have lower Reach than HD Movie channels, GECs not only dominate the HD viewership pie, but also deliver better ATS when compared to SD GEC channels.

Looking at the share of Impressions by Genre on SD and HD channels, GEC, Sports & Lifestyle genres show a relatively higher propensity for viewing on HD channel as opposed to SD. While GEC genre enjoys the largest share of impressions within both HD & SD channels, it has a substantially higher share in HD viewership.

On the other hand sports genre & lifestyle genre performing substantially better on HD in terms of relative ranking. Conversely, News, Kids & Music genres seem to be performing much better on SD feed.

While GEC and Sport genres perform better on HD in terms of share of Impressions as well as engagement,The HD viewership of GECs is fueled entirely by their core content viz. Serials.

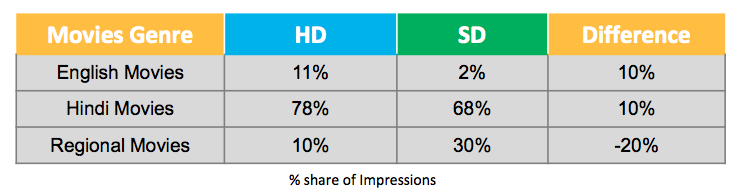

Among Sports channels, HD emerges as the preferred mode of viewing for Cricket and marginally higher for Soccer. Moreover, both English movies and Hindi movies perform relatively much better on HD channels.