London:UK adspend rose 6.3% year-on-year to reach £23.6bn in 2018, marking the ninth consecutive year of market growth and highest annual total since monitoring began in 1982.This record investmentis highlighted in today’s Advertising Association/WARC Expenditure Report, which is the only one to collect advertising spend data from across the entire media landscape.

The final quarter of 2018 recorded expenditure growth of 5.7% over Q4 2017, with adspend reaching £6.5bn. This includes adspend during the crucial Christmas period and marked the 22nd consecutive quarter of market growth.

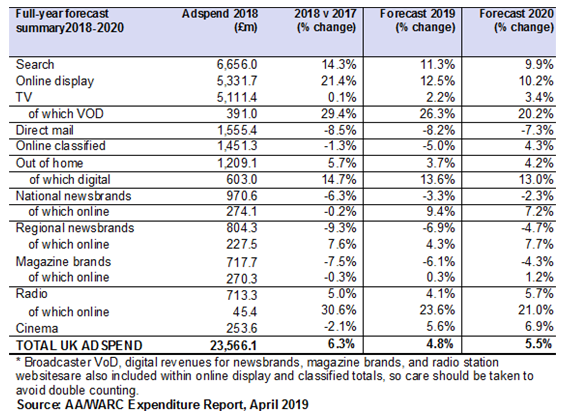

Advertising spend is forecast to grow 4.8% this year, with a further rise, of 5.5%, projected for 2020.This would push investment to over £26bn, completing more thana decade of continuous expansion for the UK advertising industry.

These figures follow a report released by the Advertising Association last month showing export of UK advertising services had hit a record high of £6.9bn in the latest annual figures for 2017. The potential for growth was celebrated in the first-ever Export Month with trade missions in partnership with the Department for International Trade to China, Japan and the USA.

Stephen Woodford, Chief Executive at the Advertising Association commented: “These figures demonstrate, once again, the strength and resilience of the UK advertising industry during a time of political and economic uncertainty in the UK – they are a testament to the world-class capabilities of the third of a million people working in advertising and marketing services across the UK. With every pound spent on advertising generating six pounds of GDP, a strong advertising industry is a key pillar of a strong economy.

“With further growth predicted for both 2019 and 2020, UK advertising looks set to deliver over a decade of continuous growth. Like all UK industries, we hope to see a positive resolution of the Brexit situation, with business-friendly data, immigration and trade outcomes that could further boost this forecast growth”.

Overall market growth is being driven by increasing spend on search (up 14.3%) and online display advertising (up 21.4%), with further, but milder,growth predicted for 2019 and 2020.

The positive story for onlinead formats was reflected across a number of media. Notably high growth was recorded for online radio ad formats, with a year-on-year rise in 2018 of 30.6%. Ad investment in broadcaster video-on-demand (VoD)rose 29.4% to reach £391m, whileregional online newsbrandsrecordedgrowth of 7.6%.

James McDonald, ManagingEditor at WARC commented:“Despite most traditional media being stagnant or in decline, the UK’s ad market expanded at its strongest rate since 2015 last year, and the growth is primarily being driven by rapidly rising investment in paid search and online display formats, particularly social media and online video.

“These online components account for just over half of UK advertising spend today, and both are almost entirely data-driven, enabling advertisers to pair their messaging with internet users based on their digital footprint. These tools are also accessible, enabling a long-tail of SMEs to invest, and this has transformed the DNA of advertising in recent years.”

The headline findings for the full year 2018 results are presented in a slightly altered form to provide a more detailed breakdown of what was previously termed internet advertising. The purpose is to provide greater clarity and understanding of the UK’s current advertising expenditure by media type. This update is the result of an in-depth consultation and review undertaken with a wide range of AA/WARC Expenditure Report subscribers and industry experts.

The key bullet points from the report show:

- UK adspend rose 6.3% year-on-year to reach £23.6bn in 2018 – the ninth consecutive year of market growth

- UK adspend rose 5.7% year-on-year to reach £6.5bn in Q4 2018 – the 22nd consecutive quarter of market growth

- Both the 2018 annual and fourth quarter totals were the highest on record

- Over H2 2018, UK adspend rose 5.6% year-on-year to reach £12.1bn – a new high

- The forecast for 2019 has been upgraded to £24.7bn, equivalent to 4.8% growth

- The UK’s ad market is expected to grow a further 5.5% in 2020