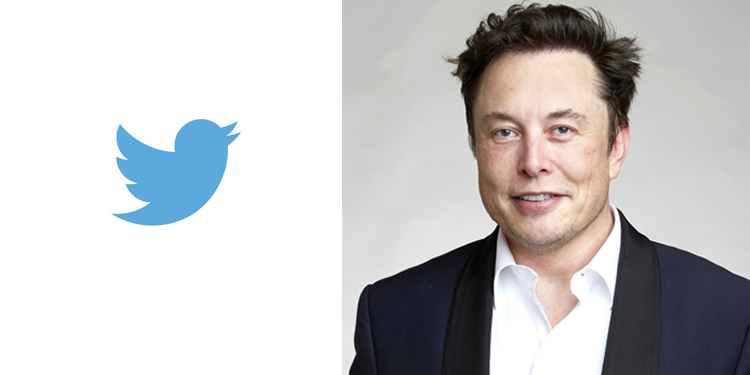

Elon Musk’s offer to buy out microblogging platform Twitter for $44 billion created headlines ever since the announcement was made on 14th April 2022. Musk said that he wanted to make Twitter better with new features, making algorithms open source, defeating spam bots, and authenticating all humans. This could be done with the company going private, he envisioned.

However, on 17th May, Musk said that the deal cannot move forward until there was proof on the number of fake accounts on the platform. In a filing earlier in the month, Twitter stated that fewer than 5pc of its monetizable daily active users during the first quarter were fake or spam accounts. But Musk claims that around 20pc of the accounts on Twitter are fake or spam accounts, and according to him, the number could go even higher.

A Twitter thread by CEO Parag Agrawal on 16th May explaining the number of fake accounts and how it is estimated, was greeted by a ‘pile of poo’ emoticon by Musk.

On 18th May, Twitter’s board said it would enforce the deal without renegotiating the agreed price of $54.20 per share.

MediaNews4u.com reached out to digital practitioners and a legal expert to ascertain the impact of the prevailing uncertainty on the deal on Twitter as a brand and social media platform.

“The uncertainty has led to doubts amongst employees at Twitter. Several have left, including senior employees, which has led to a fall in productivity. It would be difficult to retain key employees and make major changes to the business. Moreover, Twitter has even stopped recruiting, app updates, and advertising. But, overall, it won’t have a very adverse impact because of the legal hurdles that Musk would have to face – including a specific performance clause that the social media company can cite to a judge to force Musk to complete the deal. Moreover, the deal agreement does not allow Musk to walk away just because of a deteriorating business environment or lower share prices,” says Neena Dasgupta, CEO & Director, Zirca Digital Solutions.

“The fallout has affected many that were involved. The uncertainty led to a wide follower fluctuation for Twitter. Multiple accounts with large follower counts reported losing followers by the thousands, with some growing to hundreds of thousands. The absence of job security and stock compensation is also on the rise, resulting in Twitter losing out on its staff. Investors and stakeholders are also questioning the transparency and flaws that the social media platform possesses,” adds Taaran Chanana, MD & Co-Founder, MemeChat.

Krishnan Murali, Partner, Fox Mandal & Associates, has a different opinion. “There are no real disadvantages to Twitter if the deal falls through — other than for any delisting/going private ambitions that may have to be shelved. On the other hand, Elon Musk could face a $1 billion break fee, as well as the threat of Twitter enforcing a specific performance contract. The platform is still one of the safest, from a user’s perspective,” he says.

Impact of Fake Account Debate

We also asked them if the debate on fake and spam accounts, which is at the centre of the controversy, would affect brands’ trust in Twitter advertising.

“Yes, the news about fake or spam accounts will certainly affect the trust brands place in Twitter advertising. Even though the number of such accounts is small, advertising would be impacted as brands wouldn’t want to spend money on a platform that won’t actually deliver the reach they need,” says Dasgupta.

There is a counterview to this too. “Twitter is a brand in itself. These controversies will not affect the brand. As per the CEO of Twitter, the margins of error are well within its estimate of spam accounts representing less than 5pc of daily users. Also, users and advertisers are well aware of these bots and spams on the application. One can easily check the legitimacy of the profiles. Also, other social media apps like Instagram and Youtube have bot accounts for varied reasons,” notes Chanana.

According to the spokesperson, it is impossible to remove all fake accounts on social media platforms. “The only thing which will be affected by this news is the twitter valuation,” adds Chanana.