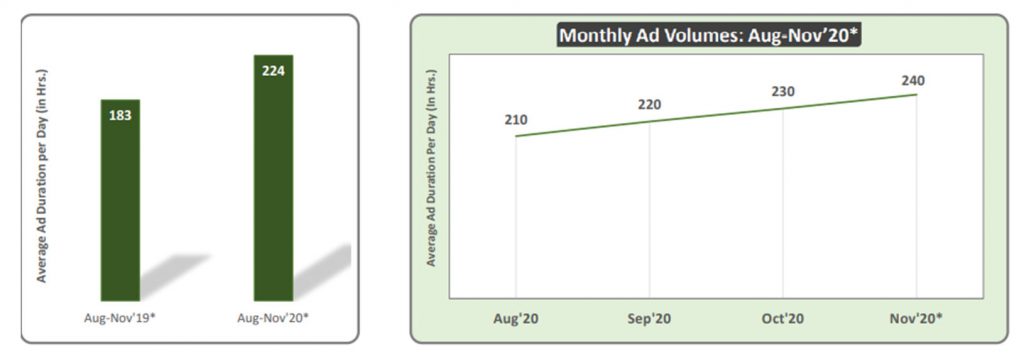

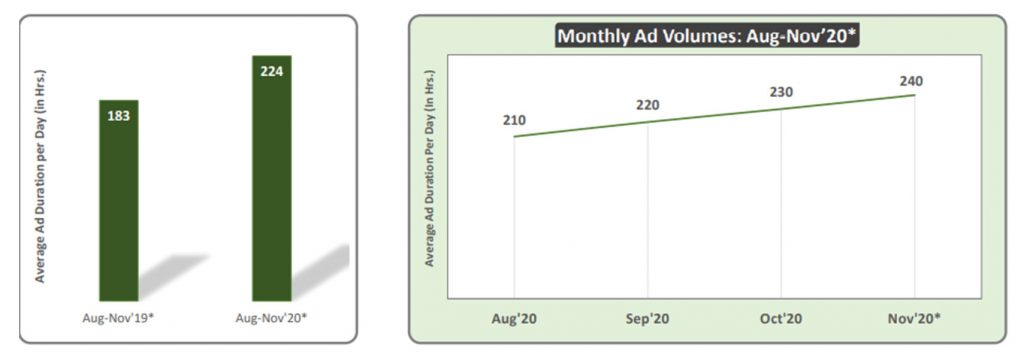

The twenty-first release in the series of TAM Television Reports talked about Television advertisements during festive season. The report highlighted several points like Festive season advertising (Aug-Nov*) increased by 19% in the year 2020* compared to year 2019*, whereas Non Festive season’s advertising (Feb-Jul) decreased by 14% in the year 2020* compared to year 2019, During the period Aug’20 to Nov’20*, Ad Volumes/Day saw continuous rise form Aug’20 and peaked on Nov’2020, Personal Care/Personal Hygiene & Toilet Soaps were the top sector & category respectively during Aug-Nov’2020 and many more.

The top 3 sectors together added half of the ad volumes on TV during Aug-Nov’20. Ecom-Media/Entertainment/Social Media were the new entrant in the Top 5 categories’ list in Aug-Nov’20* compared to Aug-Nov’19. Top 5 sectors like personal care, food & beverage, service, personal healthcare, household product& categories like Toilet soap, E-com media, shampoos, toothpaste, washing powder added 65% and 22% share of Ad Volumes respectively during Aug-Nov’20.

HUL & RB were the Top 2 advertisers on TV during Aug-Nov’20* as well as Aug-Nov’19. Also, the Top 5 advertisers together added 37% share of Ad Volumes on TV during Aug-Nov’20*.

Section 2 of the TAM report focused on F&B, E-com, Auto, and retail sectors. Where Average Ad Volumes/Day on F&B sector rose by 22% in Aug-Nov’20* compared to Aug-Nov’19 and Sep’20, Oct’20 & Nov’20* records 5%, 10% and 15% growth in Ad Volumes/Day compared to Aug’20.

Section 2 of the TAM report focused on F&B, E-com, Auto, and retail sectors. Where Average Ad Volumes/Day on F&B sector rose by 22% in Aug-Nov’20* compared to Aug-Nov’19 and Sep’20, Oct’20 & Nov’20* records 5%, 10% and 15% growth in Ad Volumes/Day compared to Aug’20.

In the F&B sector Milk Beverages category topped with an 18% share of F&B advertising and retained its rank in Aug-Nov’20* compared to Aug-Nov’19* whereas Hindustan Unilever topped in both Aug-Nov’20* and Aug-Nov’19. Also, there were Top 5 categories and advertisers who added 45% and 52% share in Ad Volumes respectively in Aug-Nov’20. There were a total of 200+ new^ advertisers & 500+ new^ brands advertised in the sector during Aug-Nov’20* compared to Aug-Nov’19*.

In the F&B sector Milk Beverages category topped with an 18% share of F&B advertising and retained its rank in Aug-Nov’20* compared to Aug-Nov’19* whereas Hindustan Unilever topped in both Aug-Nov’20* and Aug-Nov’19. Also, there were Top 5 categories and advertisers who added 45% and 52% share in Ad Volumes respectively in Aug-Nov’20. There were a total of 200+ new^ advertisers & 500+ new^ brands advertised in the sector during Aug-Nov’20* compared to Aug-Nov’19*.

During Aug-Nov’20*, the highest growth in advertising was recorded in the News genre (38%) followed by the Movies genre (32%) compared to AugNov’19*

In the E-com sector, the Average Ad Volumes/Day on the E-com sector rose by 54% in Aug-Nov’20* compared to Aug-Nov’19*. whereas Sep’20 and Oct’20 witnessed a 12% and 9% rise in Ad Volumes/Day compared to Aug’20.

In the E-com sector, the Average Ad Volumes/Day on the E-com sector rose by 54% in Aug-Nov’20* compared to Aug-Nov’19*. whereas Sep’20 and Oct’20 witnessed a 12% and 9% rise in Ad Volumes/Day compared to Aug’20.

Ecom-Media/Entertainment/Social Media category topped with 34% share of E-com advertising; maintaining its rank in Aug-Nov’20* over Aug-Nov’19. Among the Top 5 advertisers, Amazon topped in both Aug-Nov’20* & Aug-Nov’19* and Facebook Inc. moved up by 209 positions to achieve 2nd Rank. The Top 5 categories and advertisers added 76% and 32% share of sector Ad Volumes respectively in Aug-Nov’20*

Ecom-Media/Entertainment/Social Media category topped with 34% share of E-com advertising; maintaining its rank in Aug-Nov’20* over Aug-Nov’19. Among the Top 5 advertisers, Amazon topped in both Aug-Nov’20* & Aug-Nov’19* and Facebook Inc. moved up by 209 positions to achieve 2nd Rank. The Top 5 categories and advertisers added 76% and 32% share of sector Ad Volumes respectively in Aug-Nov’20*

News Genre topped during Aug-Nov’19* and Aug-Nov’20* with 28% & 31% share of sector Ad Volumes respectively, whereas Top 5 channel genres added 90% and 85% share of sector Ad Volumes during Aug-Nov’19* and Aug-Nov’20*.

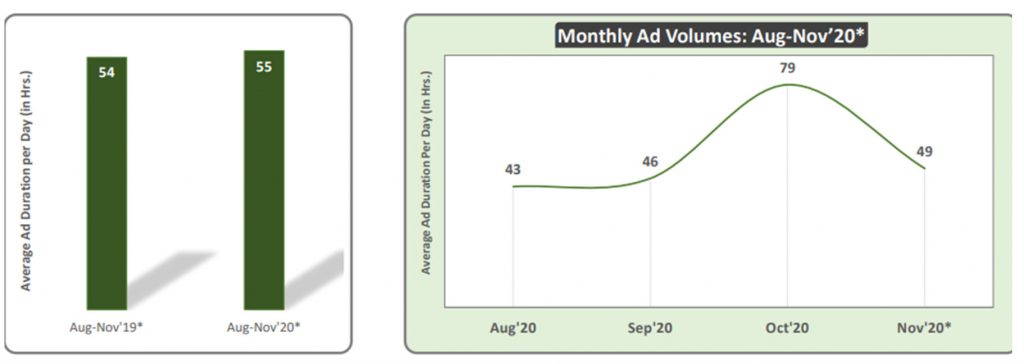

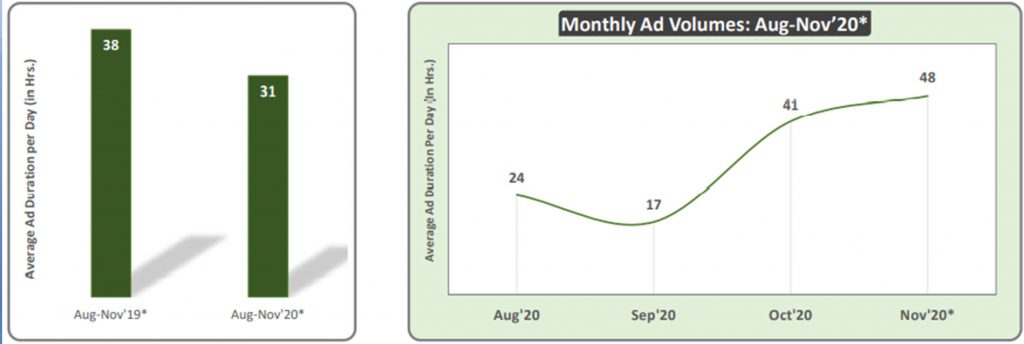

In the Auto sector, the Average Ad Volumes/Day on the Auto sector grew by 3% in Aug-Nov’20* compared to Aug-Nov’19. And Oct’20 had the highest record Ad Volumes/Day in the sector with 85% growth compared to Aug’20.

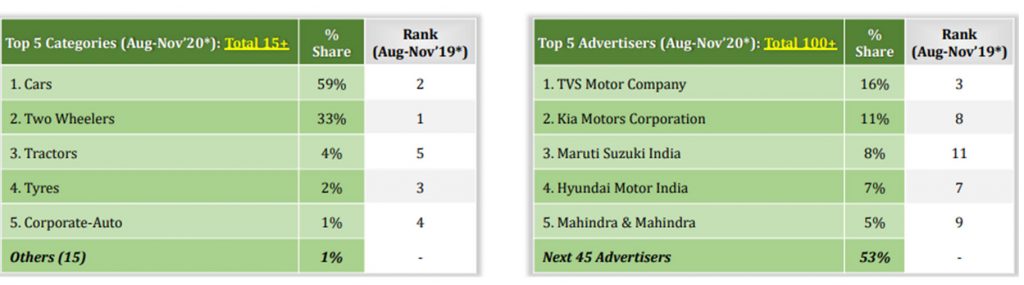

Cars category topped with 59% share of Auto advertising in Aug-Nov’20* displacing Two Wheelers which was on top during Aug-Nov’19*Among the Top 5 advertisers, Maruti Suzuki saw highest rank shift i.e. 3 rd Rank in Aug-Nov’20* compared to 11th Rank in Aug-Nov’19. The Top 5 categories and advertisers added 99% and 47% share of sector Ad Volumes respectively in Aug-Nov’20*

Lastly in the retail sector, the Average Ad Volumes/Day on Retail sector declined by 17% in Aug-Nov’20* compared to Aug-Nov’19. Whereas Nov’20* records highest Ad Volumes/Day in the sector with 2 times growth compared to Aug’20.

Jewelers category topped in both Aug-Nov’20* and Aug-Nov’19* with 56% share of Retail advertising. Among the Top 5 advertisers, Lalitha Jewellery moved up by 3 positions to achieve 1st Rank in Aug-Nov’20* compared to Aug-Nov’19*. Also, the Top 5 categories and advertisers added 96% and 40% share of sector Ad Volumes respectively in Aug-Nov’20*