Mumbai: Television advertising in India witnessed a 14% surge in ad volumes in 2024 compared to 2020, according to the latest TAM AdEx Television Advertising Recap 2024. However, ad volumes declined by 4% compared to 2023, indicating a shift in media strategies among advertisers.

FMCG Brands Lead the Ad Space

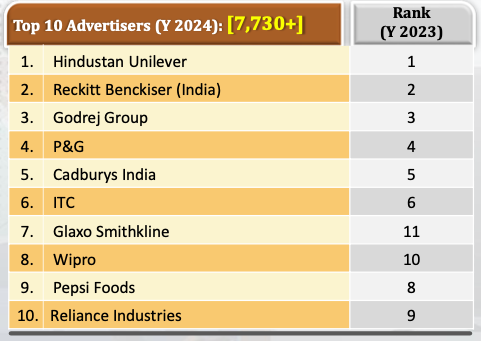

The Food & Beverages sector dominated television advertising with a 21% share, followed by Personal Care/Personal Hygiene (16%). Hindustan Unilever (HUL) remained the top advertiser with a 16% share, while Reckitt Benckiser, Godrej, P&G, and Cadbury rounded out the top five.

Among brands, Harpic Power Plus 10x Advanced led television ad volumes, with five out of the top ten brands belonging to Reckitt Benckiser. Glaxo Smithkline entered the top 10 advertisers for the first time in 2024, highlighting the growing importance of healthcare and wellness brands.

Sectoral Growth: Paints & Beauty Products Shine

While FMCG remained dominant, emerging categories made significant strides. Paints saw the highest increase in ad volumes (51%), followed by Beauty Accessories/Products, which skyrocketed 303 times compared to 2023. The Travel & Tourism sector doubled its advertising presence with 100% growth, reflecting a post-pandemic boom in leisure and business travel.

Exclusive Advertisers & New Entrants

A key highlight of 2024 was the rise of 4,000+ new advertisers. Velnik India topped the exclusive advertisers’ list, along with Canva, Express Broadcasting, and Comfort Grid Technologies. This trend signifies the increasing participation of digital-first and emerging brands in television advertising.

Co-Branding with Movies Gains Traction

Brands continued to leverage co-branded advertising with blockbuster movies, clocking 770+ hours of TV ads. The segment grew by 5% in 2024, with Spotify App leading the charge (7% share). Among movies, “Fighter” emerged as the most sought-after co-branding partner, collaborating with 13 brands, followed by “Bade Miyan Chote Miyan” (10 brands) and “Pushpa 2” (6 brands).

Future Outlook

Despite a 4% YoY dip, television advertising remains a powerful medium for brand building. The growing presence of niche and emerging categories, digital-first brands, and co-branded advertising trends suggests an evolving landscape. With General Entertainment Channels (GECs) maintaining their dominance (30% share) and News channels holding 26%, television continues to be a preferred platform for mass outreach.

As brands refine their media mix, television advertising is expected to remain a crucial player, complementing digital and other emerging formats. The coming years will likely witness more dynamic advertising strategies, integrating storytelling with high-impact partnerships.