Mumbai: This is the tenth edition of the report on ‘Crisis Consumption on TV and Smartphones’ jointly released by BARC India and Nielsen Media.

BARC India is the official currency on Television Measurement in India and Nielsen Media runs a 12,000 strong smartphone panel in India passively capturing smartphone behaviour.

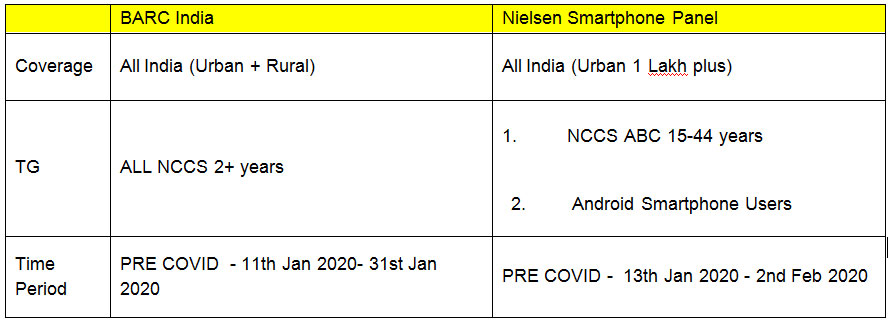

Considerations:

Some of the Key Highlights of TV and Smartphone consumption are as follows: –

- Total TV viewership in H1 2020 is 9% higher than 2019.

- Total number of advertisers on TV in H1 2020 is 10% lower than H1 2019

- With the onset of ‘unlock’ in June 2020, there is revival of Advertising on TV – significant increase in the presence of ‘top 10’ and ‘next 40’ in June 2020

- TV viewership share for Movies, News & Kids have increased in H1 2020 vs. H1 2019 – share of GEC declined from 49% to 46% due to no original programming during lockdown period

- In week 26 Total TV viewership recorded 1 trillion viewing minutes (15% higher than pre-COVID). Smartphone consumption, after a peak during Lockdown Phase 2, has gradually dipped to 17.2 Bn minutes but is still 7% higher as compared to Pre-COVID.

- On TV, recent weeks show growth in primetime viewership – more pronounced in South than HSM (return of original programming) – however, levels still lower than pre-COVID

- On Smartphones, Social N/W and Gaming show higher consumption than Pre-COVID levels, whereas VOD mirrors the pre-lockdown levels.

- With the country opening up gradually, categories like Shopping and Mobile Payments see revival, especially amongst 25+ yrs.

- Cab aggregators in Metros, and Travel Planners in Tier I towns show a good revival post Unlock 1.

- Chinese Apps saw a drop in usage post the Galwan attack with the ban acting as the last nail in the coffin.