Mumbai: No doubt, the extensive measures initiated by Disney Star and JioCinema, the official broadcast and digital streaming partners of IPL, has resulted in viewership of both TV and digital platform hitting the new records.

The concurrency of viewership, a data point that sets the viewership trend, also witnessed new high in both the platforms. They claim supremacy through various data points to impress the marketers and advertisers. Concurrency of viewership was one such fact.

JioCinema has claimed concurrency of 2.2 Cr viewers CSK vs RR match and it further reached to 2.4 Cr viewers during CSK-RCB match. On the other hand Disney Star has claimed that 26 of 38 matches of IPL on TV has clocked 3+ crore concurrency.

Are advertisers reaching their target audiences?

While JioCinema’s concurrency is visibly live on screens. Disney Star claims are based on BARC data. The broadcaster has been highlighting the IPL TV reach numbers to advertisers citing massive audience access and reach this season of the IPL through Linear Television.

Let’s do a little dissection of the BARC data to understand the reach better in terms of TGs that matter the most for advertisers.

Advertising Categories like Automobiles: 4 wheelers & 2 wheelers, Financial Services like Mutual Funds, Banks, Pay Wallets, Fantasy Gaming Companies, Paints, Lubricants, Cements, Consumer Durables like mobiles typically get the best return on their media investments by targeting the TG of M15 +AB Urban. These advertisers invest in Sports Media like Cricket, to target the TG of SEC AB Urban Male 15 + years of age.

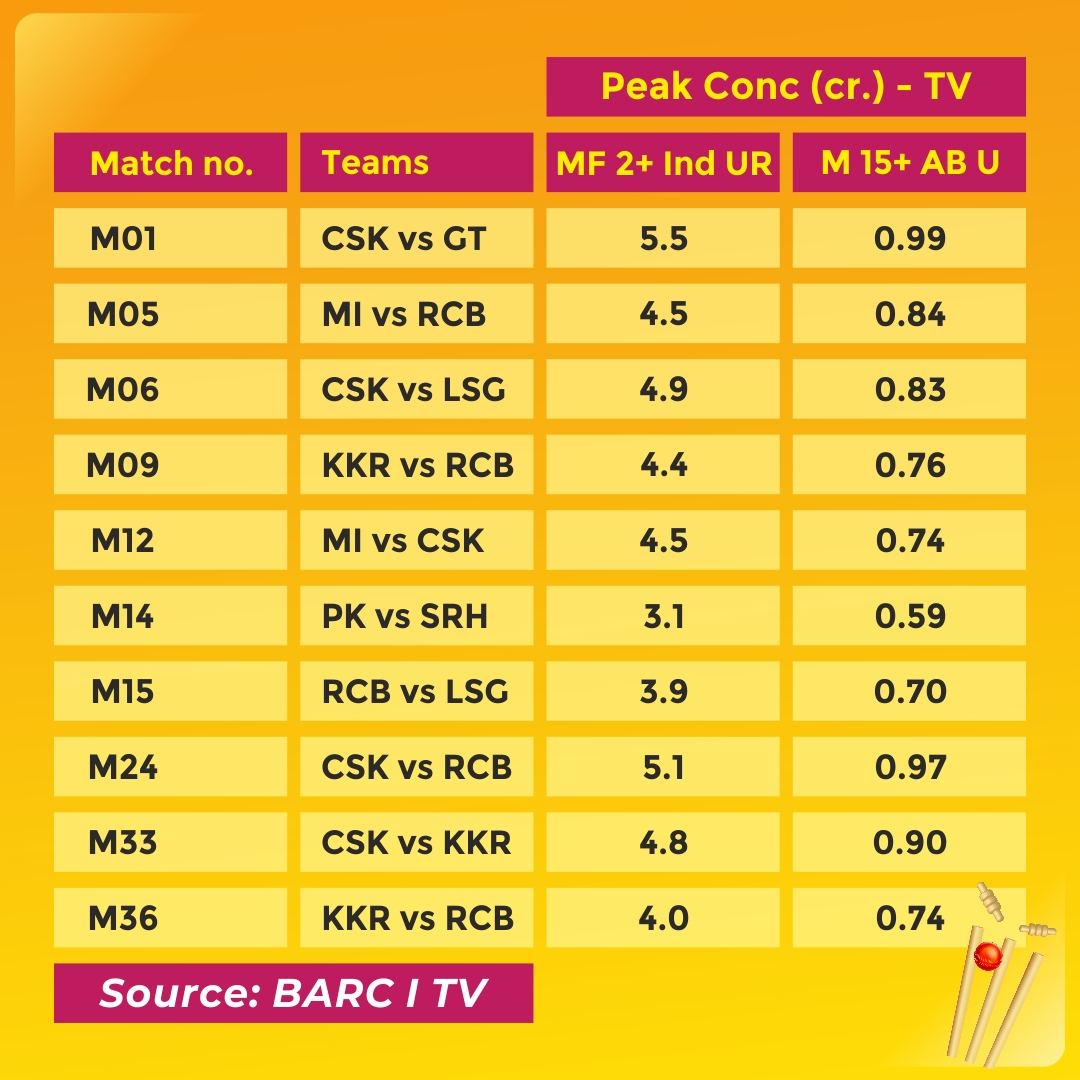

Analysis of Peak Concurrency on TV with relevant TG:

TG wise analysis of peak concurrency of viewership of IPL on TV reveals that 5.5 crore peak concurrency on TV under all TG (BARC: MF 2+ Ind Urban+ Rural) during the 1st match between CSK vs GT has clocked less than a crore (0.99 crore) concurrent viewers under TG that matters the most for majority advertisers (M 15+ AB Urban) in a sports genre. Similarly, in match no. 06 involving MI vs CSK, the peak concurrency under all TG was 4.9 crore against just 0.83 crore concurrent viewers garnered under the core advertiser oriented TG. The graph attached reveals the comparison of data on concurrent viewership in all TG vs the key advertiser oriented core TG which is almost 1/7th in most of the cases.

Similar trend could also be noticed in match reach data wherein the first match between CSK vs GT under MF2+ was 128 pc vs 21 pc under advertiser TG of M15+ AB Urban. The average reach up to 38 matches of IPL 2023 stood at 84 pc under all TG while the same stood at a meagre 15 pc in advertiser oriented TG.

Data: Reach composition of first 38 matches of IPL 2023

The data from BARC suggests Males 15+ SEC AB Urban is a mere 14 pc of the total reach. BARC data reveals that the Cumulative Reach of IPL on Residential TVs is 378 Mn for the 1st 38 matches. Out of which 23 pc of audiences on IPL on TV i.e. about 87 mn reached are in age range of 2-14 years who do not have any major say in purchasing of goods and services listed in the above mentioned categories.

While the claims of viewership on TV being made by showcasing overall reach numbers, the core TG that maters the most for the advertisers and brands is just 1/7th of the overall quoted numbers on IPL TV, on the other hand upto 80 pc of the audiences of IPL on digital are of the Males SEC AB Target segment that advertisers are pursuing the most.

Technically, majority or considerable volume of these audiences falling under Male SEC AB category are most of the time stay out of their home on work, commute etc which in turn keeps them away from TV screen during the IPL match time band. With the availability of IPL on digital mediums across mobiles, laptops, any time friction free access to their own private screen enables these audiences to access IPL anytime anywhere on the move.

Experts in digital advertising revealed that IPL on digital in this season enabled advertisers with better reach and technology to target the prime sports TG efficiently with minimal spillage when compared with TV.