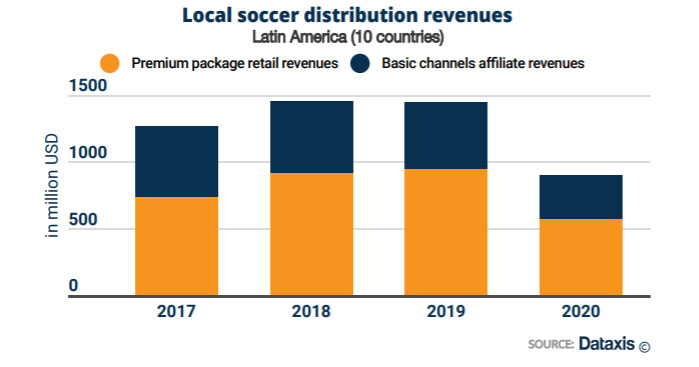

Although it generated $ 900 million, 2020 will not be remembered as a fruitful year for the distribution of local football on Pay TV. In the year-on-year comparison, distribution revenues fell by 38% in dollars. Although 2021 is expected to be a recovery year, the business revenue metrics remain at very low historical levels and the industry doesn’t show signs of improvement, a situation which puts strain on the value chain and could open opportunities for new players.

The Premium model contributed around 65% of the revenues in 2020. With the suspension of local leagues in 2020, most platforms had to cancel subscription charges for several months. The year-on-year drop in income for this specific loss amounted to 40%.

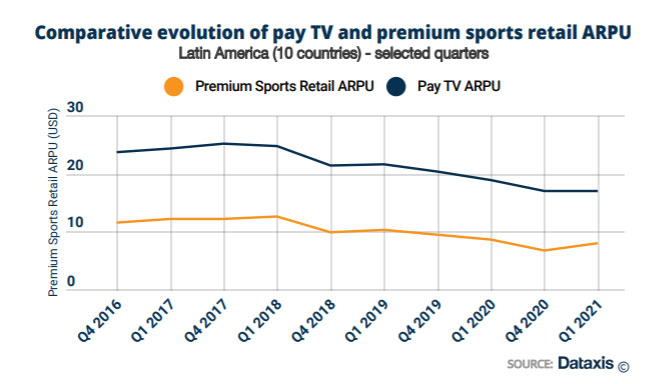

In 2021 some of the main Premium players froze their prices or applied discounts in local currency to attract their audiences back. In Q1 2021, the average revenue per subscriber (ARPU) to Premium football was $ 7.9; far from the previous level of $ 10 in 2019. Until 2018, that average represented around $ 12. The ARPU has fallen due to devaluations and loss of purchasing power.

The basic channels broadcasting local soccer also experienced a decrease in distribution income of around 35%. They were affected by the drop of pay TV subscribers and by the strong adjustment decided by operators in their content spending. This value is limited by the pay TV ARPU.

These changes in the income equation could create contract renegotiations and digital distribution opportunities. For example, in 2020, Globo and DAZN decided to cancel some of their sports rights in Brazil. This decision led to the appearance of Federations and Clubs as actors deploying their own digital platforms. In the same way, GOL TV from Ecuador recently launched an OTT option to compensate for the loss of partners in the distribution of Pay TV.

Carlos Blanco | Senior Analyst