AVOW is a global app growth marketing company specialising in mobile OEM advertising.

It has more than 100 advertisers on its roster. Last year, AVOW jointly formed KYLN- a premium multi-channel distribution platform (SaaS) for app developers. In India, AVOW has partnered with players like Amazon Shopping, Navi, Coinswitch, Swiggy, Pizza Hut, KFC, Zupee, and My11 Circle amongst others empowering them to

– Invest their advertising spend (outside of Google, Facebook or Third-party ad networks) across mobile OEM (Original Equipment Manufacturer) advertising platforms from Xiaomi, OnePlus, Oppo, Vivo, Huawei, Realme, Transsion, itel, Infinix, and Tecno for incremental user growth and engagement; and

– Overcome the challenge of saturation in user growth by offering direct access to leading mobile OEMs’ untapped mobile advertising inventory of over 1.5 billion daily active users and 10 million monthly installs.

Medianews4u.com caught up with Ashwin Shekhar, Co-Founder and CRO, AVOW

Q. The plan is to make India the hub for Southeast Asia and the APAC region centrally. Could you talk about the opportunity that AVOW sees in the country?

India is a key market for AVOW for business and people, with over 1.2 billion mobile connections and a rapidly growing smartphone user base. The diversity and expansion of Tier-2 and Tier-3 cities present a unique opportunity for mobile OEM advertising, with brands gaining direct access to users via OEMs like Xiaomi, Huawei, OPPO, Vivo, Transsion, and OnePlus.

By making India our central hub for Southeast Asia and the APAC region, we can tap into the region’s booming mobile app economy. This move also supports our broader global strategy, as we’re investing in building a strong team in India to drive innovation, support regional growth, and enhance AVOW’s global operations. We’re actively hiring to bring in top talent who will help us scale and deliver greater value to brands worldwide.

Q. What is AVOW’s strategy for building close relationships with OEMs globally?

AVOW’s expertise lies in driving performance for advertisers across multiple geographies and verticals. By working closely with OEMs, we help connect the dots, aligning their advertising technologies with market demands. Our focus on building the most relevant products for each market ensures we not only meet the unique needs of OEMs but also support them in defining and refining their ads business for greater success. With collaborations covering 86% of the global Android market, AVOW emphasises scale, quality, and alignment with OEM goals to ensure mutually beneficial outcomes in the mobile advertising ecosystem.

AVOW builds strong, enduring relationships with OEMs through collaboration, innovation, and consistently delivering measurable value. By hosting global roadshows, localized workshops, and exclusive events, AVOW has developed close ties with leading OEMs like Samsung, Xiaomi, Huawei, Vivo, OPPO, Transsion, and OnePlus. These partnerships provide mobile marketers with access to over 1.5 billion daily active users, making OEM advertising a critical element of the marketing mix.

Q. Are clients like Amazon Shopping, Navi, Coinswitch, Swiggy, Pizza Hut, KFC, Zupee, and My11 Circle finding that ad spending on mobile OEM ad platforms from Xiaomi, OnePlus, Oppo, Vivo an effective add-on to the likes of Google, Facebook?

While Google and Facebook offer broad reach and sophisticated targeting, mobile OEMs and their alternative app stores provide access to highly engaged users within specific ecosystems.

This allows for more granular targetting, such as device models and in-app behaviour, which can be especially valuable for reaching niche audiences and optimising campaigns for specific user segments. Additionally, mobile OEM platforms have access to unique user bases outside Google and Facebook, enabling advertisers to reach a wider audience and achieve higher returns on investment (ROI).

Q. How does spending on mobile OEM ad platforms allow brands to target niche markets and audiences?

Spending on mobile OEM ad platforms will enable brands to target niche markets by leveraging OEM data for precise audience segmentation. For example, brands can connect with first-time smartphone users, regional audiences, or specific demographics through on-device ads and alternative app stores. This ensures tailored campaigns that deliver higher engagement and better ROI.

Q. Could you offer examples where OEM ad platforms have allowed brands to personalise campaigns more effectively compared to other platforms?

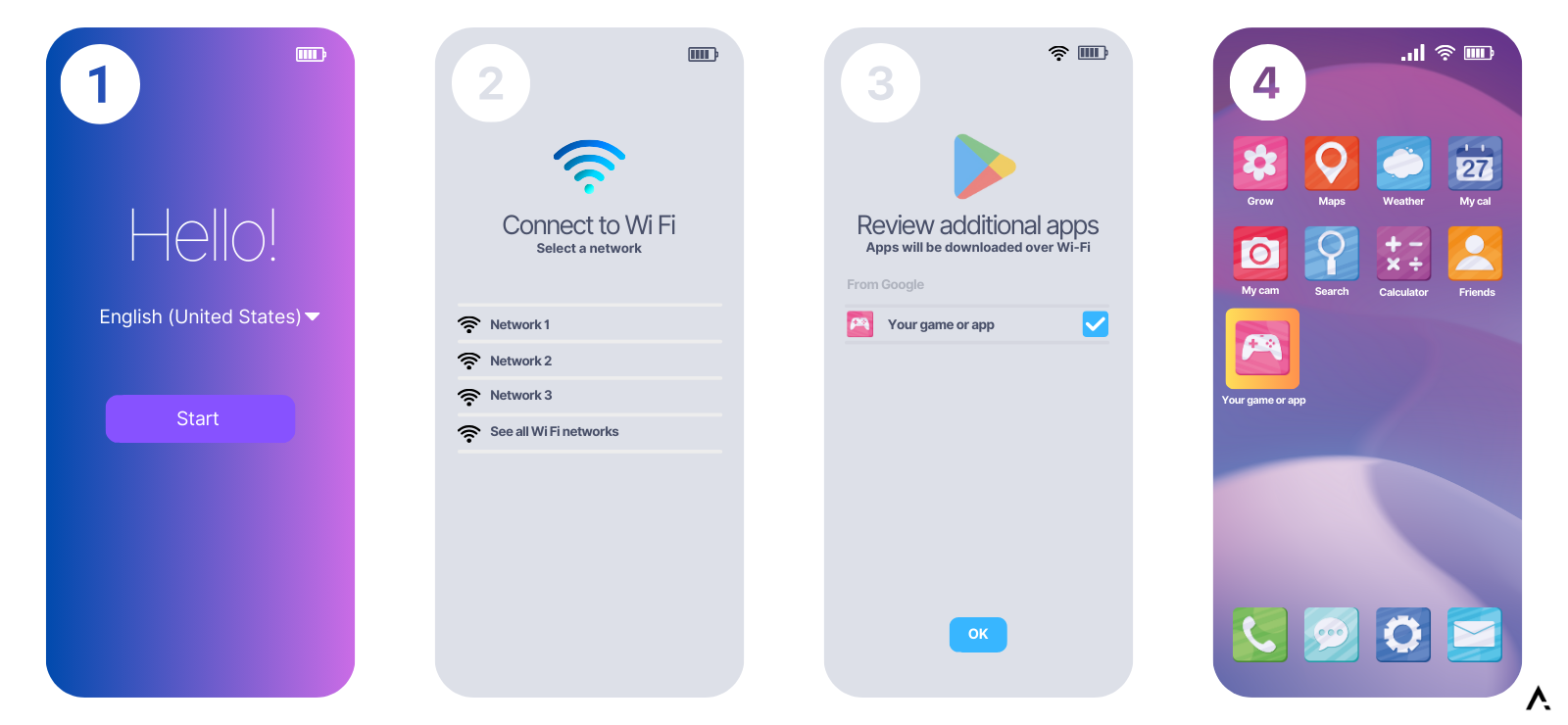

● Dynamic Preloads: OEM advertising allows apps to be preloaded dynamically and featured prominently during device setup. Getting apps in front of users during their first exposure to their new device will enable apps to piggyback off of the excitement of being part of the new device’s out-of-box experience (OOBE)

● Display Ads with Tailored App Recommendations

○ User/App Behaviour Insights: Unlike platforms reliant on third-party cookies and data, OEMs use first-party device data for personalised targetting. Take gaming, for example:

■ Device Capability Targetting: Gamers with high-performance phones are shown game-related ads, especially for higher-performing games.

■ Demographic Matching: Game ads are usually targetted at teens and young adults known for playing games.

■ App Category and Behaviour: Target users who may already be playing or have shown interest in a particular game genre, such as puzzle or casual games.

● Enhanced Retargetting: OEM platforms enable retargetting based on in-app behaviours. Device-level push notifications can be used to advertise special deals, leveraging precise targeting unavailable on broader platforms.

● Fraud-Free and Cost-Efficient Personalisation: OEM platforms bypass intermediaries to ensure personalised campaigns reach genuine users while reducing fraudulent activities.

● High-Impact Ad Formats: Banner, interstitial, and video ads are just some of the high-impact ad formats that OEMs offer natively throughout the device, far surpassing other platforms in both breadth and depth.

Q. Fraud and waste of money are a huge issue for digital advertisers. How do mobile OEMs minimise this risk?

Mobile OEMs minimise fraud and wastage through alternative app stores and controlled ecosystems. These platforms reduce reliance on intermediaries, lowering risks like click fraud or bot traffic. By leveraging first-party data and transparent reporting, OEMs provide secure advertising environments, ensuring efficient campaigns with genuine user engagement.

Q. Could you talk about how deep tech will allow AVOW to improve its product offering in 2025?

AVOW’s proprietary AVOW Intelligence, optimises all mobile OEM on-device inventory in real time. Integrated with major Mobile Measurement Partners (MMPs), it tracks user activity, including rejected installs, through an anti-fraud package.

By leveraging AVOW Intelligence, we take performance campaigns to the next level, ensuring ads reach the right audience and achieve KPI goals. We’re always exploring new ways to use technology to enhance our services further, ensuring we provide our clients even more value and efficiency.

Additionally, through KYLN, we’re enhancing app distribution across multiple app stores. KYLN simplifies app distribution, provides visibility across various platforms, and improves user acquisition without the need for SDK integrations. This is a key part of our 2025 vision to improve efficiency and scale, delivering greater value and ROI for our clients.

Q. How will the Digital Markets Act (DMA) encourage competition? There have been complaints for years about the duopoly of Google and Facebook.

The Digital Markets Act (DMA), introduced in Europe, aims to create a fairer digital ecosystem by limiting the dominance of major players like Google and Facebook. It encourages competition by requiring gatekeepers to open their platforms to alternative services, giving smaller players and innovators equal opportunities to access users.

This change drives the adoption of alternative app stores and platforms, providing brands with more diverse and competitive channels to engage with their audiences effectively.

Q. Q-commerce brands and platforms are looking to continue growth momentum in 2025. How will OEM mobile channels help them in this regard?

The Q-commerce market in India is set to grow significantly, with 26.2 million users already and a projected value of $9.95 billion by 2029. To sustain this momentum, brands must focus on more than just speed, emphasising localised strategies, customer-centric innovations, and effective engagement.

OEM mobile channels will play a crucial role by providing access to untapped audiences through alternative app stores and on-device ads. These platforms enable precise targetting and tailored campaigns, ensuring Q-commerce brands remain competitive and connected to evolving consumer needs.