The pandemic and lockdown saw fresh content go off air in the GEC genre. TV saw a spike in viewing but it was geared towards News and Movies.

We saw a shift in consumers toward the OTT platforms, OTT gave a new lease of life to many small films as Cinema halls had also shut down. This saw subscriptions to OTT platforms surge and consumers were eagerly waiting for fresh content on the platform.

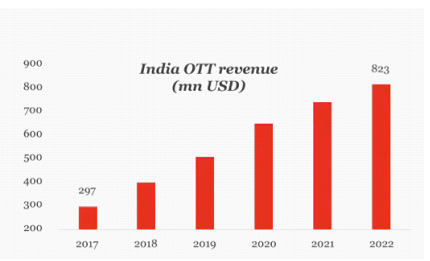

According to the recent report by PWC, smartphones penetration in India is expected to grow around 99% by 2022, and at the same time OTT platform are expected to grow at the CARG of 22% by 2022 to around INR 6k crore. Netflix is expected to gain more than 25 million subscribers by the end of 2020 whereas Amazon prime already have 10 million of subscriber.

Between march- June 2020 India saw 30 % of growth in OTT sector. The content of OTT platform was more edgy and the audiences lapped this up. This was totally different from how a story is told in a television series. Shows like ASUR, Mirzapur, Money heist, Breaking Bad, Special Ops, Aarya, Scam 1992 and many more were the most hyped shows on these platforms.

As these shows are getting eyeballs in huge numbers many brands have shifted their focus to the OTT platforms, according to the study by MAGNA they found out that, the video ads on OTT platform are 67% more successful than ads on broadcast.

OTT platforms are also seeing a surge in their subscription numbers.

MediaNews4U spoke to leading OTT players, Abhishek Joshi – Head of Marketing and Business Partnerships at MX Player, Rahul Maroli, Senior Vice President and Business Head – Subscription Video on Demand, ZEE5, Divya Dixit, SVP, Marketing, Analytics and Direct Revenue, ALTBalaji, Balkrishna Hari Singh, Founder & CEO, Frenzi and SonyLIV, on the surge in viewership and subscriptions.

What do you attribute this surge in OTT viewership, is it content, novel marketing initiatives?

Abhishek Joshi – The pandemic and the safety regulations implemented in the last few months has confined people to their homes, pushing them to embrace the virtual world. In terms of entertainment, this shift has resulted in the evolution and diversification of consumption choices, making OTT video streaming platforms emerge as the new mass medium. The small screen, from being a 2nd screen has surely moved to be the main screen for content consumption.

This accelerated adoption of OTT platforms is mainly driven by the varied content options across formats/ categories and languages that are available as well as the expansion of offerings by different platforms. MX Player, in the last 9 months has launched close to 30 shows, we have expanded our games vertical offering over 100 games, and we have additionally introduced our new short video app MX TakaTak.

Content will always remain as the USP or a key market differentiator when it comes to OTT platforms. That being said, marketing these initiatives and pieces of content to the right audiences is key, and that’s where marketing plays an important role, with the fundamental scope being to build awareness.

Coupled with an intriguing narrative, the well-rounded marketing campaign for Aashram Chapter 2 – The Dark Side, including impactful print ads, OOH, social & digital experiences, PR , digital & performance marketing and OOH has driven the show to achieve a massive 500% higher streams on Day 1 as compared to its previous edition and it is performing exceedingly well on the platform – on every metric.

Rahul Maroli – Content drives a major chunk of OTT viewership and at ZEE5, our strategy hinges around three pillars, content, data, and cutting-edge technology to provide superlative viewing experience. ZEE5’s biggest USP is the sheer amount of content it offers. Our focus has always been on delivering content that is real, resonant, and relevant. We have library of more than 120 originals – 10x more than the closest competitor. Being the largest producer of content in India, we understand the pulse of the audience and curate originals, movies and shows across genres and languages. Consumers gravitate towards platforms with great content and this is where marketing comes in. Creating high quality, engaging content is the first step, and marketing said content to its most relevant target audience is the second. The two are meant to go hand-in-hand and co-exist in the same universe since they cannot exist in isolation.

Further, the lockdown has also brought a culture shift in the way people consume content. Within the first week itself our platform witnessed a spike across key metros with audiences continuing to consume a wide variety of content in 12 languages. When it comes to marketing, for us it differs from show to show and geography to geography. Our budget is very sizeable and is dependent on the kind of content they are launching. To an extent, the marketing spends is equivalent to the show budget. So, from an overall industry standpoint, rich repository of content, novel marketing initiatives coupled with the increasing broadband penetration, availability of cheap data prices and smartphones, and the innovative pricing models are causing a surge in OTT viewership.

Divya Dixit – While we witnessed a sharp rise in watch time in the last few months, ALTBalaji continues to see deeper audience engagement with the platform, with consumers watching more shows, including older library content. Our content strategy is clearly focused on creating content for mass India that is well reflected in each of our offerings that viewers find highly relatable and engaging.

Along with content, through a 360-degree integrated marketing strategy, ALTBalaji has created multiple touch-points to establish itself as the streaming platform of and for the masses. To further amplify its objective, the SVOD platform is associated with short format video platforms like Roposo, Chingari, MX Takatak, Moj India and Firework, which has a very well captured non-metros mass audience. It lays its focus on expanding audience engagement and reach by giving the viewers a glimpse of ALTBalaji’s diverse content offerings. Programmatic, targeted digital performance and Influencer marketing are various other tools that have worked in favour of the platform. The soaring popularity of its web-shows and actors amongst the audiences has resulted in the ALTBalaji app consistently trending in its category on Google Play Store.

Balkrishna- If Distribution is King then Content is God and the OTT platforms have been able manage the Kings and Gods very efficiently. The growth of the OTT platform can be attributed to a mix of right initiatives for Content and Marketing. OTT platforms have created compelling original content and have made it accessible to the masses by bundling with Telco offerings and OEM Tie ups. In the pandemic environment, absence of no new content on GEC platforms has further pushed consumption of OTT content and subscription.

SonyLiv – At SonyLIV, we have been getting an encouraging response from the audience for our content offerings. Starting with Your Honor, we have experimented with a variety of genres so far which has worked in our favour to trigger viewership. We are consciously delving deep on stories that are intrinsically Indian, that offer a glance at this country, its eventful history and incidents one should know about and as a result, we have seen a 143% rise in viewership post Scam 1992. In addition to this, SonyLIV has been home to a variety of content in terms of catch Up TV, English content and sports that have garnered sizeable traction. We saw a record spike during the registrations for KBC 12 where the participation on the platform increased by 360% this year and saw more than 3.1 crore initial audition entries. While novel marketing initiatives are key to tap the right kind of audience for your platform, the ultimate appetite rests with the content. I believe, good content and good marketing complement each other and are not substitutes.

Now that GEC is back with fresh content, will OTT be able to maintain its position and attract its core viewers and also get in new viewers and subscriptions?

Abhishek Joshi- I strongly believe that all entertainment platforms can co-exist and there will still be a scope to grow. There is no one size fits all formula to this as different content genres will find their core audiences always. The digital video ecosystem is still at a very early growth stage and there is enough headroom for it to grow and sustain.

The audience is hungry for interesting content and powerful storytelling that can hold their attention and OTT platforms are just about that. They offer a wide spectrum of content across genres that consumers can stream at any point in time. We have ensured a constant pipeline of content that can appeal to any palette with shows like EkThi Begum, Times of Music, Raktanchal, High, Bhaukaal amongst others. Our recent offering Aashram is performing phenomenally well as well. Viewers today are spoilt for choice and open to experimentation, which in turn ensures that all good content is able to find itself the right audience.

Rahul Maroli – There are different archetypes of the Indian consumer based on their usage behavior and the type of content they consumer – there are some who are heavy TV watchers, some who are OTT experimenters and rely on AVOD consumption, while others who are early adopters who have gravitated towards the SVOD model. With abundant choice and seamless accessibility facilitating content consumption on-the-go, binge-watching became a standard. The result is that a large amount of content is now created for its stickiness. The OTT platforms have restructured the content creation and distribution in the entertainment industry, and it appears that the lockdown has been acting as catalyst to accelerate the growth of this sector.

Despite the introduction of fresh GEC content, OTT is here to say. While we observed an unprecedented rise in our subscribers in the first few months of the year, May, June, and July did witness a slow-moving growth rate. However, in August, the numbers significantly spiked, as new content was introduced. We reported a 33% jump in daily active users and 45% in app downloads in May, and despite the lockdown being eased in several parts of India, there has not been a significant drop. As of September, the platform had close to 50 million monthly active users and 4 million daily active users. In general, OTT segment in India is extremely bullish. The growth is coming from both inside and outside the home as internet-connected devices proliferate, notably new smartphones and connected TVs. I don’t foresee this upward growth trajectory to dip substantially in future. There may be some fluctuations but largely this upswing will continue, and digital video proliferation will only increase with time.

Divya Dixit – It was evident that the huge growth witnessed by OTT platforms over the past few months was due to the lockdown. This phase also converted many fence-sitters into subscribers. Now, the streaming services are making sure that these subscribers are retained for the long term through a pool of immersive content. As we see the country gradually unlock itself, resulting in operations coming back in full swing, people might get busy with their work and social life. But we think digital content has made its way into the lives of these viewers, and there won’t be much drop in terms of eyeballs.

With OTT platforms coming up with innovative ways of retaining the consumers, creating intriguing content, keeping in mind the taste and preference of the audience, we believe this number will be retained further.

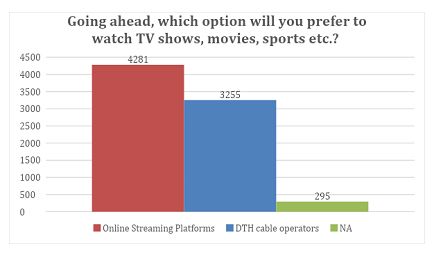

Balkrishna- The long viewing hours as seen during the lockdown may not be sustainable but the shift from linear broadcasting channels to OTT is very much permanent. Over the last 10 months of lockdown the viewing habits of consumers have drastically changed. They have been treated to some compelling original content and series, digital first movies and localised content as well. The attractiveness of OTT platforms of anywhere, anytime viewing meets the WFH needs of a consumer. With OTT also enabling catch-up TV, even with fresh content coming on GEC platforms, consumers would choose to consume the same content on an OTT platform. The change in strategy by corporate houses like Disney to go OTT first, and exit of broadcasting players like HBO and WB, is just an indicator of the same.

SonyLIV- The good thing about SonyLIV is that we come from a broadcasting network that has a loyal audience base to its credit. Millions of people come on SonyLIV to consume the shows that SPN creates as a broadcast brand. Hence, with fresh content coming back on TV, we are rather expecting a surge in such viewership as the family audience would still want to binge on their favorite shows. In terms of original content, we are just trying to foray into the same audience segment with something new and introduce them to diverse forms of storytelling. TV and OTT audience are not isolated but rather inter-changeable and it just provides them with more options in content to choose from.

Edited & Additional inputs by Kalpana Ravi.