The volume of ads on TV increased by more than 2 Times during Apr’21 compared to Apr’2, as per TAM AdEx’s Ad strategy report for April ’21 vs Apr’20.

All weeks of Apr’21 recorded around 2 Times rise in Ad Volumes of TV compared to respective weeks in Apr ’20, the report stated.

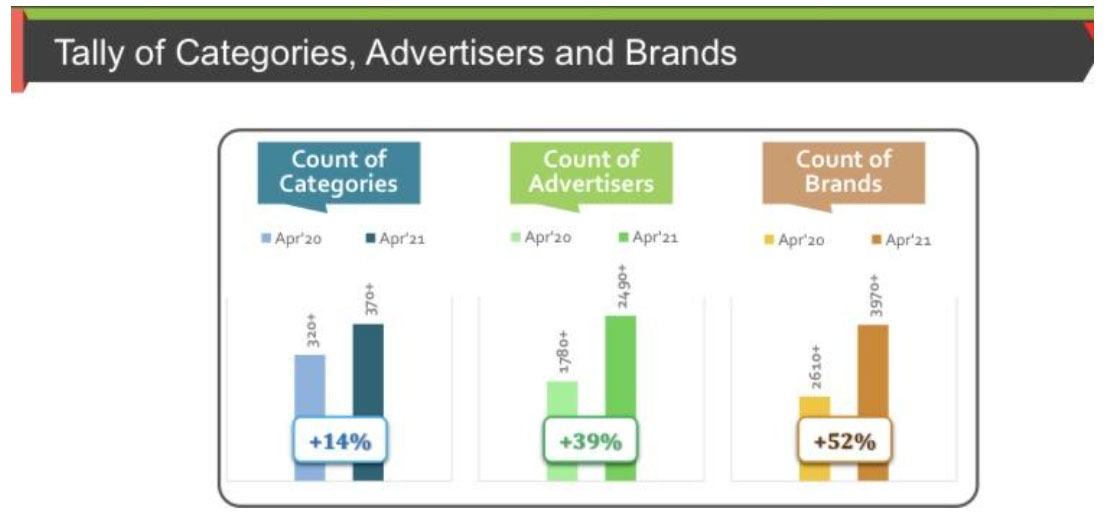

Tally of Categories, Advertisers, and Brands grew by 14%, 39%, and 52% respectively during Apr’21 compared to Apr’20 in the Television medium.

The Toilet Soaps led the list of Top 10 Categories for April’21 with a 6% share of Ad Volumes, followed by Toilet/Floor Cleaners with a 5% share.

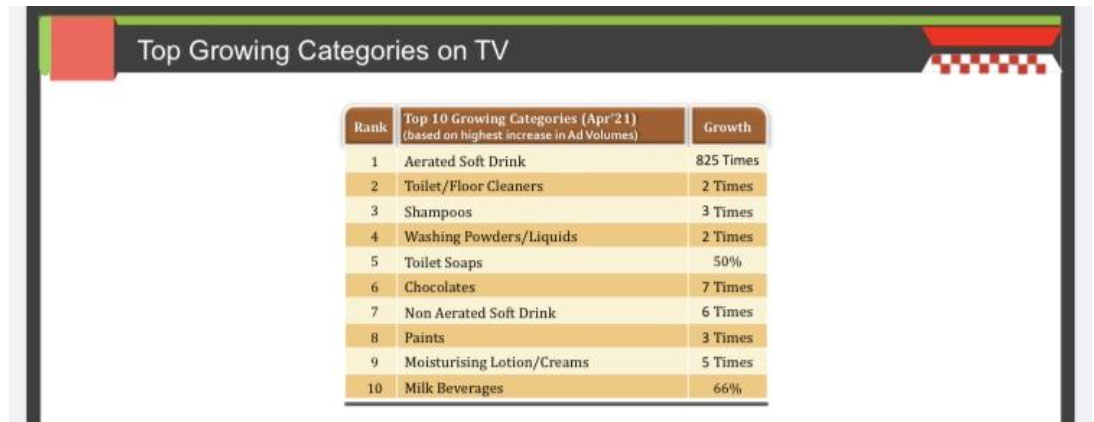

Aerated Soft Drink, Chocolates, and Non-Aerated Soft Drink were the new entrants in the Top 10 list of Categories during Apr’21. The top 4 categories observed positive rank shifts. The Aerated Soft Drink category showed the highest improvement in rankings compared to Apr’20.

The Aerated Soft Drink category saw a surge in Ad Volumes with a growth of 825 Times, followed by Toilet/Floor Cleaners with a 2 Times increase during Apr’21 compared to Apr’20. There were 220+ growing categories present in Apr ’21 compared to Apr’20 on TV.

Reckitt Benckiser (India) and Hindustan Unilever were almost tied first with a 14% share of Ad Volumes. Reckitt Benckiser (India) and ITC saw a positive rank shift in Apr ’21 compared to Apr’20. Pepsi Company, Cadburys India, Godrej Consumer Products, and Ponds India were the new entrants in the Top 10 advertisers’ list. Top 10 advertisers added 43% share of Ad Volumes.

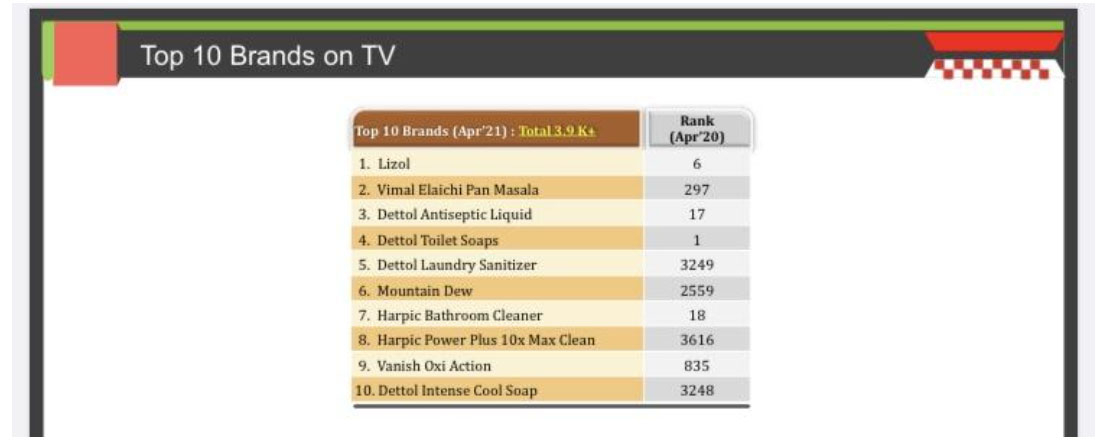

Lizol was the top brand in Print during Apr ’21, followed by Vimal Elaichi Pan Masala.

During Apr ’21, a total of 3.9 K+ brands were present on TV. The top 10 brands had a 10% share of Ad Volumes, among which eight belonged to Reckitt Benckiser (India). Harpic Power Plus 10x Max Clean saw the highest improvement in rankings.

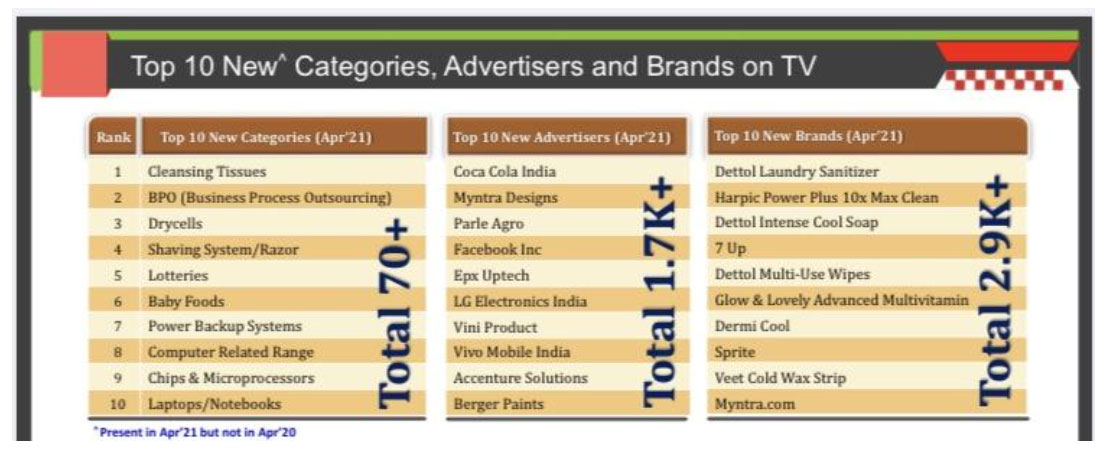

70+ new categories, 1.7 K+ new advertisers and 2.9 K+ new brands advertised during Apr’21 compared to Apr’20. Cleansing Tissues topped among the new categories, followed by BPO in Apr’21 over Apr’20.

Coca Cola India was the top new advertiser, followed by Myntra Designs in Apr ’21. Dettol Laundry Sanitizer topped among the latest brands, followed by Harpic Power Plus 10x Max Clean in Apr ’21 compared to Apr’20.

The Ad Space in Print grew by more than 4 Times during Apr’21 compared to Apr’20. The Ad Space in week 3 of Apr’21 surged by almost 6 Times compared to week 3 of Apr’20 whereas week 5 saw the lowest increase of 79%.

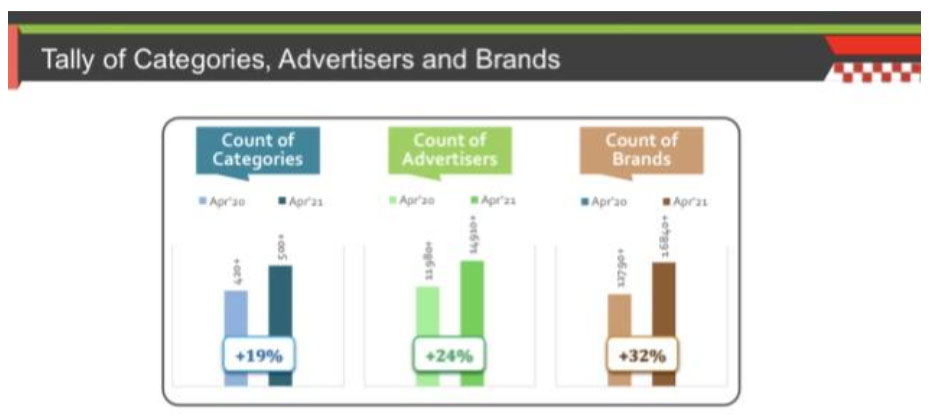

Tally of categories grew by 19%, whereas that for advertisers and brands rose by 24% and 32% respectively during Apr’21 compared to Apr’20.

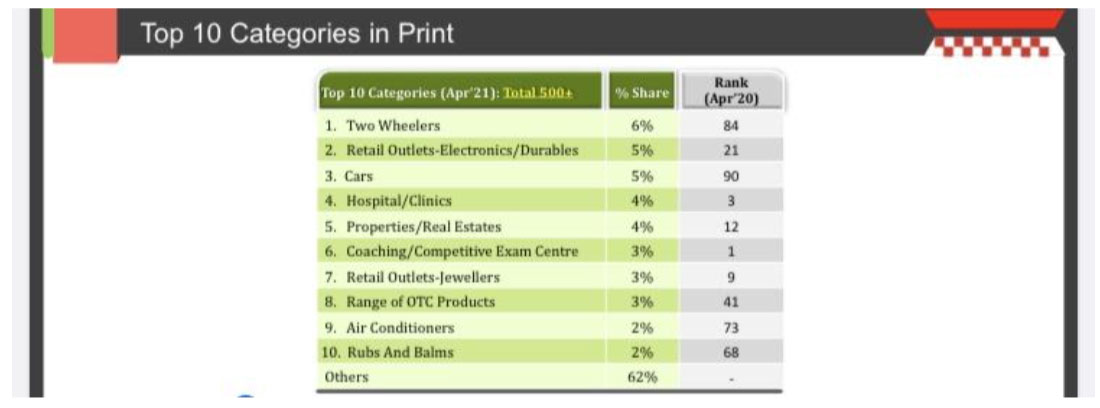

Two Wheelers topped in the Top 10 categories with a 6% share of Ad Space in Apr ’21. Cars category improved the most in terms of rankings, landing in the Top 10 list. 7 out of the Top 10 categories were new entrants, including the Top 3 during Apr’21. Only categories on 4th, 6th, and 7th rank were among the Top 10 in April of the previous year. The top 10 categories had a 38% share of Ad Space.

Two Wheelers among the categories saw the highest increase in Ad Space with the growth of 166 Times followed by Retail Outlets-Electronics/Durables with 25 Times growth during Apr’21 compared to Apr’20. There were 300+ growing categories present in Apr’21 compared to Apr’20 in Print.

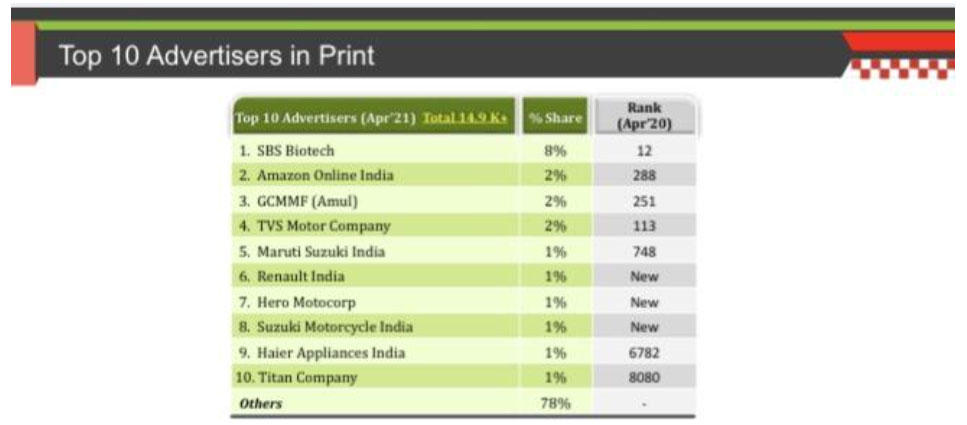

SBS Biotech was the top advertiser with an 8% share of Ad Space during Apr’21.

3 of the Top 10 advertisers with rank 6, 7 and 8 were exclusive to Apr’21 compared to Apr’20.

Titan Company saw the highest positive rank shift to enter the Top 10 list during Apr’21 over Apr’20. None of the Top 10 advertisers was among the Top 10 in April of the last year. Top 10 advertisers added 22% share of Ad Space in Print during Apr’21.

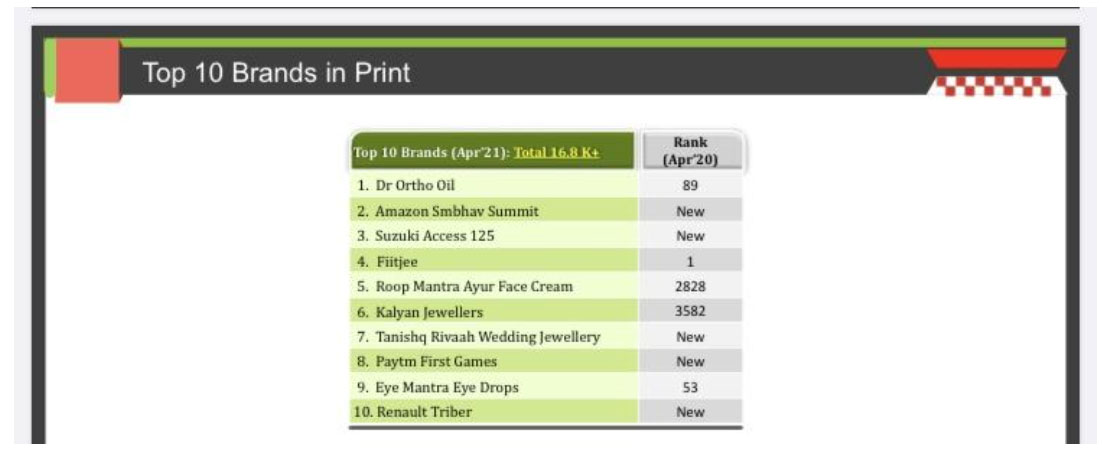

Dr Ortho Oil was the top brand in Print during Apr’21, followed by Amazon Smbhav Summit. 5 of the Top 10 brands with rank 2, 3, 7, 8 and 10 were exclusive to Apr’21 compared to Apr’20. The highest shift in rankings was seen for Kalyan Jewellers during Apr’21 compared to Apr’20. Only Fiitjee (4th rank) was present in the Top 10 list of Apr’20. The top 10 brands grabbed an 11% share of Ad Space in Apr’21, among which three belonged to SBS Biotech.

120+ new categories, 12.4 K+ new advertisers and 14.6 K+ new brands seen in Apr’21 over Apr’20. Refrigerators were the top new category followed by BPO during Apr’21 compared to Apr’20.

Renault India was the top new advertiser, followed by Hero Motocorp in Apr’21 over Apr’20.

Amazon Smbhav Summit topped among the new brands, followed by Suzuki Access 125 in Apr’21 compared to Apr’20.