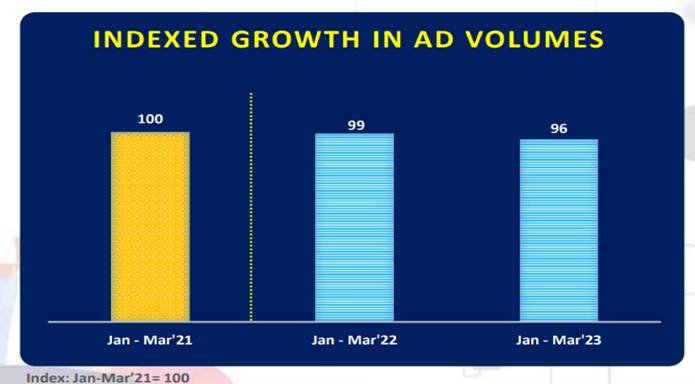

According to TAM AdEx-Television Advertising Quarterly Report for Jan-Mar’23, in comparison to the previous two years, it witnessed 4pc de-growth in ad volumes. Also, ad volumes during Jan-Mar’22 witnessed de-growth of 1pc compared to Jan-Mar’21.

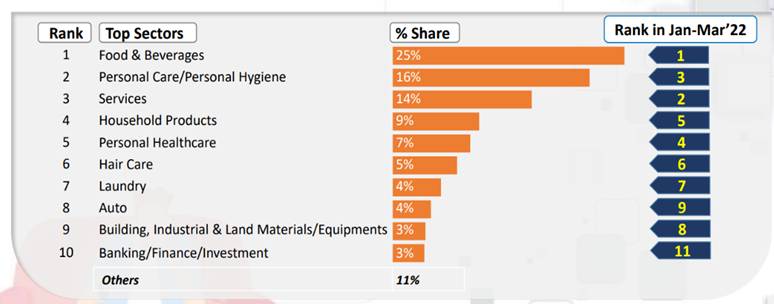

Food & Beverages was the leading Sector during Jan-Mar’23 and Jan-Mar’22. Banking/Finance/Investment (BFSI) entered the Top 10 list during Jan-Mar’23. Top 10 sectors together added 89pc share of ad volumes.

In the top Categories during Jan-Mar’23, Toilet Soaps ascended to first position with 5pc share of ad volumes. Biscuits was the only category that entered in Top 10 list. Four out of Top 10 categories were from F&B sector.

Among the top Advertisers, Hindustan Unilever led the list during Jan-Mar’23. Hindustan Unilever & Reckitt Benckiser (India) retained their positions. Britannia Industries was the new entrant in the Top 10 list.

Among the top Brands, Harpic Power Plus 10x Max Clean was the leading brand during Jan-Mar’23 with 2pc share of ad volumes. Seven out of Top 10 brands were from Reckitt Benckiser. Among the top 10 brands, three of them belonged to Toilet/Floor Cleaners category. Top 10 Brands contributed to 11pc share of Television ad volumes.

185+ categories registered positive growth. Home Insecticides witnessed highest increase in ad secondages with growth of 3.3 Times followed by Pan Masala with 2.6 Times growth during Jan-Mar’23 compared to Jan-Mar’22.

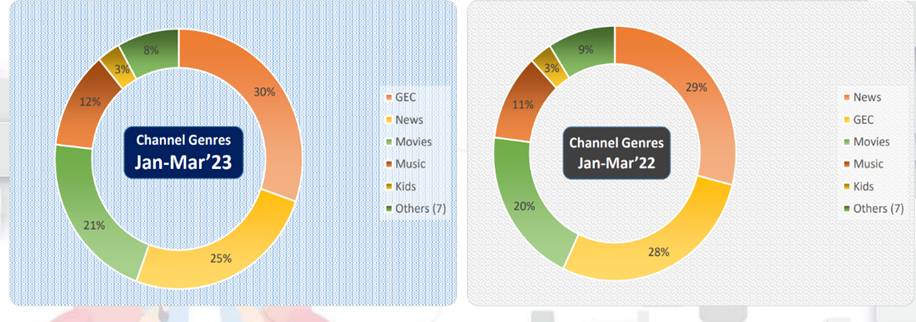

News and GEC switched their positions during Jan-Mar’23. GEC was the leading channel genre with 30pc share of ad volumes. Top 5 channel genres accounted for 92pc share of ad volumes while GEC and News had 55pc share.

Feedback: [email protected]