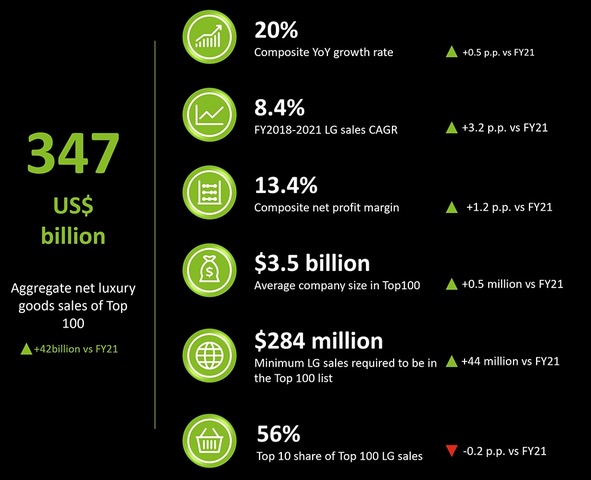

Mumbai: India’s luxury goods market is undergoing a significant transformation, driven by technological advancements and a growing focus on sustainability. According to Deloitte’s 2023 Global Powers of Luxury Goods report, India made significant contributions to the global luxury industry, which surged to $347 billion in FY2022. The growth was attributed to the strategic integration of technology, particularly GenAI, which facilitates personalised customer experiences and real-time support.

With its growing middle class and weddings, India has become the second-largest gold jewellery market in the world. Traditional gold retailers are making way for modern retail chains with renowned luxury brands. This year’s report highlights six Indian luxury companies that specialise in vertically integrated jewellery and are amongst the top 100 global luxury goods companies.Malabar Gold & Diamonds, Senco Gold and Thangamayil Jewellery are the new entrants, joining Titan Company Limited, Kalyan Jewellers India and Joyalukkas India . These companies reported more than 20 per cent sales growth in FY2022 and contributed to the industry’s 32.8 per cent composite growth.

Furthermore, luxury brands are driving sustainability initiatives in the fashion sector, emphasising circularity and environmental consciousness. The report underscores the pivotal role of emerging technologies in driving this green transition while fostering consumer trust and strengthening brand relationships.

Anand Ramanathan, Partner, Consumer Products and Retail Sector Leader, Deloitte India, said, “Luxury brands are swiftly embracing environmentally responsible, circular economy models driven by evolving consumer preferences and regulatory mandates. Digital technologies, such as artificial intelligence, machine learning, and the Internet of things, are crucial in advancing this green shift while enhancing brand-consumer relationships. We anticipate these innovations to revolutionise the luxury market, globally. Moreover, with the surge in discretionary spending, Indian consumers are increasingly inclined towards luxury purchases, accentuating India’s pivotal role in shaping the future of luxury retail. The country’s growing economic, demographic, and urbanisation trends amplify the demand for jewellery, especially amongst the burgeoning middle-class segment.”

Evan Sheehan, Global Consumer Products and Retail Sector Leader, Deloitte, said, “With the help and advancements of technology, in FY2022, the world’s Top 100 luxury goods companies are bigger and more profitable than ever. It is a good news story as companies registered double-digit sales growth in all product sectors—in particular, the fashion sector saw growth with the strongest recovery in FY2022.”

As the luxury sector continues its upward trajectory, companies are increasingly adopting circular economic principles and stepping up their sustainability efforts, including net-zero targets and supply chain traceability. Concurrently, growing consumer consciousness regarding ESG issues is influencing the luxury companies’ product strategies. In addition, this shift is propelled by increased governmental regulations and reporting standards, underscoring the industry’s commitment to responsible production practices and accountability.