Mumbai: Tata Consultancy Services (TCS) remains the nation’s most valuable brand for the third straight year, according to the new Kantar BrandZ Most Valuable Indian Brands Report published today. With a brand value of $49.7 billion, TCS has seen a 16% rise versus last year, driven by investments in innovation, particularly in AI and digital transformation.

Some Of The Other findings:

- HDFC Bank, Airtel, Infosys and SBI join TCS in the Top 5

- Zomato is the Top Riser with 100% brand value growth year-on-year

- Automotive brands accelerate to top growth due to sector expansion and rising demand

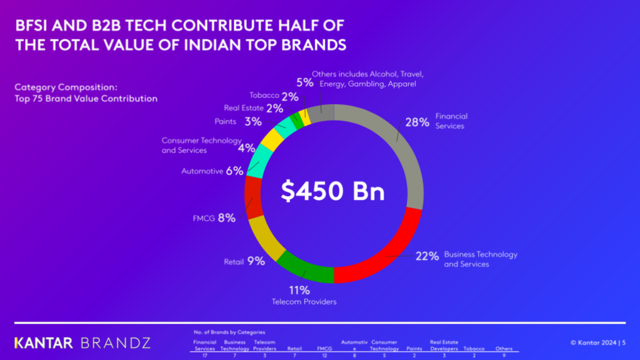

India’s top 75 most valuable brands now have a combined value of $450.5 billion, marking a 19% increase from last year. Brands across diverse business sectors fuelled this growth, with 54 brands boosting their brand value over the past year. This impressive growth outpaces most other BrandZ rankings globally and closely mirrors the 20% increase seen in the Global Top 100.

TCS tops a strong group of seven Business Technology and Services Platforms, collectively worth almost $100 billion, and equalling 22% of the total value of India’s Top 75 ranking.

Financial Services brands also dominate, with 17 brands, contributing 28% of the ranking’s overall brand value. HFDC Bank (No.2; $38.3 billion) retains its position as India’s second most valuable brand. State Bank of India (No.5; $18 billion), ICICI Bank (No.6; $15.6 billion) and LIC (No.10; $11.5 billion) also feature in the Top 10.

Zomato (No.31; $3.5 billion) is this year’s Fastest Riser with 100% growth in brand value year-on-year due to relentless innovation and expansion into quick commerce. It has also boosted efficiency and elevated its customer experience over the last year.

The automotive sector has also seen impressive results, led by Maruti Suzuki (No.17; +24%), Bajaj Auto (No.20; +94%), Mahindra (No.30; +78%), TVS (No.34; +71%) and Hero (No.35; +62%). Mahindra’s SUVs now make up 53% of India’s passenger car market (June 2024). The success of models like XUV700, Scorpio N, and Thar, which continue to see high demand and long waiting periods, has solidified Mahindra’s leadership in mid and premium SUVs.

Rising disposable income and a growing middle class are driving demand for vehicles, shifting car ownership from a status symbol to a necessity. Improved infrastructure, government support for EVs and strong export growth expectations are further fuelling the industry’s momentum.

India’s motorised two-wheel vehicle market is bouncing back, driven by a recovering economy and rising demand for personal transportation. Key factors include urbanisation, the need for affordable transport, and a growing young population. New models with advanced technology are also fuelling growth, meeting diverse consumer needs.

Seven brands debut in India’s brand ranking this year, including jewellery retail brands CaratLane (No.45; $2.7bn) and Kalyan Jewellers (No.71; $1.6bn) and Real Estate brand, Lodha (No.63; $1.9bn). Godrej Properties (No.70; $1.66bn) also re-enters the ranking.

Deepender Rana, executive MD, Insights, South Asia Kantar said, “Strong brands consistently outperform the market. Over the past year, the companies behind India’s Top 75 brands have achieved an impressive 52% stock market growth, outpacing the 37.6% growth for the Sensex. Brands that thrive are those that create a Meaningful Difference by meeting evolving consumer needs, challenging industry norms, and forging strong emotional connections. The top performers in this brand ranking have excelled by embracing disruption and innovation, leading to significantly higher growth.”

Kantar BrandZ Top 10 Most Valuable Indian Brands 2024

| Rank 2023 | Rank 2024 | Brand | Category | Brand Value 2024 (US$ M) |

| 1 | 1 | Tata Consultancy Services | Business Technology and Services Platforms | 49,657 |

| N/A | 2 | HDFC Bank | Financial Services | 38,286 |

| 4 | 3 | Airtel | Telecom Providers | 29,856 |

| 3 | 4 | Infosys | Business Technology and Services Platforms | 25,221 |

| 5 | 5 | State Bank of India | Financial Services | 17,979 |

| 6 | 6 | ICICI Bank | Financial Services | 15,604 |

| 8 | 7 | Jio | Telecom Providers | 13,744 |

| 7 | 8 | Asian Paints | Paints | 13,555 |

| 10 | 9 | HCL Tech | Business Technology and Services Platforms | 11,815 |

| 11 | 10 | LIC | Financial Services | 11,499 |

India’s GDP growth outlook is bright, with an expected 8.2% increase compared to the global average of 3.1%, potentially positioning the country as the world’s third-largest economy by 2030. However, despite strong investor confidence, large brands face a looming challenge: a long-term decline in demand power. While they may remain stock market favourites for now, they risk losing relevance in the minds of consumers if they don’t adapt to shifting expectations.

Soumya Mohanty, MD, Chief Client Officer, Insights, South Asia Kantar said, “It’s not enough to make consumers want to buy, brands must build their saliency and relevancy across all touchpoints, from advertising to in-store experiences. Successful brands create a consistent presence that resonates with consumers, driving both awareness and loyalty. Those that thrive have combined strategic reach with compelling, creative messaging to capture consumer attention and drive significant brand growth.”

Other key highlights from the Kantar BrandZ Most Valuable Indian Brands Report include:

Opportunity to expand beyond national borders: Many Indian brands remain heavily reliant on the domestic market, benefiting from a stable local economy. However, the global market of 6.7 billion people remains largely untapped, with overseas contribution accounting for only 26% of the Top 75 Indian brands. Indian brands must expand beyond their borders to unlock their full potential on the global stage.

A Blueprint for Brand Growth: Kantar’s new Blueprint for Brand Growth is designed to help businesses build profitable, strong and sustainable brands in recognition that being Meaningfully Different to more people is a key driver for growth. While maintaining Meaningful Difference is a global challenge, it is more pronounced in India. With over 20% of Indian brands lagging in this area, the need to adapt and differentiate is more critical than ever to remain competitive and see long-term growth.