TAM shared its report on Mirroring Y 2020 for Radio Advertising. The report was divided into three sections, 1st was Advertising Overview on Radio, 2nd was Trends: Lockdown vs. Unlockdown and the last one was Social Advertisements by Government.

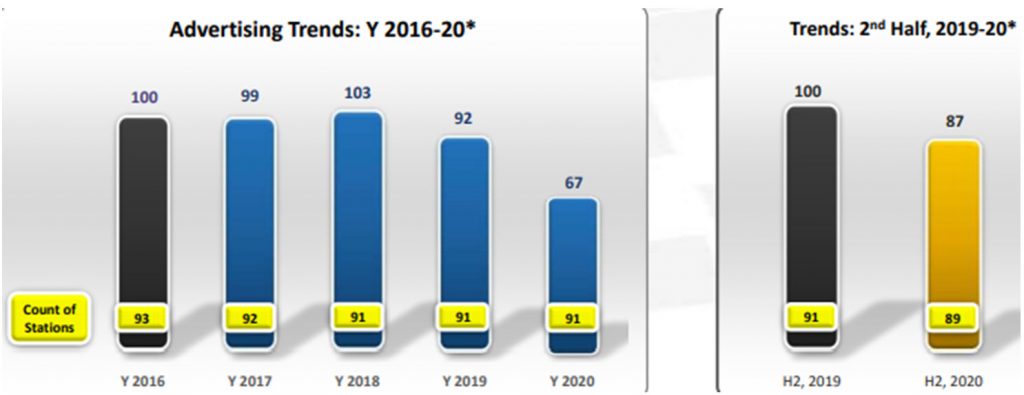

In Trend of Ad Volumes on Radio, 2018 witnessed Ad Volume growth of 3% on Radio and 2020 saw 33% decline compared to 2016. Compared to 2019, the drop reduced to 27% in 2020. Ad Volumes in 2nd halves of Y 2020 compared to 2019 registered only 13% drop which shows a recovery on Radio during Unlockdown period (H2, 2020). Due to Covid-19, lowest Avg. Ad Volumes saw in the 2nd quarter which includes the lockdown period. And the Ad Volumes on Radio shown a v-shaped recovery in Q3’20 and Q4’20.

In the leading sector, the Personal Healthcare sector tuned up in Top 10 with considerable upsurge. Whereas, Services sector had 26% share of Ad Volumes on Radio followed by BFSI with 12% share during Y 2020.

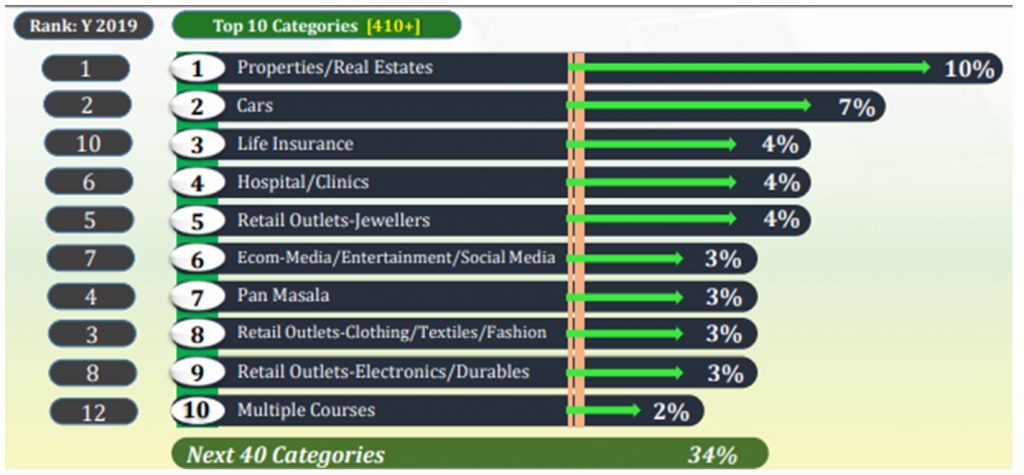

In the leading category, Life Insurance shifted up 7 positions to secure 3rd rank. Properties/Real Estates leads among the categories on Radio with a 10% share of Ad Volumes. Properties/Real Estates, Cars, and Retail Outlets-Jewellers maintained their ranks. 3 out of the Top 10 categories (ranked 5th, 8th, and 9th) belonged to the Retail sector. Multiple Courses category was the new entrant in the Top 10 categories’ list.

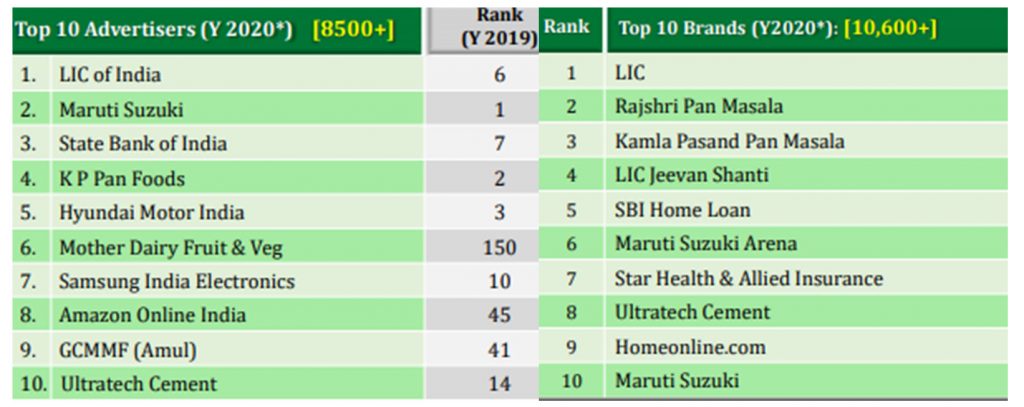

In leading advertising in the year 2020, LIC topped the advertiser list of 2020 followed by Maruti Suzuki. LIC moved up by 5 positions to become 1st. whereas, LIC, SBI, and Samsung observed a positive rank shift compared to Y 2019. And mother Dairy Fruit & Veg, Amazon, GCMMF (Amul), and Ultratech Cement were the new entrants in the Top 10 advertisers’ list of Radio. In Leading Brands in 2020, LIC also topped among the brands of Y 2020 followed by Rajashri Pan Masala. LIC moved up by 9 positions to become 1st. During Y 2020, there was a total of 10.6K+ brands present on the Radio. 4 out of the Top 10 brands were from the BFSI sector and 2 were from the F&B sector.

Leading Exclusive^ Advertisers and Brands in 2020 we saw 4.9K+ advertisers & 6.5K+ brands exclusively advertised during Y 2020 compared to Y 2019 on Radio. Kedia Builders & Colonizers and Kia Sonet were the top exclusive^ advertiser and brand respectively during Y 2020 compared to Y 2019. 3 of the Top 10 exclusive brands belonged to the Auto sector.

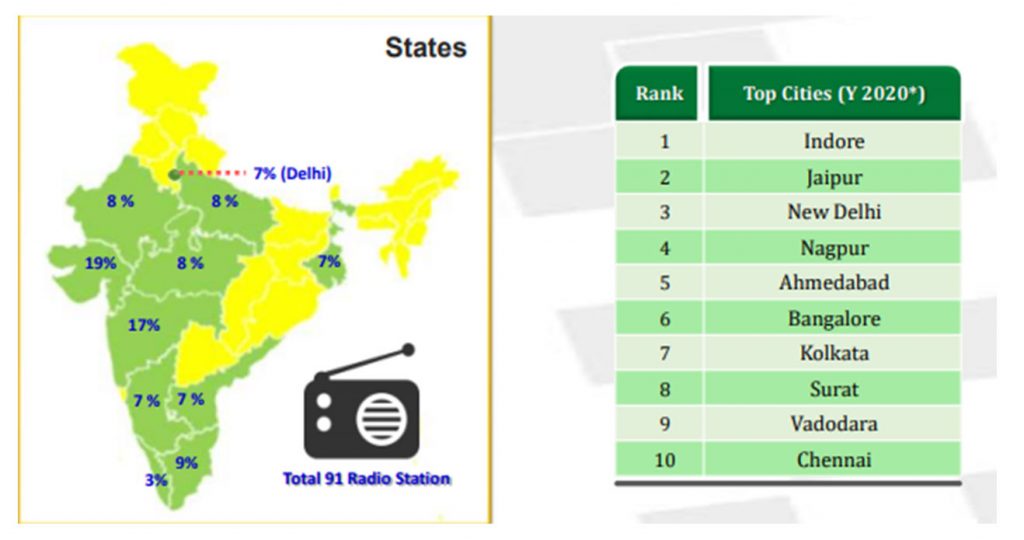

In terms of Advertising in leading States and Cities on Radio, Gujarat State was on top with 19% share of Ad volumes on Radio followed by Maharashtra with a 17% share. The top 5 States accounted for 61% of Total Ad Volumes and South Radio Stations accounted for 26% share on Radio. Whereas, Indore topped among the 18 cities on Radio followed by Jaipur in 2nd position. The top 10 cities accounted for 68% of Total Ad Volumes on Radio.

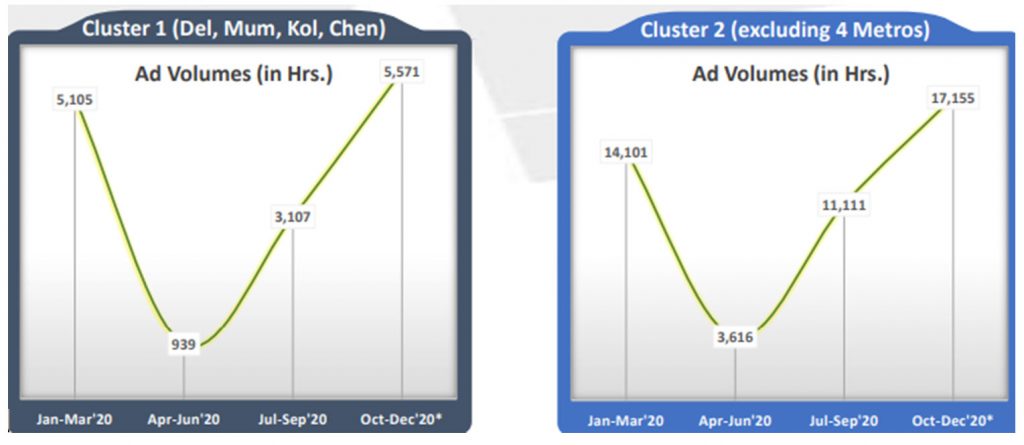

In Advertising Trends: 4 Metros (Del, Mum, Kol, Chen) vs. Other Cities, both the Clusters, Ad Volumes on Radio witnessed considerable upsurge during Q3’20 and Q4’20 compared to Q2’20. Q4’20 saw 5.9 Times rise for Cluster 1 cities and 4.7 Times rise for Cluster 2 cities compared to Q2’20.

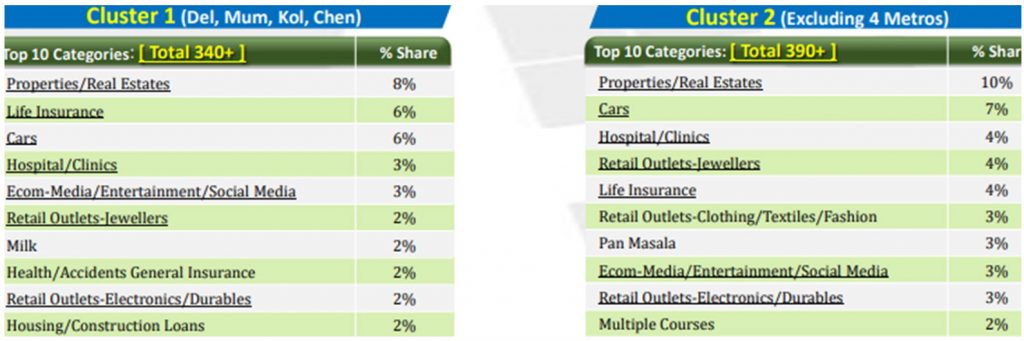

Leading Categories for Cluster 1 and Cluster 2: Y 2020, both the Clusters, Properties/Real Estates topped on Radio with 8% share in Cluster 1 and 10% share in Cluster 2. 7 of the Top 10 categories (underlined) were common between both Clusters. The top 10 categories added 39% share of Ad Volumes for Cluster 1 and 43% share for Cluster 2 during Y 2020.

And in Leading Advertisers for Cluster 1 and Cluster 2: Y 2020, LIC of India topped among the Top 10 advertisers of Cluster 1 and was 2nd in Cluster 2 list. Whereas, 8 of the Top 10 advertisers (underlined) were common between both Clusters. Top 10 advertisers added 22% share of Ad Volumes for Cluster 1 and 17% share for Cluster 2 during Y 2020.

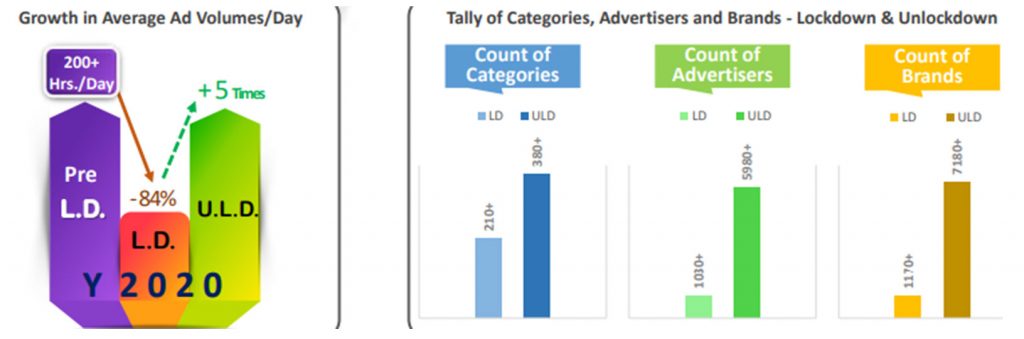

Unlockdown Period saw 180+ Hours of Average Ad Volumes/Day 5 Times more compared to Lockdown Period 5 Times growth in average Ad Volumes/Day was seen during Unlockdown period compared to Lockdown period. § Tally of Categories grew by 78% whereas that for Advertisers and Brands rose by 5.8 Times and 6.1 Times during the Unlockdown period.

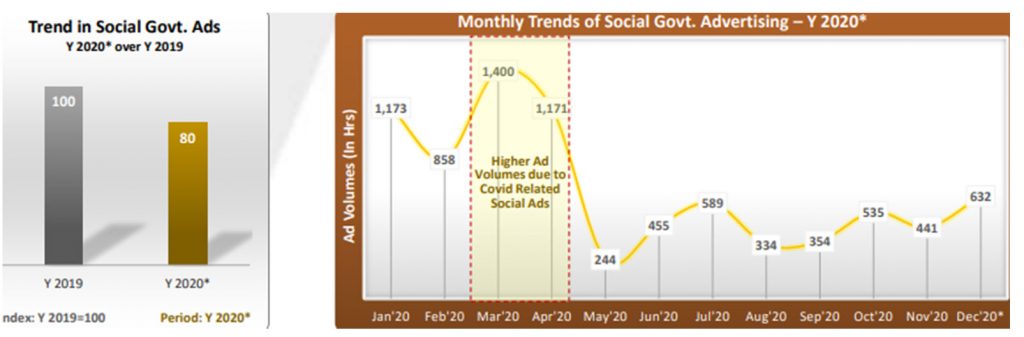

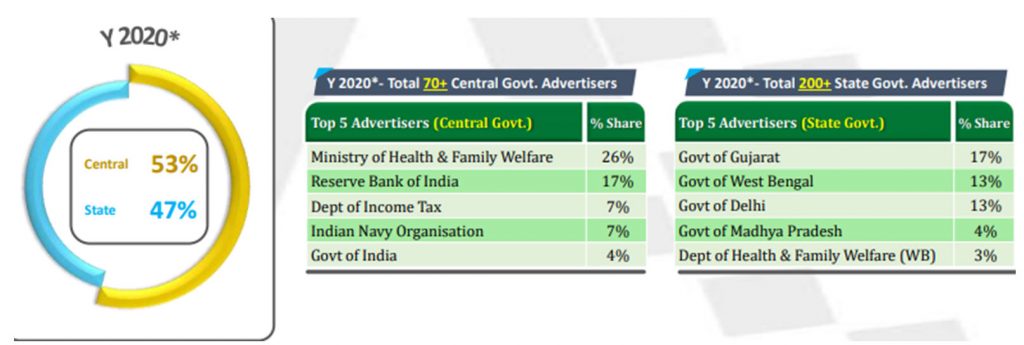

During Y 2020*, 53% of Social ads by Govt. were from different Central Government bodies. On Radio, Social Ads by Government added 31% share of Ad Insertions in Y 2020. In the Trend of Social Advertising by Govt, we saw a Decline of 20% during Y 2020 over Y 2019 in Social Ads by Govt. § Ad Volumes surged during Mar’20 and Apr’20 due to Covid – 19 related Social Ads by Govt.

During Y 2020, 53% of Social ads by Govt. were from different Central Government bodies. Where, Ministry of Health & Family Welfare and Govt. of Gujarat topped among the Central and State govt. advertisers respectively.