TAM released its report on Advertising by the FMCG sector. The report was divided into two parts, with Television and Print constituting the first part and Radio and Digital comprising the second part. The detailed TAM report highlighted volume growth, Ad Space, Ad Volumes of FMCG category on Television, Print, Radio and more.

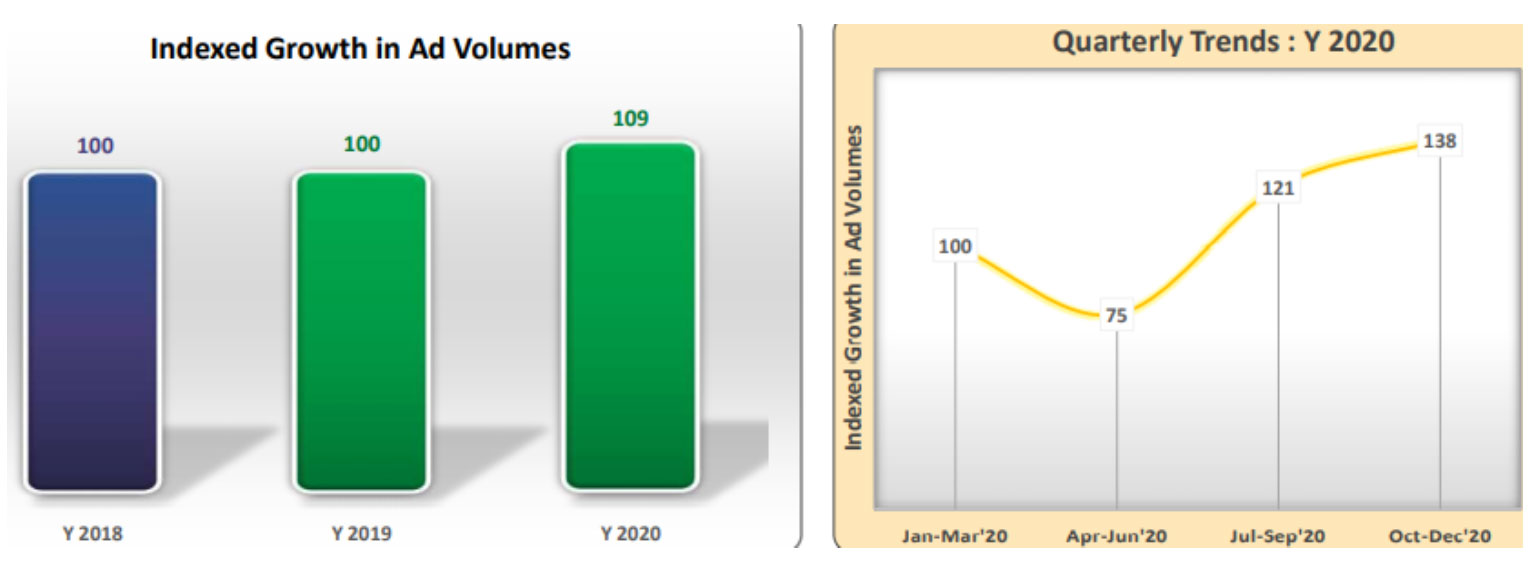

According to the report, Ad Volumes for the FMCG sector on TV witnessed a growth of 9% ad volume on Television in 2020 over 2018. The Q3 and Q4 of 2020 witnessed 21% and 38% Ad Volume growth than the 1st Quarter of 2020. The Q2 marked the lowest Ad Volumes due to the global pandemic, and the lockdown followed. The Television Ad Volumes recovered to the level of Pre-Lockdown within 3 months of post Lockdown period.

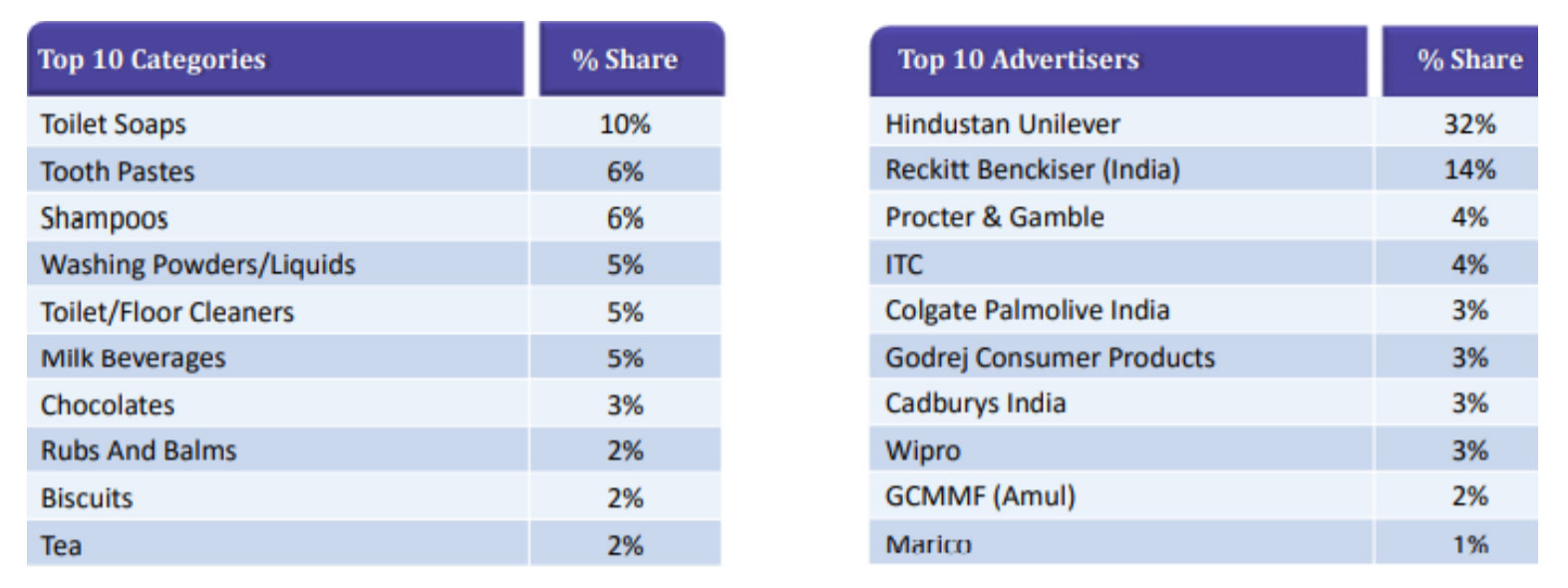

5 out of the Top 10 Categories were from Personal Healthcare and Personal Hygiene which were, Toilet Soaps, Tooth Pastes, Shampoos, Washing Powders, and Floor Cleaners. Top 10 Advertisers accounted for more than 65% share of ad volumes in 2020, with HUL topping the list.

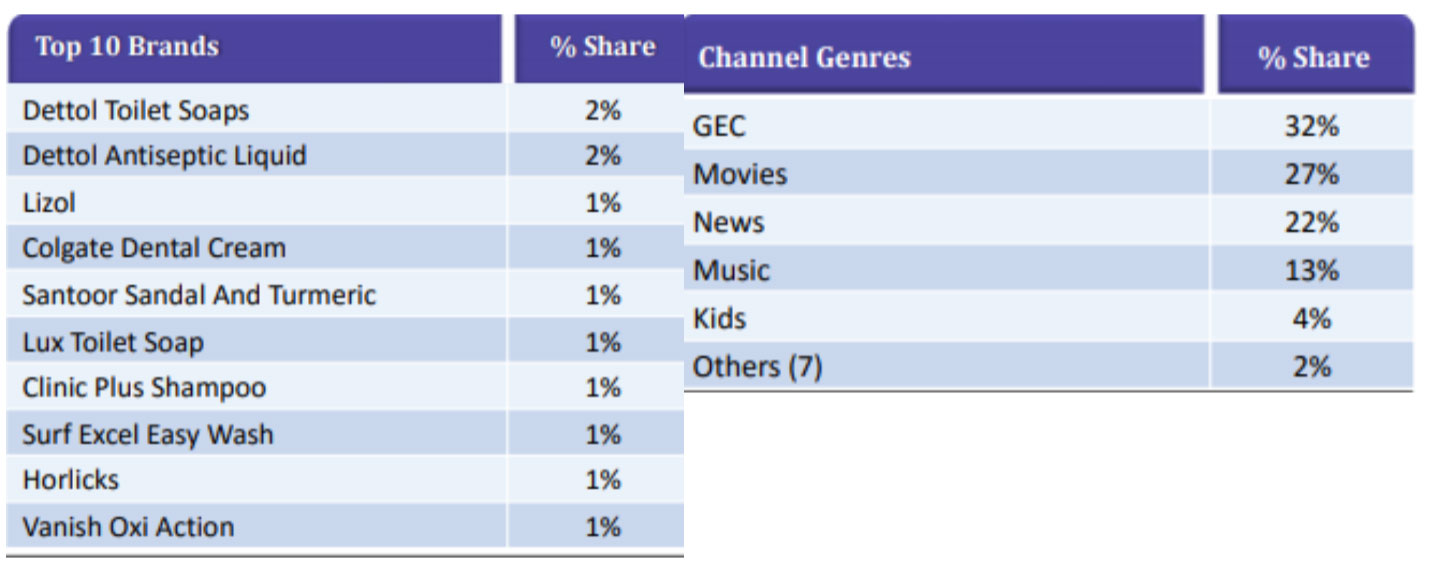

Among the Top 10 FMCG brands, Top 3 belonged to Reckitt. Top 10 Brands accounted for more than 12% share of Ad volumes in 2020, with HUL topping the list. Whereas, Top 2 channel genres on TV together accounted for almost 60% of Ad volumes shared for the FMCG sector in 2020. GEC Channel Genre topped the preference list of FMCG players during 2020.

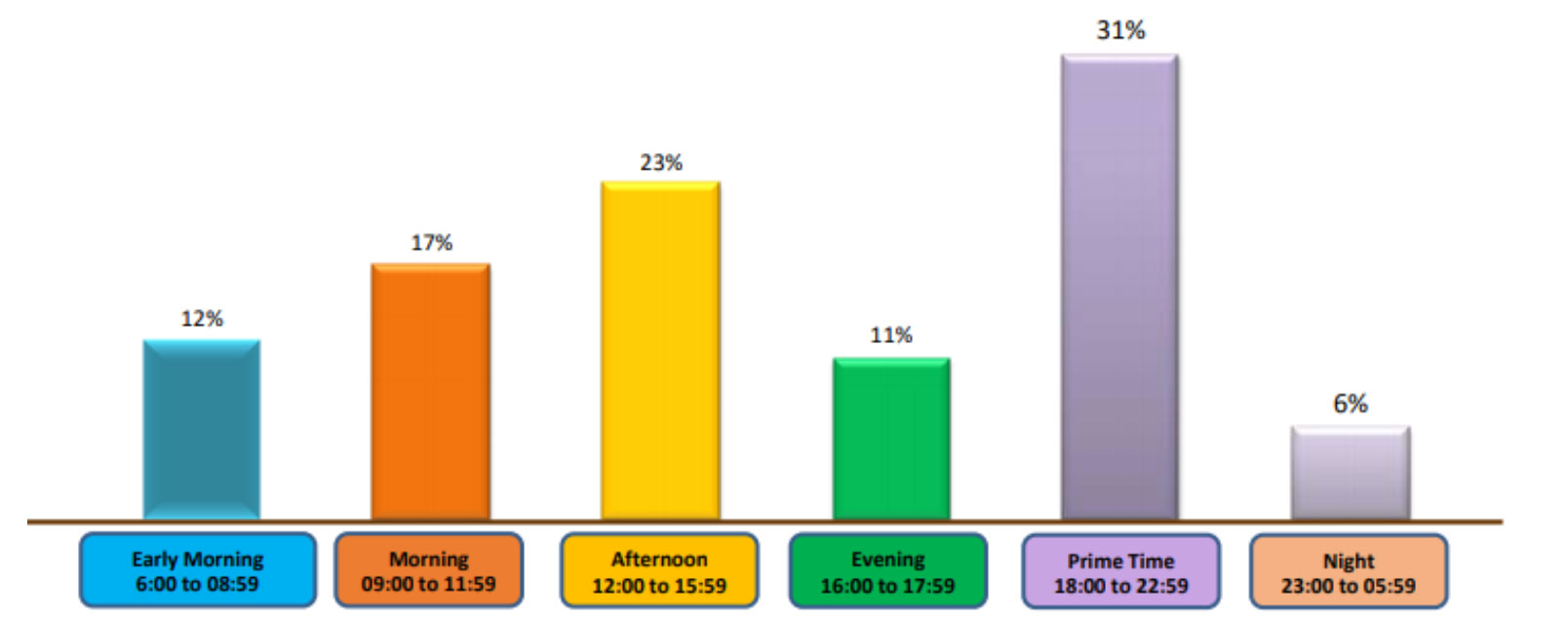

Prime Time was the most preferred time-band on TV, followed by Afternoon and Morning time-bands. Also, Primetime, Afternoon & Morning time bands together accounted for more than 70% share of ad volumes.

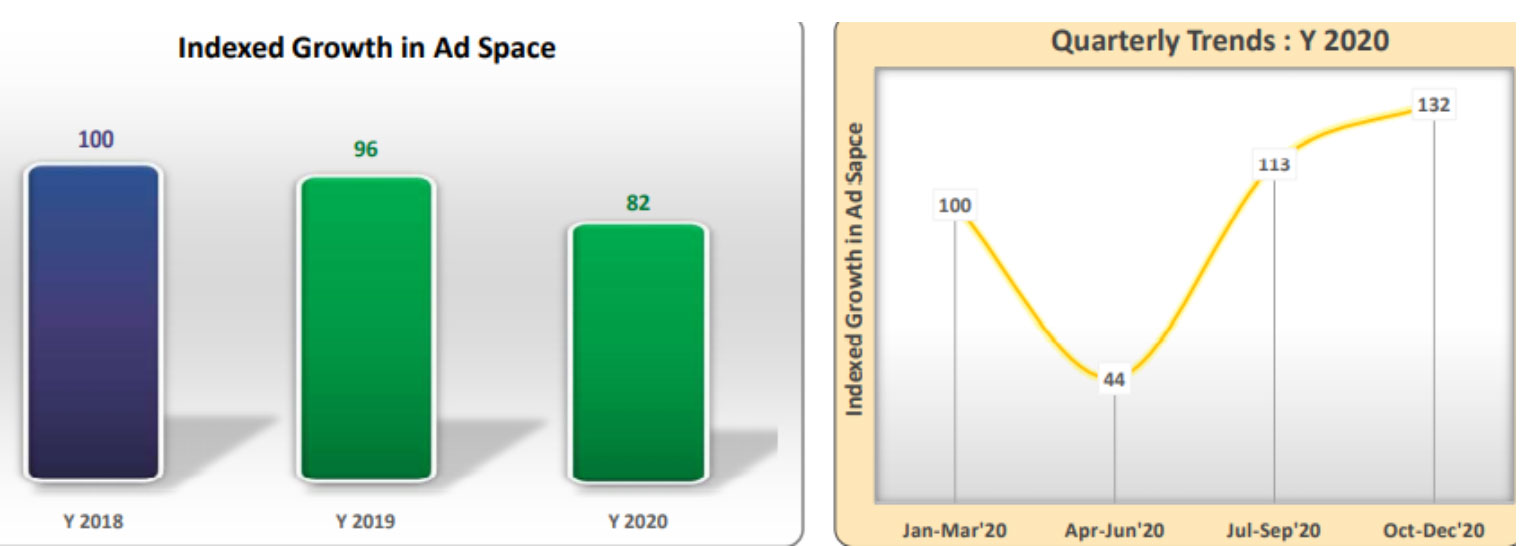

In the Ad Space for FMCG sector in Print, 2020 witnessed an 18% ad space drop for FMCG in the Print medium compared to 2018. Compared to the 1st Quarter of 2020, Q3 and Q4 witnessed 13% and 32% Ad space growth. Due to Covid-19, the lowest Ad Volumes observed in the 2nd quarter includes the lockdown period. within three months of the post- lockdown period, Print Ad Space recovered and matched up to the Pre-Lockdown level

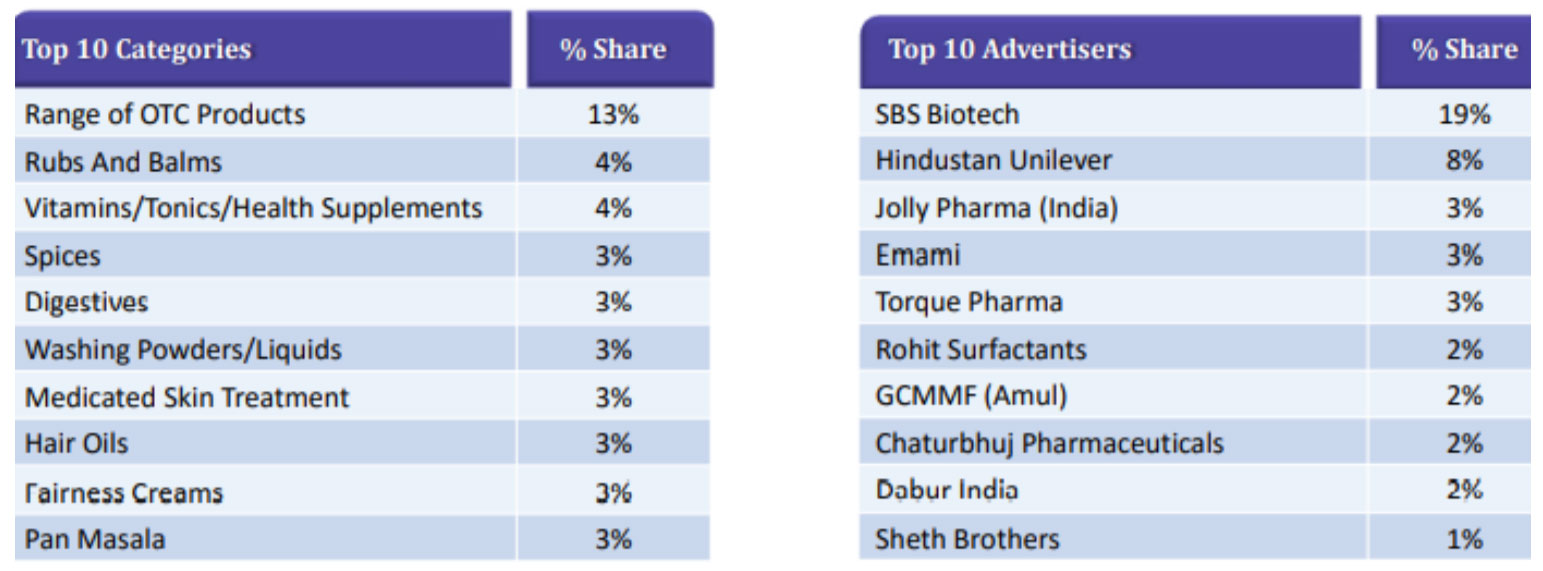

6 out of Top 10 Categories were from Personal Healthcare and Personal Hygiene, Range of OTC Products, Rubs, and Balms, Health Supplements, Spices, Digestives, Washing Powders. Top 10 Advertisers accounted for around 45% share of ad space in 2020, with SBS Biotech leading the list.

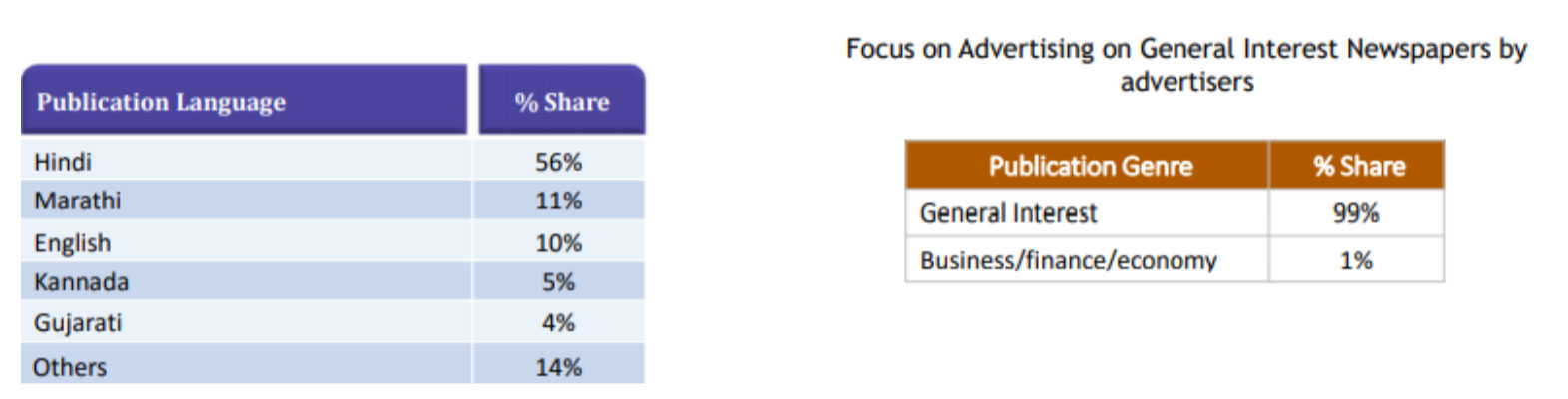

Top 5 Publication Languages (Hindi, English, Marathi, Kannada, Gujrati) accounted for 86% share of the sector’s Ad space. The General Interest publication genre added a 99% share of the sector’s Ad volume.

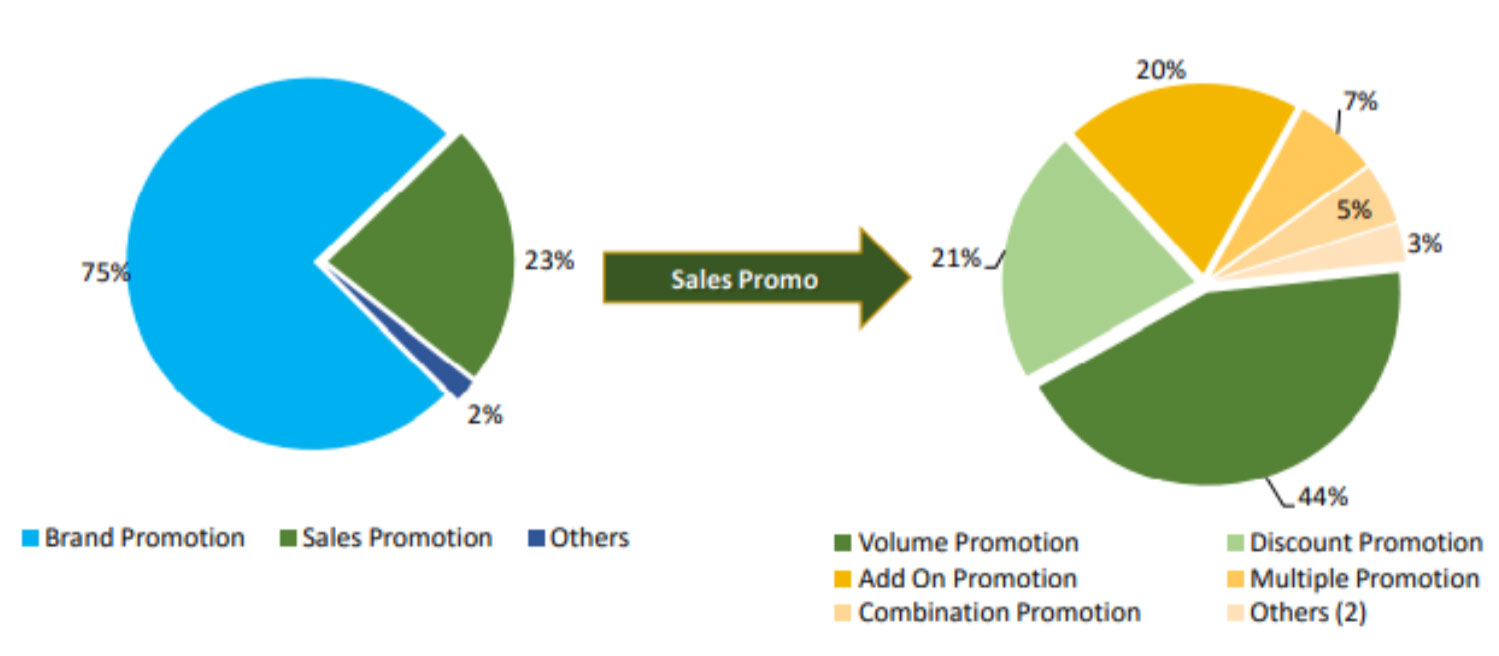

The Sales Promotion for the ‘FMCG’ sector accounted for more than 1/5th of ad space share in the Print medium. Among Sales Promotions, Volume Promotion occupied 44% share of the pie, followed by Discount Promotion with a 21% share in 2020.

The Ad Volumes for the FMCG sector on Radio observed a 22% Ad volume drop for FMCG ads on Radio in 2020 compared to 2018. Compared to the 1st Quarter of 2020, Q3 and Q4 witnessed 12% and 42% ad volume growth. Due to Covid-19 and the lockdown, 2nd Quarter observed the lowest Ad Volumes.

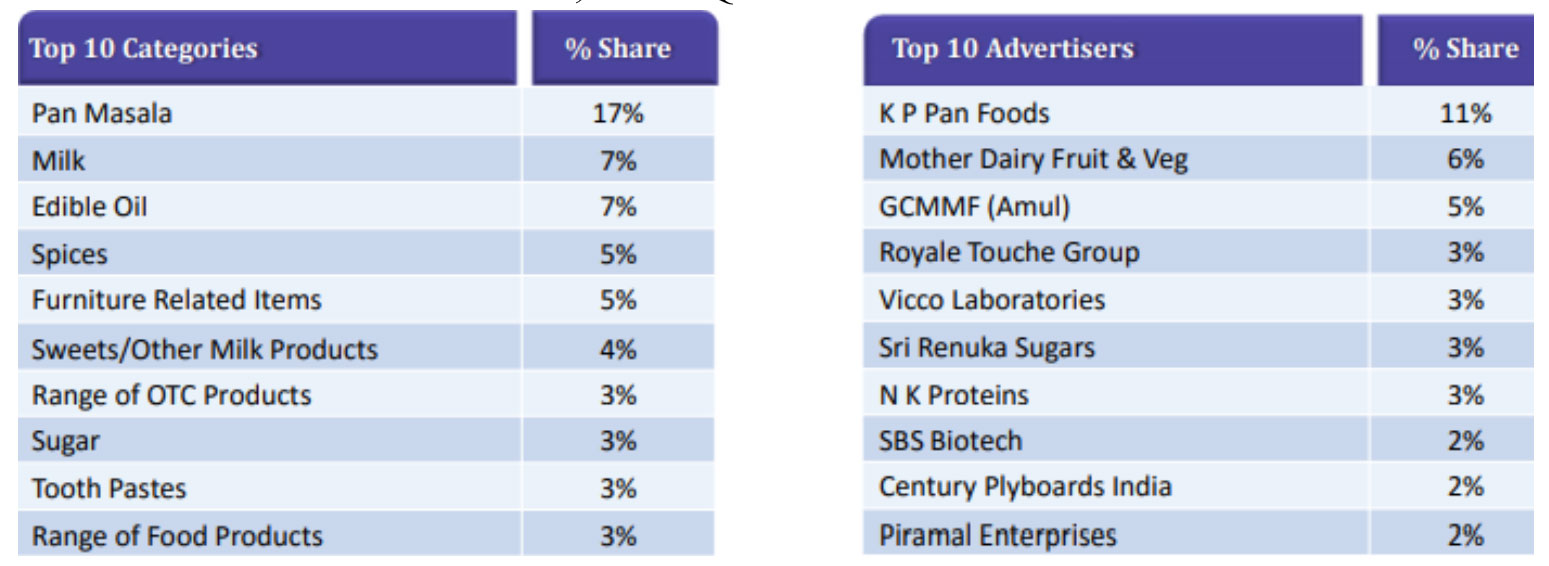

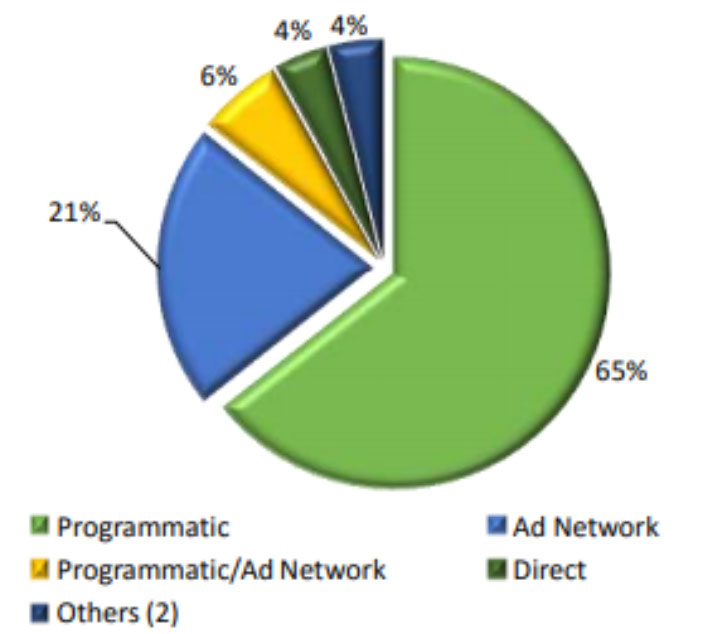

F&B Sector dominated the Top 10 list of categories with 8 out of Top 10 in 2020 on Radio. Whereas, top 10 Advertisers accounted for nearly 40% share of Ad volumes in 2020, with K P Pan Foods leading the list.

The Top 3 states, Gujarat, Madhya Pradesh, Tamil Nadu, occupied more than 50% share of Ad Volumes for the FMCG sector. Gujarat tops the states with more than 1/4th share of the sector’s ad volumes in 2020.

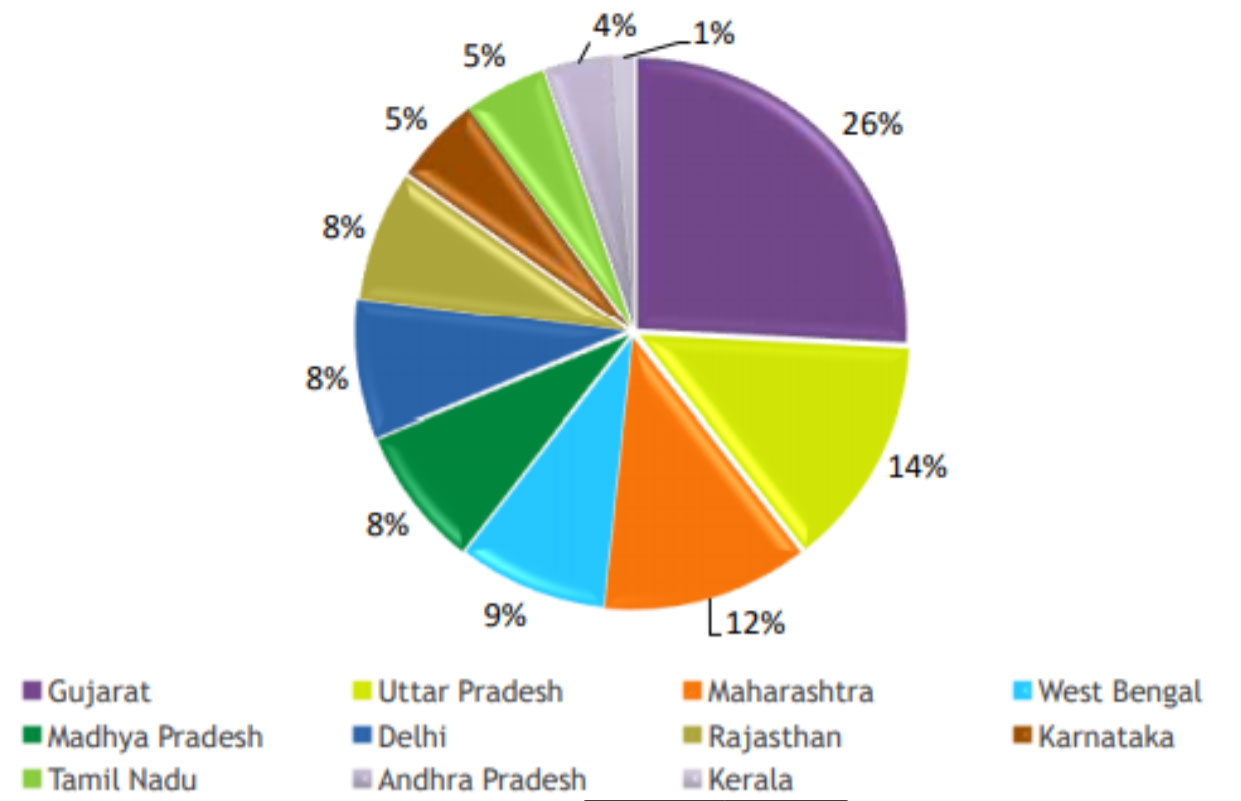

The Ad Insertions for the FMCG sector on Digital witnessed a drop of 36% in 2020 compared to 2019. Compared to the 1st Quarter of 2020, Q3 and Q4 saw 62% and 93% Ad insertion growth. Like other categories, Digital also witnessed Ad insertions drop due to the pandemic.

Personal Healthcare/Hygiene and F&B Sector rules the Top 10 list of categories in 2020 on Digital. Whereas, top 10 Advertisers accounted for nearly 50% share of ad insertions in 2020 with HUL leading the list.

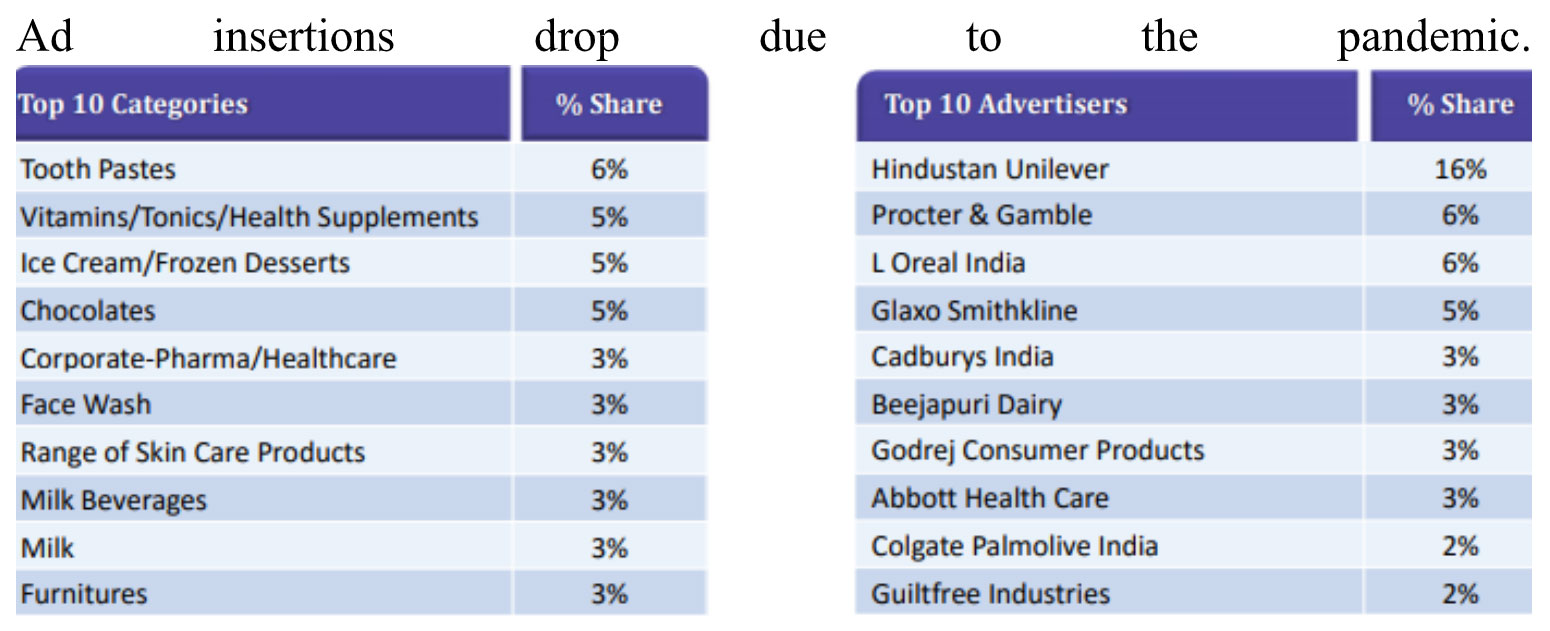

Programmatic was the top transaction method for Digital advertising in the FMCG sector in 2020. Programmatic and Ad Network transaction methods captured more than 85% share of FMCG ad insertions on Digital.