With the Q2 results coming out, ZEEL has reported a consolidated revenue of Rs. 21,220 million. The domestic television business is heavily dependent on its Hindi movie cluster and the regional portfolio which continues to grow. During 2QFY20, Zee’s television network had an all-India viewership share of 18.4%.

Punit Goenka, Managing Director and CEO, ZEEL, commented, “I am pleased with the performance we have exhibited during the quarter. Our entertainment portfolio continues to grow from strength to strength across all formats and maintained its leading position. Our television network has emerged stronger post the implementation of tariff order on the back of a strong customer connect and brand pull of its channels. ZEE5 continued to gain traction across audience segments and markets, driven by its compelling content library and expanding list of partnerships across the digital eco-system.”

“This strong operating performance allowed us to deliver industry-leading growth in both advertising and subscription despite the tough macro-economic environment. Domestic subscription growth of 27% has reaffirmed the value proposition our television network has built over the years. The impact of tariff order has now largely settled down and has brought increased transparency along with improved monetization. Our domestic advertising revenue growth, though significantly lower than historical trend, is higher than the industry growth. We have witnessed an improvement in ad spends through the quarter and we believe that the onset of festive season along with measures taken by the government will help revive the consumption growth.”

Post the NTO mayhem, the company claims to have seen strong acceptance across markets under the new tariff regime, especially in the regional markets. Even while the reach of all their pay channels had been impacted during the implementation of new tariff order. In the regional markets, there has been a strong revival of reach post the disruption in early days of the NTO, and in almost all these markets, recovery in reach has been better than competition.

ZEEL claims to have maintained leadership position in the Marathi, Bangla and Kannada markets. While Zee Tamil and Zee Teluguwitnessed a marginal decline in overall viewership due to high impact non-fiction shows launched by competition, the channels have maintained their share in the fiction genre. Zee Keralam, continued to gain share in the Malayalam market led by performance of fiction shows, reaching 8% viewership share in less than a year of launch. Zee’s portfolio of regional movie channels – Zee Talkies, Zee Bangla Cinema and Zee Cinemalucontinued to perform strongly.

ZEEL’s Digital Business led by their OTT platform, ZEE5 recorded a peak DAU (Daily Active User) base of 8.9mn in the month of September 2019. Time spent on the platform averaged to about 120 minutes in September 2019. Zee5 have launched 23 original shows and movies in 5 languages in Q2. Also launched Ad-suite products such as Ampli5, Ad Vault, Infonomics, Play5 and Wish Box to offer holistic advertising solutions to clients.

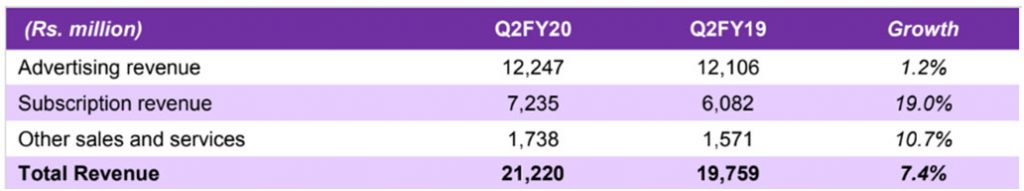

ZEEL’s advertising revenue in Q2FY19 was 12,106 which grew to 12,247 in Q2FY20 by 1.2% YoY.The domestic advertising revenue growth was impacted by the tough macro-economic environment which had a negative effect on demand across categories. The impact on growth due to conversion of two channels from FTA to pay in March continued during the quarter.

Susbcription revenue on the other hand in Q2FY19 was 6,082 which grew to 7,235 in Q2FY20 by 19.0% YoY. The acceleration in domestic subscription revenue growth is driven by sustained growth in viewership of ZEEL’s network.

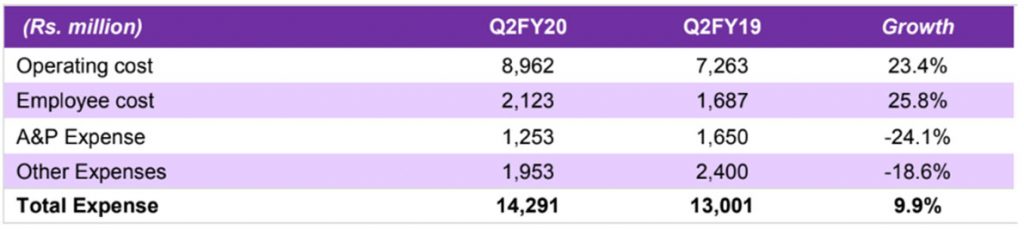

While the economic slowdown has impacted all industries, the cost of producing quality content has defiantly increased. The programming cost for the quarter increased by 23.4% YoY to Rs. 8,962 million. The increase was led by the massive demand for content on their OTT platform, ZEE5 along with the higher movie amortization costs for their Hindi and regional channel portfolio. Advertising, Publicity and Other expenses at Rs. 3,206 million declined by 20.9% YoY, clearly showing how where the slowdown has hurt the network. The decline in ad spends is due to lower marketing spends by ZEE5 during the quarter.