Crosshairs don’t kill. Instead, they set a target.

Star Sports might suffer the collateral damage from this ongoing conflict of digital vs linear over IPL media rights. While digital space is looking more formidable with time, the broadcasting faction is however struggling to gain any position of advantage. And when media warlords see a wounded faction, they go in for the kill! The entertainment business is a battleground where pawns can become kings and queens or get slaughtered for the sake of reigning nobility in the game. If our estimates are to be believed, the ‘Digital’ space could replace over 132 million Cable and Satellite (C&S) households across India.

To set the scene, Jio and Star Sports are two star-crossed entities that are invested in the Indian Premier League (IPL). However, they are not direct competitors owing to unique distribution rights, but at the same time, they compete over the same audience. Star Sports is the official broadcaster of the IPL and thereby holds the broadcasting rights for the tournament in India. Jio, on the other hand, offers an IPL streaming service that allows users to watch matches on internet. Jio’s streaming service is meant to complement Star Sports’ broadcasting rights by providing an additional platform for viewers to watch these IPL matches.

However in the race to garner maximum eyeballs, Jio might have steered a strategic approach that could potentially hamper the reach of its broadcasting foe. As it is known, Jio Digital is a subsidiary of Reliance Industries Limited (RIL) which also owns GTPL, Hathway and DEN – with a collective base of 11.78% of the total 165.9 million active Cable and Satellite (C&S) subscribers (as per Chrome SES, January 2023). In short, this monopolization of the distribution strategy could inadvertently skew the game in Jio’s favour.

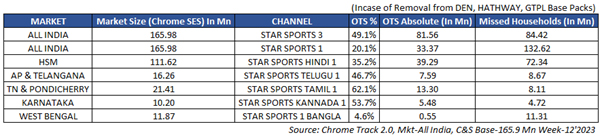

So, while Star Sports was earlier included (and continues to be as I write this article) in their base packages, there are changes being administered on the ground – if the sources are to be believed- where the Star Sports channels might get axed from their default basic packs to ‘a-la-carte’. In other words, if the consumer wishes to view the channel, he/she must pay for it separately in addition to their basic packages. According to the data sourced from Chrome DM, if Star Sports channels are removed from DEN, Hathaway and GTPL’s base packs, then the channels Star Sports 3 and Star Sports 1 could potentially see their net OTS (Opportunity to See or simply the percentage of audiences that have access to a channel) amounting to 49.1% and 20.1% of the all-India C&S base of 165.98 million Homes respectively. The resulting loss, (if at all it does happen on ground) could thereby place the missing households at 84.42 million and 132.62 million respectively, of the total 165.98 million C&S Homes. Likewise, Star Sports could see a drop in its subscriber base across regional markets where Star Sports Telugu might witness a loss of 8.67 million households of the total 16.26 million C&S Homes in AP & Telangana, while the states such as Karnataka and West Bengal could oversee their net OTS amounting to 53.7% and 4.6% respectively.

Live TV and big events have always upped the game in user-engagement for streaming platforms. However, this entertainment industry sustains in the brethren of savages and ‘Distribution game’ remains an old school business. You are either a prey to the commercial assault or a predator plunging its monetary fangs into the apex of free competition. In the deep wilderness of this cut-throat business, the formidable always wins the favor.

Live TV and big events have always upped the game in user-engagement for streaming platforms. However, this entertainment industry sustains in the brethren of savages and ‘Distribution game’ remains an old school business. You are either a prey to the commercial assault or a predator plunging its monetary fangs into the apex of free competition. In the deep wilderness of this cut-throat business, the formidable always wins the favor.

After all – they say all’s fair in war!

(Author is Founder & CEO, Chrome Data Analytics & Media)