Mumbai: India Ratings and Research (Ind-Ra) opines the credit profile of media and entertainment (M&E) players is likely to remain comfortable in FY25.

Multiplexes have started showing growth in both revenue and profitability for the past one to two years, supported by a consistent increase in the number of films being released and a meaningful increase in the average ticket price (ATP) and spends per head (SPH). That being said, the admits and occupancy levels still lag the pre-covid levels. The agency expects the occupancy levels to pick up in FY25 to support the growth in the revenue and profitability of these companies. The over-the-top platforms are expected to co-exist as an alternative entertainment medium; the agency however opines them to be no near-term threat to multiplexes.

“The operating environment for multiplexes, broadcasters, print and multi-system operators (MSOs)/cable companies is expected to remain stable in FY25, with multiplexes likely to see pick up in ATP and SPH, broadcasters and newsprint companies likely to continue to see improvement in advertisement revenue and MSOs likely to continue diversify into broadband services,” says Priyanka Bansal, Associate Director, Ind-Ra.

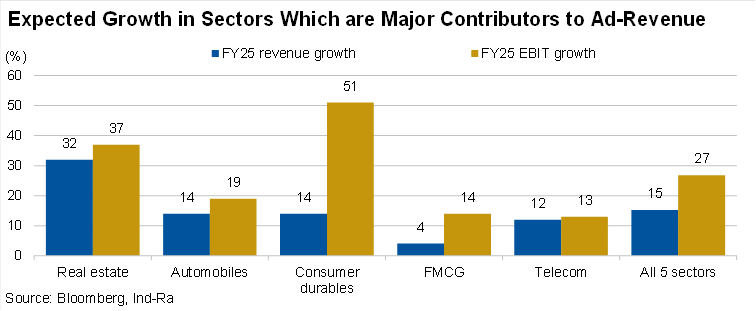

Ind-Ra has a Stable rating Outlook for broadcasters for FY25, on the expectations of continued, similar growth in advertisement revenue as in FY24. That being said, the agency believes a greater share of revenues earned from the subscription-based digital platforms created by broadcasters will support major growth in their revenues and EBITDA.

The reliance of print companies on advertising revenues remains high, as revenue from advertisement constitutes 60%-70% of the total revenue for major print companies. While the industry has seen some recovery in advertisement and overall revenue for print companies, Ind-Ra believes that this segment is likely to report single-digit growth in FY25 with the emergence of alternative mediums for news such as digital applications and social media.

The agency believes given the synergies available between the cable TV business and the broadband business, MSOs will increasingly bundle their offerings with broadband services which ride on the same infrastructure. The agency expects cable MSOs to continue leverage their existing network and offer higher-margin broadband services in a bundled form to mitigate the impact of margin pressures in the cable business. MSOs are also expected to increasingly diversify their geographical presence in the short to medium term, to minimise the impact of subscriber erosion driven by competitive intensity.