GfK released insights into the consumer durables sector for the period of January to October 2023, compared with the same period in 2022. GfK Market Intelligence and POS offline retail tracking revealed a 9 pc surge in value for smartphones. The data also notes a 2 pc decline in volume. The overall impact of the volume decrease, though, was mitigated by an 11 pc growth in the Average Selling Price.

This highlights a dynamic trend within the smartphone market, showcasing the sector’s ability to maintain value growth despite a dip in volume.

Anant Jain – Head of Customer Success Management, India GfK – an NIQ Company, said, “The industry’s expansion can be credited to a noticeable consumer inclination toward premium products spanning diverse categories. Lower-town segments are significantly shaping this trend by seeking convenient tech and durable products to enhance their overall lifestyle comfort. The decrease in Average Selling Prices (ASPs) during the festive season has resulted in a comprehensive upswing in sales this year, underscoring the dynamic evolution of consumer preferences.”

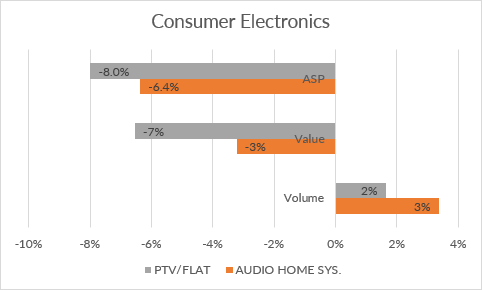

In the Consumer Electronics sector, audio home systems saw a 3 pc increase in volume and a corresponding 3 pc decrease in value. The Average Selling Price (ASP) declined by 6 pc.

The Panel Television category saw 2 pc growth in volume, but this was counterbalanced by a 7 pc contraction in value due to a higher mix of smaller size PTV sale as compared to previous period.

The categories of desk computing, mobile computing, and media tablets displayed a dynamic trend. Each category underwent fluctuations in volume, value, and ASP over the period under review, highlighting the inherent dynamism within these segments.

Feedback: [email protected]