By Yohan P Chawla

It indeed is an honour to speak to a legend from the world of advertising, and Sir Martin Sorrell is one of the few true legends who need no introduction;

anyone and everyone from the business of marketing and advertising would know of his legendary status.

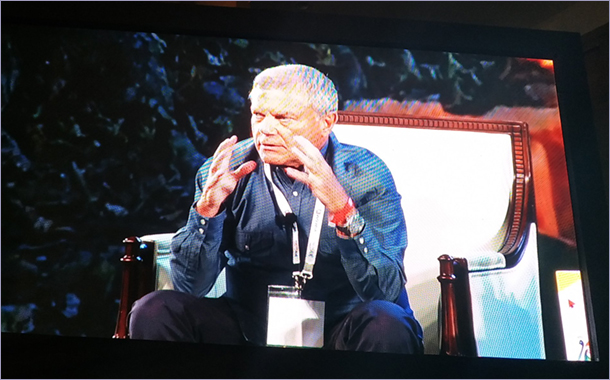

At the IAA World Congress 2019 in Kochi, I met with Sir Martin Sorrell, and what superseded even the awe one was feeling was the chastening knowledge that even legends sometimes need to begin anew.

So I began with his upcoming entry into the India market with S4 Capital, and the conversation covered a few more topics. Edited excerpts:

When are you launching S4 Capital in India?

Sir Martin Sorrell: We will launch S4 Capital in India by the end of February 2019. We are not acquiring any agency in India; instead, we have hired somebody to run the operation. With no Indian agency as a partner, we will be starting from scratch.

Digital is the prime mover, and globalization is of great importance. We’re going to set up very soon in Japan too. But maybe it’s not quite necessary to be present in a hundred and thirteen countries. Once we launch in India, we would have reached our 15th country.

Your take on the Indian market… what is it that excites you about it?

Well I think the Indian market remains very vibrant. Obviously, the industry is still growing and the agencies in India have seemed to, you know, sort of flattened out, so it’s tougher for them, and hence they face the same challenges as the ones abroad.

I think the Indian market is more traditional. The traditional media will play a greater role in the Indian market and may do in the future too, but will be subject to the same pressures; newspapers, for example. At the same time, it’s interesting to see that the Indian market is a two-speed economy in the sense that tech in India, as Amitabh Bachchan in his inaugural speech at the IAA World Congress 2019 defined ‘Brand Dharma’ — which includes tech, healthcare and pharmaceutical drugs, and cricket.

The market is moving that way. It’s not slower because the technological pace in India is very high, and Bangalore is a hub just like Silicon Valley or Beijing. It’s an important hub.

Then you’ve got the export of Indian talent to Silicon Valley, and that annual festival of Indian technology entrepreneurs is truly extraordinary.

So it’s really vibrant. It’s a great market and will be the most populous on the planet. So it’s full of potential and I think that’s a dividend not a liability. It won’t be the wealthiest country on the planet, but it will, from the media point of view, become more and more important. And then there’s the BPO, consulting operations here in India, which also are very important in the same context.

A quick snapshot of the Asia PAC market, if you would…?

So India will be in the centre. I mean, if l look at Asia, India is right there — in the centre! However Japan, still, is a challenge for foreign companies. When you think about the Australia and New Zealand markets, they’ve grown, but not spectacularly. I believe China is the dominator.

How will the year 2019 be? Do you think it’ll be a bumpy ride? Which are the challenge one can expect in 2019?

This year at the World Economic Forum in Davos, there were a lot of governments including the Indian Prime Minister. Everybody in the governments were minding their own affairs, business people were not depressed. But they were, I think, a little gloomy, they were a little bit negative given all the global problems of the socio-political issues. The financiers, though, the private equity people and the money men were probably pretty optimistic. If not optimistic, they were positive.

It is strange dichotomy to me that signals that we are going to have a fair amount of bumpiness. To my mind, Brexit is a sideshow to the trade fight. It’s not a tiff, it’s a war, and I think the Chinese will dig in and I think the Chinese look at Trump being there for two years or for six years — I think he will be there for six years… But they really think things like these over even a hundred-year period! And I think this is about who’s going to be top dog.

Wouldn’t the bumpiness hurt S4 capital in India?

Well, disruption and bumpiness is good for us because we’re disruptive and, you know, we are at the beginning, so we’re not a big far-flung company. We have 1200 people this year and brokers are forecasting 225 million in revenue and 45 million EBIDTA and 600 million-market cap. For us, bumpiness is a good thing. For established people this creates challenges. For us, it creates opportunities. The more friction there is in the system, the more disruption there is the system.

The digital industry too, which has been consistently growing with many many new entrants every week, is highly fragmented. Is that fragmentation good or bad?

Fragmentation in itself is not a bad thing. It’s a good thing and I think that you could be a bit careful about that when an industry is in its early stages. It tends to be more fragmented, and as it matures, it gets more consolidated. See, back in the day, nobody took it seriously — but it’s different with digital because that is serious stuff and people understand it.

So the opportunities to consolidate and pull things together were very significant. So that’s what we did, and I like to think, maybe wrongly, that the digital part of this is ripe for the consolidation too, so, you know if you have ten agencies here in India and all of them doing two or three million dollars of business. I spoke to one agency that was, I think, doing about two or three million dollars of revenue — they’ve consolidated four agencies for that… to get two to three million.