Mumbai: Private Insurer, Shriram Life Insurance Company’s profit after tax has grown 3 times to Rs. 106 crores in FY 20-21. This growth is backed by technology adoption and an increase in rural penetration in the country as the company continues to serve the community at large. Effective and consistent focus on fundamentals also yielded strong results with the AUM growing at 30% to Rs 6,261 crores. Income from Investments has excelled more than double to cross 500 crores.

Even during these unprecedented times, Shriram Life Insurance was able to grow its gross premium by 23% crossing the milestone of 2,000 crores. This growth was supported by a 25% growth on total new business premium and 24% growth on retail renewals. The company continues to extend financial protection to customers residing even in the deepest rural locations within the heartlands of India with approximately 47% of its new business from the rural segment. Also, 54% of the company’s claims came in from the rural segment.

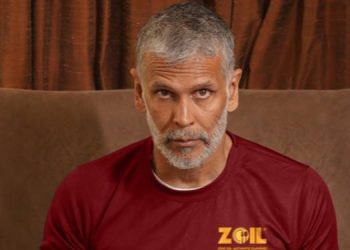

Casparus Kromhout, MD & CEO, Shriram Life Insurance said, “Shriram Life has been focused on serving the protection needs of the rural segment and lower income segments. These segments are most affected by the crisis due to the dual impact of the health emergency and loss of income. We remain committed in reaching our customer segment during this difficult time to ensure that financial protection is extended to more customers and that life cover continues for existing customers. The growth of 8% in number of policies sold underlines this commitment. Our complete focus has been on unhindered customer service especially for claims settlement.”