Mumbai: Podcasts are growing in cultural and political influence, but growth in podcast advertising spend remains slow. Publishers and platforms are looking to address this by expanding beyond audio, with a greater focus on creators and video content, according to WARC Media’s latest Global Ad Trends report, ‘Podcast media sets sights on video boom’.

Alex Brownsell, Head of Content, WARC Media, says: “Podcasts are having a moment. Fresh from seemingly helping Donald Trump to win last year’s ‘podcast election’ in the US, brands are reappraising the medium through fresh eyes.

“However, ad investment growth remains sluggish, with podcasters trapped in a contest for a slow-growing pool of global audio ad budgets. Publishers and platforms are now eyeing expansion into video, in the hope of further boosting consumption, as well as winning a share of a fast-growing slice of the ad market.”

WARC’s latest Global Ad Trends report ‘Podcast media sets sights on video boom’ highlights the following trends:

Podcast advertising spend growth remains slow

For all its burgeoning cultural impact, podcasts remain caught in a battle to win share of audio ad dollars.

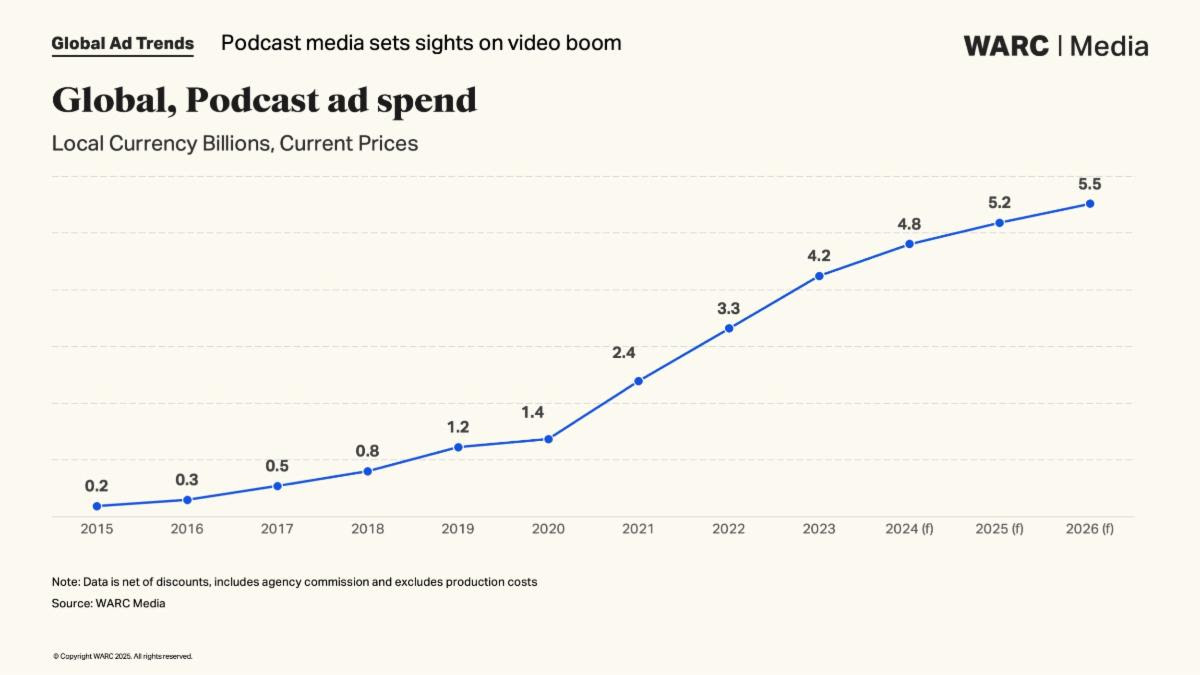

WARC Media forecasts that global podcast ad spend reached $4.8bn in 2024, will exceed $5bn in 2025, and amount to $5.5bn in 2026. However, year-on-year growth is set to slow from 13.2% in 2024 to 7.9% in 2025, and only 6.5% in 2026.

This is markedly down on the expanding investment levels in other emerging channels, including retail media (+14.8% in 2025), CTV (+15.4%) and even DOOH (+14.9%).

Difficulties in scaling podcast ad buys is one oft-repeated complaint among brands. Another is a perceived deficiency in podcast measurement tools.

However, according to WARC’s annual Marketer’s Toolkit survey, more than half of global marketers (55%) plan to increase their podcast ad investment this year. Podcasts ranked fifth highest in intention to invest – behind only online video, influencer/creator marketing, and social media.

Global podcast listenership is growing and remains diverse

The total global audience reach of podcasts has increased from 60.6% in 2020 to 66% in 2025.

Edison Research estimates that 135 million listen in the US each month, equivalent to 47% of all consumers aged 12+. In the UK, Ofcom found the percentage listening to podcasts on a weekly basis has doubled from 10.8% in 2018 to 20.7% last year.

On average, younger cohorts spend more time on podcasts each day than older groups. As of Q2 2024, podcasts’ reach among Gen Z audiences worldwide (68%) exceeds radio by ten percentage points.

In markets like the UAE and Brazil, podcast listenership among all adults has exceeded radio, whereas countries like Germany and China exhibit subdued and downward trends, according to WARC Media and GWI data.

Podcast publishers are aiming to drive growth through video

YouTube has emerged as the most popular platform for podcast video. Viewers watched over 400 million hours of podcasts per month on YouTube’s TV app in 2024. More than 250 million users have streamed a video podcast on Spotify, with consumption most prevalent among Gen Z users: in the first five months of 2024, the younger cohort watched 2.9 billion minutes of video podcast content, up 58% year-on-year. Spotify found a +55% lift in intent for campaigns with an audio and video takeover versus audio-only campaigns.

As brands become more sophisticated in how they incorporate creator content into media plans, it may provide an opportunity for podcast media to escape its audio bubble. However, obstacles include consumers wanting to minimise video and listen to audio only, podcast creators unwilling to embrace video and lose control over monetisation, and perceived deficiency in podcast measurement tools.

The US is the world’s largest podcast advertising market

The US – home to mega-shows such as The Joe Rogan Experience – accounts for nearly half (45.9%) of all global podcast ad spend.

Recent research by WARC and Audacy found that, while podcast listening accounts for 4.5% of all ad-supported US media consumption, the channel only receives 1.0% of total US ad investment ($2.4bn in 2025).

Retail continues to be the category with the highest podcast ad spend in the US, while the US election prompted a slight increase in government and non-profit spend. Food category spend remains low, but is forecast to record the fastest growth in 2026 (+13.2%).

As the medium matures, larger brands are becoming a more dependable source of income for podcast publishers. Top podcast spenders in the US include Amazon, T-Mobile, Capital One and Toyota.

In the UK, podcast ad spend is forecast to reach £110m this year, growing at 12.8%, according to WARC Media estimates. This is a faster rate of growth than in the US, and a sharper incline than forecast for UK spend on search, social media, DOOH and BVOD in 2025.

Podcast reach in the UK is increasing: a fifth (23.6%) of people aged 15-24 listen to at least one podcast per week, and consumption is highest among 25-34-year-olds (27.9%).

Podcasts are becoming more important to political discourse

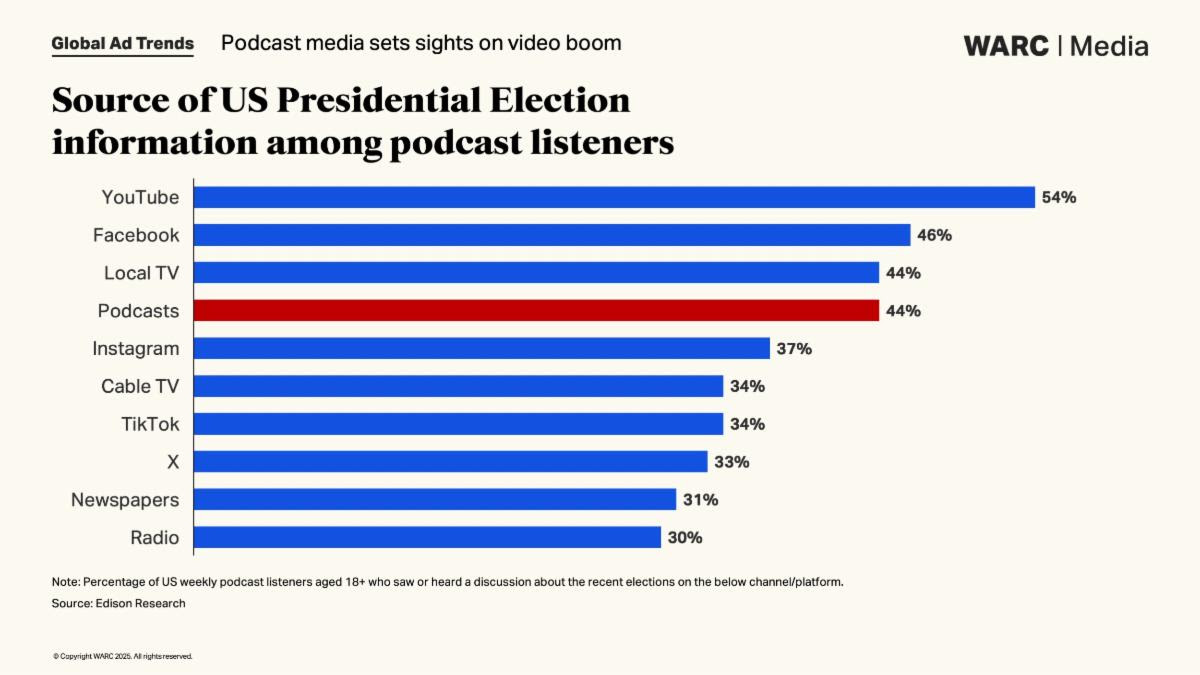

Donald Trump triumphed in the ‘podcast election’. His podcast strategy was more effective than that of rival Kamala Harris, achieving greater reach with shows known for delivering better returns for brands. Trump appeared on podcasts with a total average reach of 23.5 million compared to 6.4 million for Harris, and the shows selected by Trump drove 2-3x better results for brands in areas such as site visits, sign-ups and purchases.

According to Edison Research, nearly half (44%) of those surveyed by them said they sourced US election information from podcasts, ahead of cable TV (34%) and platforms like X (33%).

Following the US election result, previously cautious marketers are re-considering their ‘podcast safety’ approach – in particular in advertising against more right-wing content to reach younger male audiences.

Podcast audiences tend to be more receptive to ads

Nearly 40% of listeners say the medium has become “more relevant” in recent years, according to an Acast study. However, as programmatic trading expands into podcasting and the channel expands beyond baked-in host-read ads, other studies have found that two in five (42%) regular listeners skip podcast ads, as they find them intrusive.

Studies have found that episodic buys – that is, ads placed in a single podcast episode on a specific show – tend to outperform ads dynamically inserted throughout shows across a podcast network. In the case of host-read ads, Podscribe research found that, as ad length increases, visitor rates to advertisers’ sites also increase. On average, a two-minute-plus read outperforms 60-second or shorter reads by about 20%.

Read a complimentary sample report of WARC’s Global Ad Trends – Podcast media sets sights on video boom. WARC Media subscribers can read the report in full. A WARC podcast discussing the findings outlined in the report will be available from 25 February.

Global Ad Trends, part of WARC Media, is a quarterly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments.