Cord-cutting in developed Asia-Pacific (APAC) is set to offset gains in Direct-to-Home (DTH) and Internet Protocol television (IPTV) in emerging APAC (South and Southeast Asia) and as a result, the overall region is forecast to witness a marginal decline in pay-TV household penetration from 67.4% in 2018 to 67.0% by the end of 2023, according to GlobalData, a leading data and analytics company.

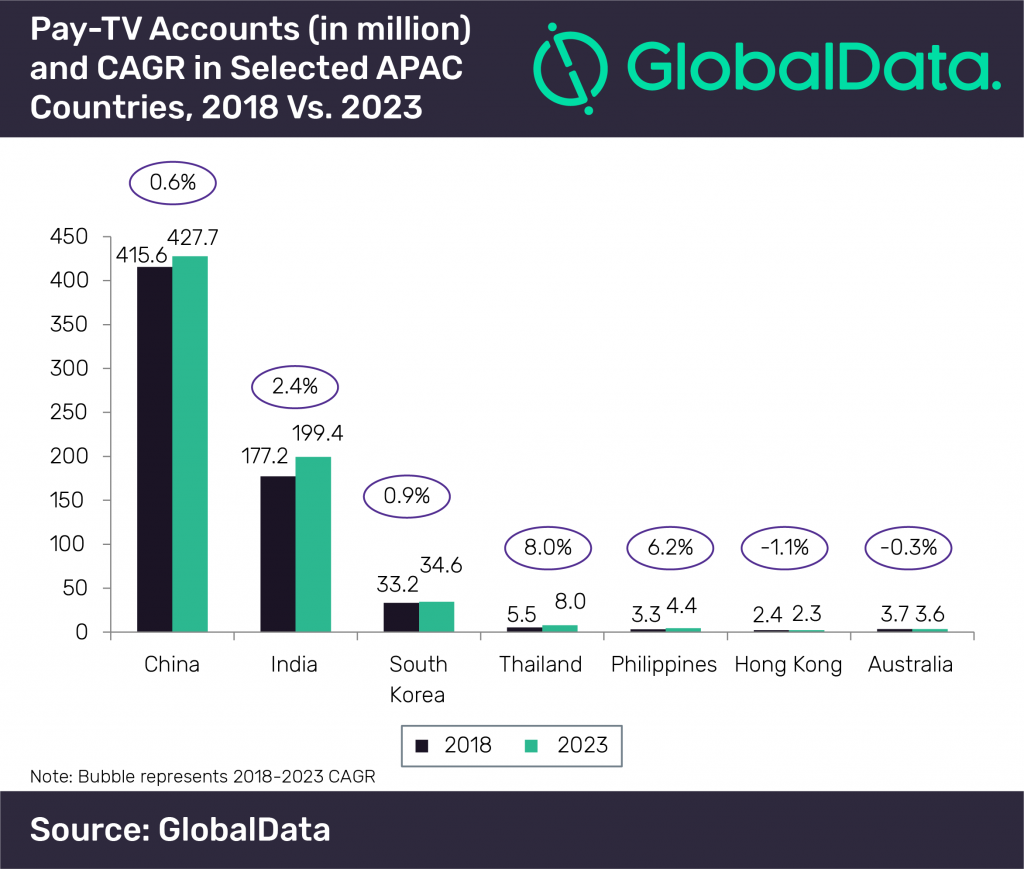

Global Data’s report, ‘Pay-TV Market Trends and Opportunities in Asia Pacific – 2019’, reveals that China and India are currently the largest pay-TV markets in the region with 415.6 million and 177.2 million subscriptions, respectively as of year-end 2018, distantly followed by South Korea with 33.2 million subscriptions.

During the forecast period, developed markets such as Hong Kong and Australia are set to witness a decline in pay-TV penetration levels primarily due to cord-cutting and the popularity of over-the-top (OTT) video streaming platforms in these markets.

Malcolm Rogers, Telecom Analyst at GlobalData, says: “The APAC pay-TV market is very diverse, with household penetration levels ranging from 11% in Indonesia to 168% in South Korea as of year-end 2018. Currently, the market is facing growing price pressure. Most OTT players offer their services at a lower price point than traditional pay-TV packages. The effect is an increasing number of consumers only willing to pay for the content they know they will watch. In response, pay-TV providers are offering more modular packages to better match consumer preferences for content and price.

“For example Taiwan’s Chunghwa Telecom offers its Multimedia On Demand (MOD) service in a menu style selection manner with variable pricing per channel from US$0.16 (NT$5) to US$4.98 (NT$150), based on the cost from the content provider. This enables Chunghwa to target price sensitive customers and better compete with lower cost OTT options.”

An increasing number of video content consumers in the region prefer services that offer watch anywhere capability. While the home TV is still an important device, customers also demand the same experience across mobile handsets, laptops and tablets. This has resulted in a trend of service convergence between traditional OTT and pay-TV.

Rogers concludes: “OTT video’s relationship with pay-TV in APAC continues to evolve. Many pay-TV providers in the region have launched or will soon launch their own OTT platforms. Standalone OTT players are also increasingly seeking pay-TV provider partnerships. The pay-TV and OTT platforms are becoming increasingly integrated as customers want a device agnostic viewing experience.”