Advertisement volumes of OTC Products on television registered 82% growth during January-May 2021 compared to the same period in 2020. The print recorded 37% growth, while Radio and Digital mediums also witnessed the huge growth of 2.5 X and 2X respectively in ad volumes during Jan-May ’21, according to the data released by AdEx India, a division of TAM Media Research.

Television

Ad volumes of the OTC Products category on Television rose by 3% during Jan-May’20* respectively compared to the same period in Y 2019.

The Top 10 advertisers accounted for more than 80% share of category ad volumes during Jan-May’21*, with SBS Biotech leading the list.

SBS Biotech’s Sachi Saheli Ayurvedic Syrup topped among the brands during Jan-May’21* with a 20% ad volume share. The top 10 brands had more than 60% share of ad volumes.

Evion Capsules was the top new brand, followed by Otrivin Breathe Clean during Jan-May’21 compared to Jan-May’20. More than 50 new brands appeared for the OTC Products category during Jan-May’21.

The news genre alone had nearly 50% of the category’s ad volumes, followed by GEC in 2nd position. Top 3 channel genres grabbed 90% of ad volumes for the OTC Products category during Jan-May’21.

News Bulletin was the most preferred program genre to promote OTC Products on Television. The top 2 program genres, i.e. News Bulletin and Feature Films, added more than 55% of the category ad volumes.

On TV, Prime Time was the most preferred time band, followed by Afternoon.

Together, the Prime Time, Afternoon, and Morning time bands combined for more than 70% of ad volumes.

The ad space for OTC Products during Jan-May’21 grew by 19% compared to Jan-May’19 and rose by 37% compared to Jan-May’20.

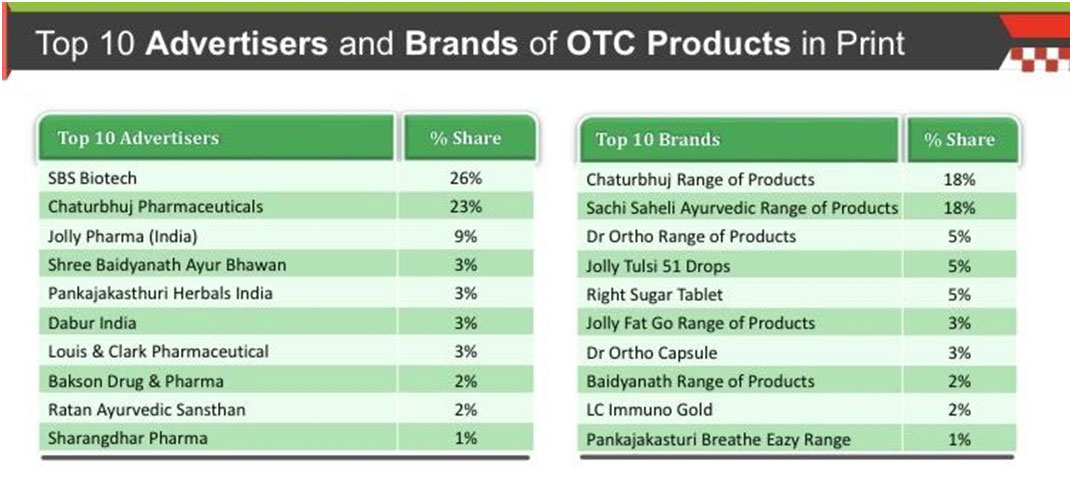

SBS Biotech, among the advertisers, topped the OTC Products followed by Chaturbhuj Pharmaceuticals together, contributing almost 50% of the category ad space in Jan-May’21*.

Chaturbhuj Range of Products was the top brand with an 18% share, closely followed by Sachi Saheli Ayurvedic Range of Products with a nearly equal percentage of ad space. The top 10 advertisers and brands added 74% and 62% share, respectively.

More than 220 new brands seen during Jan-May’21* compared to Jan-May’20*. LC Immuno Gold was the top new brand, followed by Dabur Tulsi Drops.

During Jan-May’21*, the Hindi language topped with 61% share of OTC Products’ ad space, followed by Marathi with 17% share. The Top 5 Publication languages together added 91% share of category ad space. General Interest publication genre ruled with 99% share of ad space.

North Zone topped in OTC Products with 39% share of ad space during Jan-May’21* closely followed by South Zone. Mumbai & Nagpur were Top 2 cities in overall India for advertising in Print.

Sales Promotion had 12% of OTC Products’ ad space during Jan-May’21*. Among Sales Promotions, Volume Promotion occupied 57% share of ad space followed by Combination Promotion with 27% share.

Among the Sales Promotion’s advertisers, SBS Biotech topped with a 44% share of ad space, followed by Jolly Pharma (India) during Jan-May’21*.

Radio

When comparing Jan-May’21* to Jan-May‘19*, the rise of 11% in OTC Products’ ad volumes observed on the Radio medium. Comparing it with Jan-May’20*, Radio ad volumes witnessed a surge of more than 2 Times during Jan-May’21*.

Among the advertisers, SBS Biotech topped with 24% of the ad volumes’ share in Jan-May’21*. Dr Ortho Range of Products was the top brand with 24% share, followed by Enkor D with 19% share. During January-May* of this year, the Top 10 advertisers and brands had a 93% ad volume share.

30+ new brands observed in Jan-May’21* over Jan-May’20*. Enkor D was the top new brand on Radio medium, followed by Iwall.

Gujarat state was on top with a 30% share of ad volumes followed by Karnataka with a 19% share. The Top 2 states occupied nearly half of the ad pie for the OTC Products.

Advertising on Radio was preferred in the Afternoon time-band followed by Evening & Morning. 68% share of OTC Products’ ad volumes was in Afternoon & Evening time-bands during Jan-May’21*.

Digital

On Digital medium, ad insertions increased significantly by 2.5 times and 33% during Jan-May’21* and Jan-May’20* respectively compared to the same period in 2019.

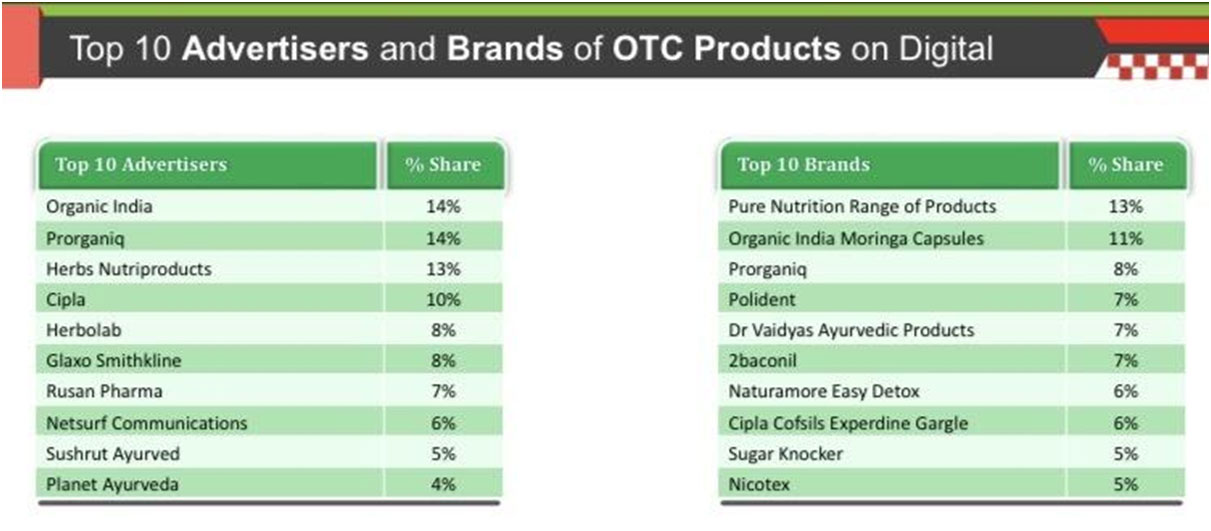

Organic India and Prorganiq were the top advertisers of the OTC Products category with almost the same share of ad insertions during Jan-May’21*. Pure Nutrition Range of Products was the top brand with a 13% share of ad insertions during Jan- May’21*. The top 10 brands had more than 70% share of ad insertions in the category.

Ad Network transaction method topped with 61% share of OTC Products’ ad insertions on Digital during Jan-May’21* followed by Programmatic with 23% share.