As India’s biggest cricketing extravaganza returns in full swing, IPL 2025 has already captured the attention of millions. But beyond the thrilling matches and dramatic finishes lies a high-stakes battleground for brands. A recent Day-After Recall Tracking study sheds light on how well brands are performing in the hearts and minds of IPL viewers—and the findings are as revealing as they are strategic.

As IPL 2025 unfolds, a new report by CrispInsight, in collaboration with Kadence International, is turning heads in the marketing world. The eDART-IPL25 study, based on day-after recall tracking of IPL matches held until March 30, 2025, challenges long-held assumptions that high ad spends guarantee brand recall. The findings from Week 1 of the tournament paint a more nuanced picture—where strategic brand integration and contextual visibility are outperforming traditional ad slots.

Brand Recall Has a Ceiling

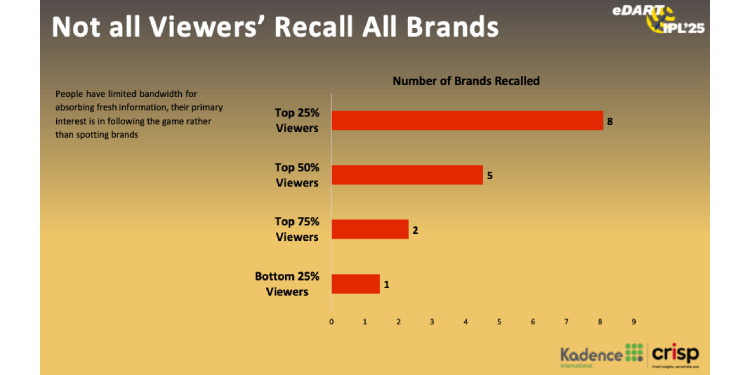

Despite the massive reach of IPL, viewer attention comes with limits. Only 1 in 4 viewers could recall more than five brands after watching a match, indicating that brand clutter is real and only the most relevant or well-placed brands cut through the noise.

What drives this recall? Category relevance. Viewers tend to remember brands that align with their interests. For instance, Fantasy Sports emerged as the most recalled category, with 66% of viewers recognizing at least one fantasy sports brand. This was followed by Tyres (32%) and Financial Services (21%), underscoring the importance of targeting aligned consumer interests.

On the other end, categories such as Business Services, Toys, and Sports & Fitness struggled, with some seeing less than 2% recall—a signal for marketers to rethink their category-specific IPL strategies.

“Sponsorship-driven visibility and strategic placements are proving to be just as powerful, if not more so, than traditional ad slots in IPL,” said Ritesh Ghosal, Partner at CrispInsight. “While fantasy sports brands dominate recall, many high-spending brands are struggling to break through the clutter, reinforcing the need for smarter, recall-focused marketing strategies.”

Visibility Isn’t Enough—Impact Is Elusive

While visibility is a strong starting point, the study shows that it rarely translates into meaningful impact. Over half (54%) of viewers didn’t feel influenced by any of the brands they noticed. This means that most IPL advertising is failing to move the needle on key consumer behaviors—be it intent to purchase, curiosity to explore more, or even a boost in brand perception.

This insight is a wake-up call for brands: recall without resonance is wasted spend. The focus must shift from being seen to being felt.

“This is where brand storytelling and contextual placements come in,” Ghosal added. “The most successful campaigns are those integrated into the IPL environment—jersey placements, boundary ropes, even team huddles—not those confined to 30-second breaks.”

The Power Players: Teams and Talent

IPL loyalty continues to be a powerful emotional hook. A whopping 77% of viewers identified with a favorite team, with Kolkata Knight Riders taking a surprising lead this season—leapfrogging past stalwarts like Chennai Super Kings and Mumbai Indians. This surge in team loyalty opens new doors for brands partnering with KKR, as regional and emotional affiliations grow stronger.

When it comes to player appeal, Virat Kohli, MS Dhoni, and Rohit Sharma remain the undisputed fan favorites, commanding deep trust and admiration. Meanwhile, new stars like Sunil Narine, Rinku Singh, and Andre Russell are quickly gaining momentum, particularly with younger demographics.

For brands, this trend highlights the effectiveness of player-based endorsements and integrations. From co-branded content and social campaigns to on-ground activations, players are not just ambassadors—they’re cultural icons that carry influence beyond the boundary lines.

“IPL this year sees a larger number of brands advertising but with lesser depth, making standing out that much tougher,” said Aman Makkar, Country Manager at Kadence International. “Our findings highlight the growing importance of sponsorship-led brand placements, which deliver sustained visibility and deeper fan engagement throughout the live telecast.”

The report also categorizes IPL viewers into:

-

Superfans (4%) – emotionally invested, watch every match

-

Active Viewers (14%) – regularly follow the games

-

Casual Snackers (82%) – watch occasionally or in short bursts

Brands looking to convert attention into impact must cater differently to each group. For example, superfans may respond better to emotionally driven team integrations, while casual viewers might only register bold, repetitive visuals during big moments.

Interestingly, even star power plays a major role in shaping brand association. The report found 95% of IPL viewers have a favorite player, reinforcing why celebrity-driven campaigns often outperform more generic approaches.

The Strategic Takeaway for Brands

The IPL remains a high-impact platform, but the game is evolving. To win in 2025 and beyond, brands must:

-

Align campaigns with high-affinity categories and interests

-

Create not just visibility, but meaningful, memorable brand experiences

-

Use emotion-driven assets like teams and players smartly

-

Segment messaging strategies based on engagement levels—from superfans to casuals

As IPL 2025 moves into its next phase, one truth stands tall: winning attention is only half the game—winning hearts is the real victory. With the tournament only in its first leg, the eDART-IPL25 series promises weekly insights that can help brands recalibrate their campaigns mid-season for maximum recall, relevance, and ROI.

“In a tournament where emotions run high and loyalty runs deep, the brands that integrate smartly and connect meaningfully will be the ones that win off the pitch,” Makkar concluded.