COVID-19 created the perfect environment to force a step-change in how Consumer Packaged Goods (CPG) brands distribute their products. As a result, by the end of 2023, WARC forecasts retail media to be worth $137bn globally – double its 2020 take. Edge by Ascential predicts media spend on ecommerce will account for 58% of global chain retail sales by 2025.

Against this backdrop, WARC, the global authority on marketing effectiveness, has today released the first of a new series of digital commerce benchmarking studies: How to win on Instacart, the leading online grocery platform in the US, with particular practices for brands.

These unique reports combine the marketing expertise of WARC with the specialist ecommerce knowledge of sister company Edge by Ascential, to provide marketers and agencies with the analysis and insights needed to build marketing strategies for the major digital platforms.

Amin Mrini, VP WARC Digital Commerce, said: “The worlds of Marketing and Digital Commerce are converging and it is imperative to understand how the major digital commerce platforms intersect with creativity and media investment, and the impact this has on brand and performance marketing.

“For ‘How to win on Instacart’, we’ve taken a deep dive into the data of five hypercompetitive product categories to uncover how to play, who is winning, and where there is room for improvement. These insights will help marketers and agencies future-proof for success on the platform.”

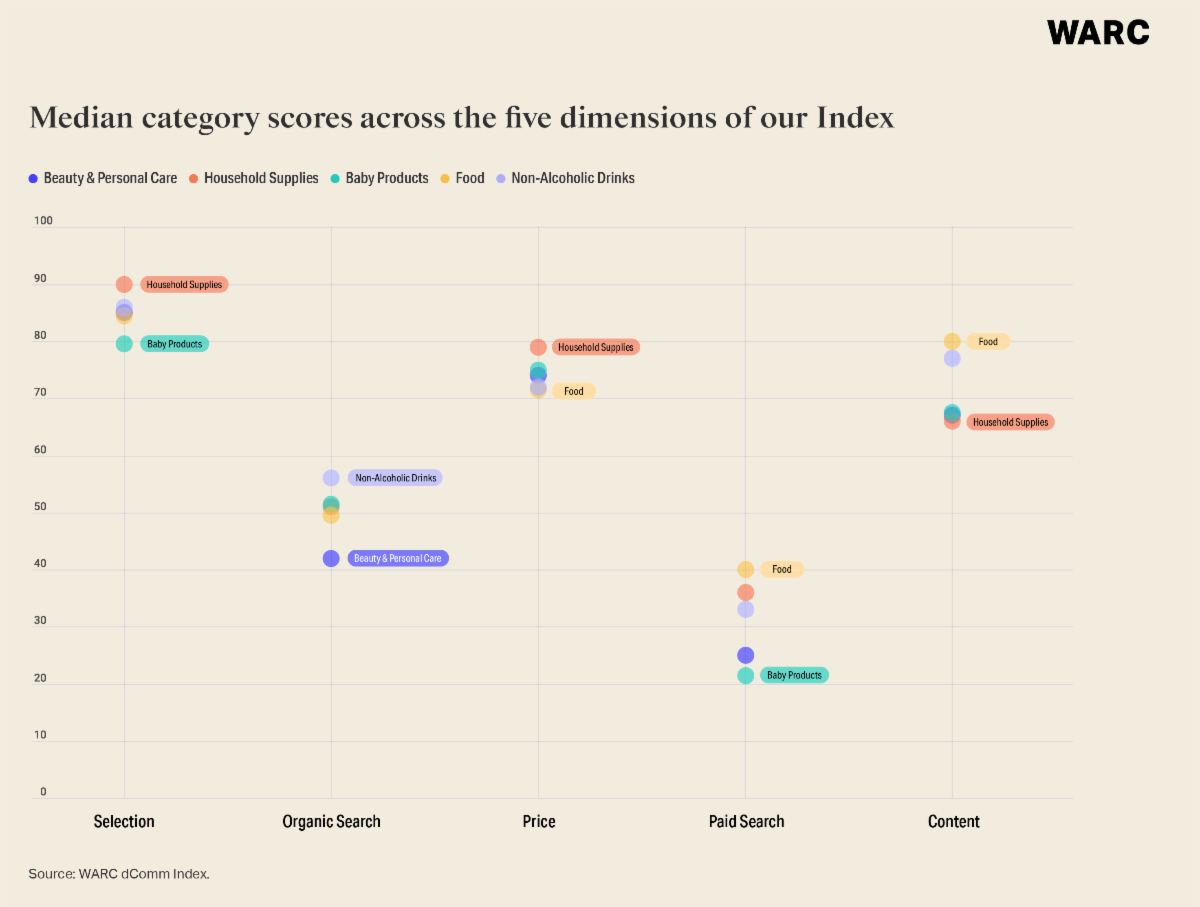

At the core of this and subsequent deep-dive ecommerce reports, is the WARC dComm IndexTM, a proprietary data-led benchmark that allows brands to measure themselves against category competitors across major digital commerce platforms.

This first report, focusing on Instacart, provides performance metrics for Food, Non-Alcoholic Drinks, Beauty & Personal Care, Baby Products, and Household Supplies.

Key insights uncovered in ‘How to win on Instacart’ are:

Build an Instacart strategy fit for the platform

Instacart has rapidly grown into the second-largest grocery ecommerce platform in the US taking 45% of market share, making it a priority for CPG brands and their marketers. However, many brands are still finding their way on the platform, particularly when it comes to maximising their presence and optimising retail media spend.

Audit availability and look to get into the basket early

Availability is key as Instacart will offer an alternative if a brand is out of stock. However, across categories there remains opportunities to expand availability in more stores, delivering a significant uplift in revenue. Getting into a consumer’s basket can have lasting benefits: after a first shopping trip, the ‘buy it again’ widget becomes very important for site users.

Review search performance

Instacart’s search algorithm has a different level of complexity than those of Walmart or the Amazon Marketplace. Results from the WARC dComm IndexTM show how hard it is to dominate organic search across the site. Paid search is growing in importance and brands should investigate its opportunities. As seen across retail media, prepare for rising costs as competition mounts.

Learn to live with the paradoxes

For CPG brands, many of the rules that apply to other channels do not apply to Instacart:

1.The consumer experience on Instacart is controlled by the retailer.

- If a retailer’s ability to monitor its inventory at the store level is poor, the brand is even more in the dark.

- New products will only be available on Instacart once a retailer has it in stock.

- Instacart does not provide sales data at retailer level, making it hard for brands to understand the impact that Instacart has on their retailer revenue numbers.

- Retail media spend on Instacart is often attributed to the ecommerce or digital advertising budget, which doesn’t get credit for incremental purchase orders from retailers.

Stay in touch with a changing platform

Instacart is evolving fast in a changing market. It announced in January that it would launch specific pages for brands to feature content and showcase products, allowing a much richer content offer within its site. It is also building display ad formats alongside its search ad formats. This may benefit smaller brands less able to compete in paid search as the major players ramp up spend. Any Instacart strategy is going to need to evolve over time.

Brand leaders on Instacart

The WARC dComm IndexTM for Instacart reveals the following as brand category leaders: Tide (household), Coffee Mate (non-alcoholic drinks), Similac (baby products), Oral-B (beauty and personal care) and Philadelphia (Food).

Summing up, WARC’s Amin Mrini, said: “Our analysis found that the main key drivers of brand growth on Instacart are ‘physical availability’ – that is, the number of stores products are available in, and levels of stock in-store. And few CPG brands are able to dominate organic listings across the platform, making paid search an important consideration.”