Nazara Technologies Limited (BSE: 543280) (NSE: NAZARA) an India based, diversified gaming and sports media platform with a presence in India and across emerging and developed global markets such as Africa and North America, announced its un-audited Standalone and Consolidated results for the quarter and nine months ended31st December 2021.

As of December 31, 2021, Nazara has diverse business segments with revenue generation accruing across gamified learning, Esports, freemium and telco subscriptions.

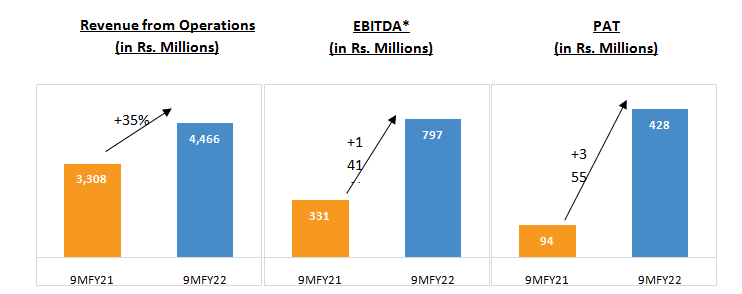

Key Consolidated Financial Highlights for 9MFY22 are as follows:

ü Operating Revenues grew by 35% YoY to Rs. 4,466 million

ü EBITDA* stood at Rs. 797 million, a growth of 141% YoY

ü EBITDA* margins stood at 17.8% v/s 10.0% for 9MFY21

ü Delivered a PAT of Rs. 428 million, growth of 355% YoY; PAT margin of 9.6%

*EBITDA excludes other income

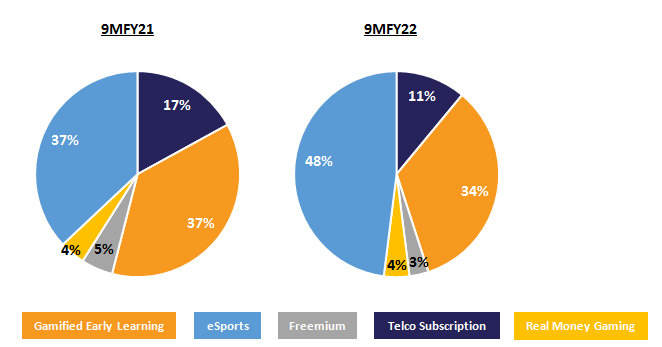

The Consolidated Revenue Mix across business segments stood as follows:

ü Esports segment has demonstrated 75% growth in revenue as well as 71% growth in EBITDA in the first 9MFY22 and has continued the YoY revenue growth momentum witnessed in FY 20-21 (102% growth over FY20). eSports has witnessed 70% revenue CAGR over the past 3 years. This segment now contributes the highest revenue in Nazara portfolio with 48% contribution in 9MFY22 revenue vs 37% in 9MFY21.

ü Gamified Early Learninggrew by 22% in 9MFY22 over 9MFY21 and added net positive paying subscriber base in Q3.

ü Skill-based Real Money Gaming grew by 53% in 9MFY22 over 9MFY21 and delivered break-even EBITDA in Q3 as against losses in previous quarters.

Commenting on the performance, Manish Agarwal, Group CEO, said, “Nazara declared revenue of Rs. 4,466 Mn in 9MFY22 vs Rs. 3,308 Mn in 9MFY21, a growth of 35% on YoY basis, and our 9MFY22 EBIDTA surged by 141% to Rs. 797 Mn as compared to Rs. 331 Mn in 9MFY21.

For Q3FY22, we reported revenue of Rs. 1,858 Mn vs Rs. 1,304 Mn in Q3FY21, a growth of 42% on YoY basis, and our Q3 EBITDA came in at Rs 302 Mn as compared to Rs. 273 Mn in the same quarter of the previous year.

Overall, we are pleased with our growth in strategic areas of focus while maintaining healthy profitability and cash flows.

We have witnessed 75% YoY growth in the esports segment for 9MFY22 led by strong growth in revenue across all sub-segments in Nodwin and SportsKeeda. The addition of original IPs such as NH7 Weekender and expansion of our esports business into the Middle East via our acquisition of Publishme has further accelerated the growth momentum.

Nazara’s strategy of having a diversified portfolio across business segments in gaming continues to provide us with a stable and strong platform on which we can continue to build future growth and success.

Nazara continues to remain committed to building multiple growth levers across gamified learning, freemium, esports, and skill-based real money gaming via growth in its current portfolio and the addition of more offerings in the ‘Friends of Nazara’ network through strategic M&A.”