Kochi: Incorporated in the year 1998, a systemically important non-deposit-taking NBFC in the gold loan sector, Muthoottu Mini Financiers Limited (“Muthoottu Mini”/ ‘MMFL’), public issue of Secured and Unsecured Debentures (“NCDs”) of the face value of Rs. 1,000 each is now open.

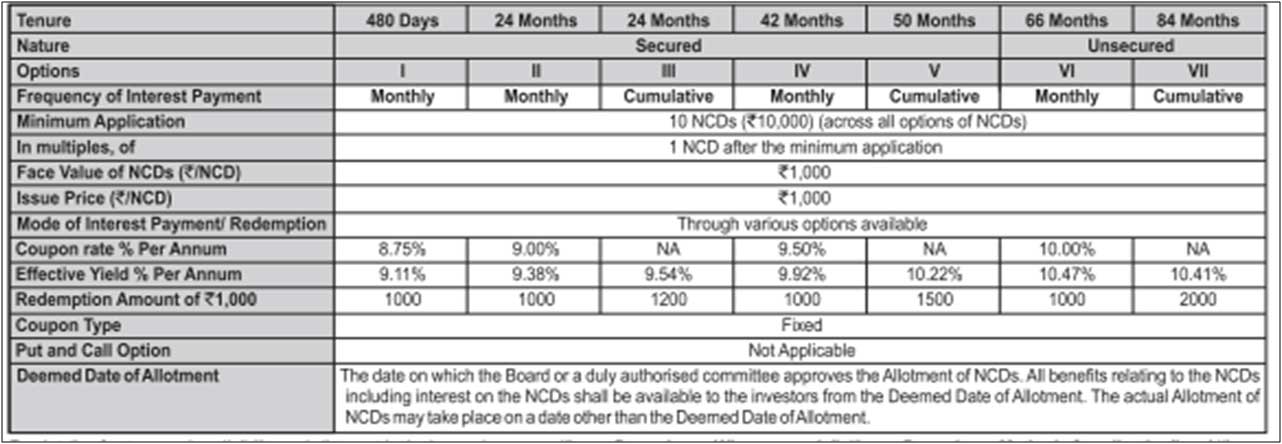

The 15th NCD Issue has a Base Issue Size of Rs. 125 crores, with an option to retain over-subscription up toRs. 125 crores, aggregating up to a total of Rs. 250 crores. The NCD Issue offers various options for the subscription of NCDs with coupon rates ranging from 8.75% – 10.00% p.a. The NCD Issue opened on August 18, 2021, and closes on September 09, 2021, with an option of early closure or extension.

As of 31st March 2021, MMFL had 3,86,110 gold loan accounts, predominately from rural and semi-urban areas, aggregating to Rs. 1,935.10 crores which accounted for 97.04% of its total loans and advances. The yield on its gold assets during the last three fiscals has increased from 19.17% in FY2019 to 19.57% as of FY2021. Its net Non-Performing Assets for FY2021 stood at 0.75%, which is lower than 1.39% reported in FY2019.

In addition to its gold loan business, it offers microfinance loans, depository participant, money transfer, insurance broking, PAN card-related, and travel agency services.

The Company, erstwhile part of a family business enterprise that was founded by Ninan Mathai Muthoottu in 1887, is now spearheaded by Nizzy Mathew, Chairwoman & Whole-time Director, and Mathew Muthoottu, Managing Director.

The terms of each option of NCDs, offered under Issue are set out below:

Net proceeds of the Issue will be utilized for the purpose of onward lending, financing, and for repayment/prepayment of principal and interest on borrowings of the Company (at least 75%) – and the rest (up to 25%) for general corporate purposes.

The Secured and Unsecured NCDs offered through Prospectus dated August 13, 2021, are proposed to be listed on the BSE.

The Lead Manager of the Issue is Vivro Financial Services Private Limited.

MITCON Trusteeship Services Limited is the Debenture Trustee and Link Intime India Private Limited is the Registrar to the Issue.