Q1: What sets the 2025 Countdown Slate apart from the previous year, and how have insights from 2024 shaped its design?

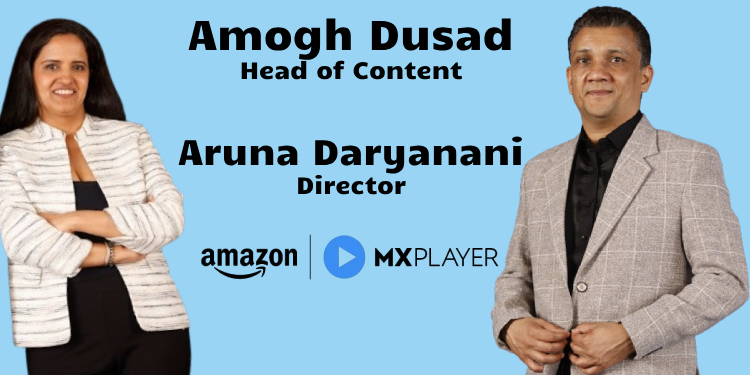

Amogh Dusad: 2025 is a fresh start for us. In September last year, we acquired MX Player and merged it with Mini TV to create Amazon MX Player. This merger guided our content strategy to not only reignite MX’s customer base but also retain the young audience from Mini TV. Our programming slate includes a mix of widely appealing shows such as Hunter, Aashram and unscripted shows like Rise and Fall. Additionally, we are doubling down on young adult themes with returning franchises like Half CA, Campus Beats, and Jamnapaar. A significant addition this year is our collaboration with Prime Video, allowing us to offer blockbuster movies like ‘Sonu Ke Titu Ki Sweety, Pushpa, Gehraiyaan, Sardar Udham’ to Amazon MX Player customers. Another key focus is international content, which has worked well for both MX and Amazon. We plan to release around 25-60 international shows over the next few weeks to engage this audience.

Q2: Many OTT platforms reduced their focus on originals in 2024. What drove this trend, and is Amazon MX Player taking a similar approach?

Amogh Dusad: At Amazon, we work backwards from consumer needs. Our programming decisions—how many shows to launch and what type of content to focus on—are based on what keeps our customers engaged. Different players in the market have different business models. We are clear on ours, which is why we are launching over 100 shows this year. This includes a strong lineup of Hindi-exclusive originals. Additionally, we are introducing MX45, a new content category featuring two-minute vertical scripted dramas designed for thumb-scrolling, offering a fresh way of consuming content.

Q3: Is regional content a major focus in 2025?

Amogh Dusad: This year, our primary focus is on strengthening our engagement with the Hindi-speaking audience. While all our shows will be dubbed into Tamil and Telugu, fully exclusive regional content is not a major priority for 2025. However, we continuously evaluate opportunities, and as we develop a firm strategy for regional markets, we will communicate those plans accordingly.

Q4: How does data analytics on viewership insights help identify and fill content gaps across genres and regions?

Amogh Dusad: At Amazon, consumer privacy is paramount, and data is just one of many signals we use. Beyond analytics, we spend a lot of time on consumer immersions—traveling to different cities, visiting homes, and understanding consumer aspirations and anxieties. Content needs to connect with audiences, either as escapism or through relatability. Our programming slate is shaped by a combination of viewership patterns, direct consumer interactions, and data insights to ensure that we resonate with our audience.

Q5: What is the strategy behind introducing international content, particularly dark-themed shows?

Amogh Dusad: The rise of digital streaming has removed geographical barriers, making international content more accessible. We saw this trend early and experimented with Korean shows, which received a tremendous response. Based on this, we expanded our programming to include content from Spanish markets. Audiences enjoy being transported into different cultures, traditions, and family structures while still experiencing the content in their local language. This trend is growing, and we aim to bring the best international content to our customers.

Q6: How successful has dubbed content been in India, particularly from regional to Hindi and vice versa?

Amogh Dusad: Language is no longer a barrier. Typically, Hindi content sees about 30% viewership from non-Hindi-speaking regions. Successful Hindi-first shows like Jamnapar and Aashram have attracted significant non-Hindi viewership. The same applies to regional content dubbed into Hindi, as seen with Telugu blockbusters performing well in the Hindi market. This trend will continue as audiences embrace content beyond linguistic boundaries.

Q7: What are some key technological innovations Amazon MX Player is implementing to enhance platform performance?

Aruna Daryanani: With a reach of 250 million users and rapid scaling, we are focusing on three major innovations. First, seamless mobile viewing is crucial, especially since India’s data networks are not always reliable in deeper markets. We are optimizing for latency-free mobile viewing with minimal data consumption to ensure smooth streaming. Second, as smart TV adoption grows, we are enhancing the streaming experience on connected TVs. Lastly, we are leveraging AI and machine learning in our recommendation engine to help users discover content more efficiently. Additionally, in advertising, Amazon’s deep understanding of shopping behavior allows us to provide advertisers with highly relevant consumer insights.

Q8: What ad tech innovations is Amazon MX Player introducing?

Aruna Daryanani: Advertisers want precision in reaching the right audience, and we leverage Amazon’s shopping signals to make this possible. Since we own the data, unlike other video platforms that rely on third-party sources, we can accurately reach specific audiences like beauty enthusiasts or tech subscribers through targeted ads. We have also created a seamless ad experience—unlike other platforms where clicking an ad takes you outside the app, our native ad experiences ensure interactions remain immersive and personalized. Furthermore, we are incorporating immersive ad technology, such as an example where a jackfruit-based moisturizer visually emerged from an ad, ensuring better brand recall.

Q9: What measurement metrics are available for advertisers?

Aruna Daryanani: Brands no longer just want to count impressions—they want to track downstream metrics. With Amazon’s ecosystem, advertisers can show video ads to build awareness and then retarget the same customers across Amazon’s platforms for conversion. We provide detailed insights, enabling brands to continuously optimize their campaigns and improve performance.