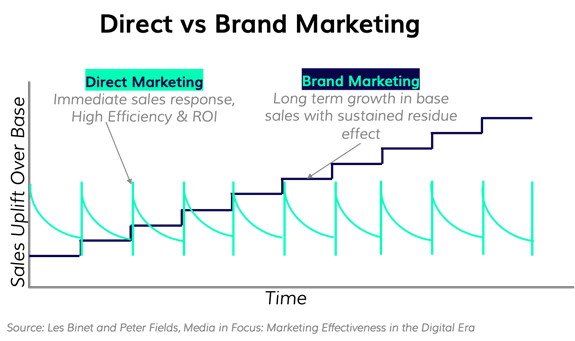

Most marketers find it easier to justify direct marketing because it is immediately measurable and helps prove their impact on business. However, direct marketing is a transaction with little residual value.

Building a brand is the only way to sustain long-term value. But brand building isn’t easy. It requires a sense of mental fortitude, simply because brand spends can’t be justified and correlated to immediate sales.

Some say brand marketing should NOT be measured. But, if it shouldn’t be measured, why spend any money on it?

These conflicting mindsets are born from the inability to measure the return on brand spends in the immediate or even the short term.

It’s not that brand spends aren’t measurable. They’re just not immediately measurable, and not by sales numbers. Over the long run, the need for and the effects of a good brand are surely measurable.

Here are a few ways to track the Return on Brand Spends over the long-term.

- Enhanced Company Valuation:

With unicorns sprouting every other week, start-up valuations may be the in-thing. But let’s focus on the larger companies and their valuations for they tell a clearer story: of having thrived for longer. Thus, allowing the measure of their brands.

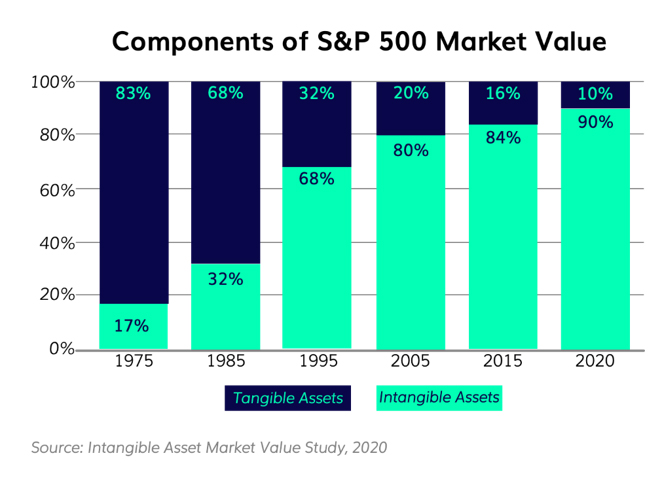

IP consulting firm Ocean Tomo periodically evaluates companies for their tangible and intangible assets. Over 45 years, most of the value of the S&P 500 companies had transformed into intangibles, hitting 90% in 2020.

Just imagine. 90% of the assets of the 500 top US-listed companies cannot be touched or weighed or shipped.

Intangible assets include IP, trademarks, copyrights and most importantly brands.

The Intangible Asset Market Value (INAMV) is calculated by subtracting net tangible asset value from the companies’ market capitalization.

A brand is estimated to make up over 25% of the INAMV on average.

The contribution of the brand to valuation is indirectly proportional to the competition intensity in a category. For example, the relevance of a brand would be higher in industries with low entry barriers like in FMCG / CPG and lower in categories like biotechnology/energy/banks, etc. with high entry barriers, and complex customer portability.

Nevertheless, proves that brands are measurable and add significantly to the value of the business in the long run.

This may not be the most convincing argument just yet for a lot of the start-ups, because of their current run-time and limited competition. But as competition heats up and the consumers (along with investors) get more prudent about their choices, the brand investments will make all the difference.

- Turbulence Insulation

Every category has its ebbs and flows. The trendline is different in every market. There are greater macroeconomic forces that most might not even understand, let alone control it or plan to benefit from it.

Strong brands provide the necessary resilience during periods of volatility, providing a reliable, positive return on the money invested to build brand equity. When turbulence drives markets down, strong brands decline more slowly, and when markets recover, strong brands rebound more quickly. Strong brands also turbocharge gains during periods of sustained economic growth.

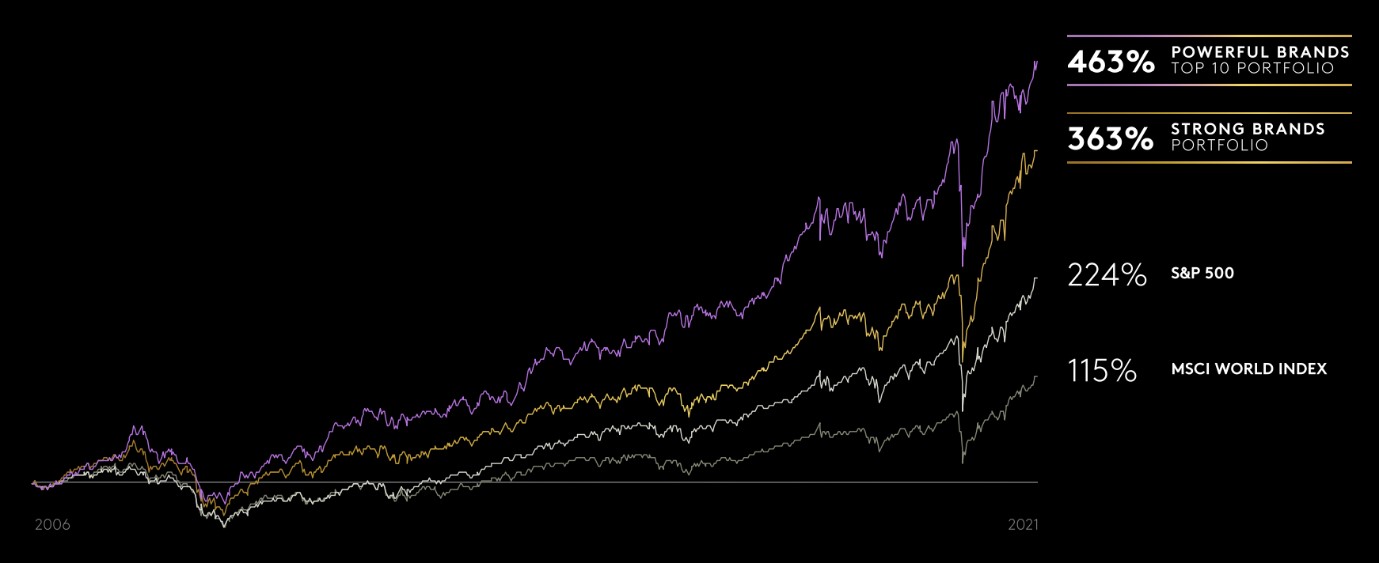

Kantar BrandZ™ measures the world’s top brands, isolating the value generated by the strength of the brand alone in the minds of customers.

In over 16 years the value of the Strong Brands Portfolio increased 363%, outperforming both the S&P 500 and the MSCI World Index.

Even with the pandemic induced crash in March’20, the Strong Brands Portfolio recovered its value twice as fast as the general market indices. They also gained an additional +135% in value over their pre-pandemic peak through April 2021.

This is just more evidence that, no matter how you slice it, the strongest and most relevant brands will always outperform those who fail to prioritize branding as an investment.

- Price Elasticity

Another very tangible aspect of branding is price elasticity. With a strong brand, you can set a higher price, leading to greater profitability.

A healthy margin can be sustained only if the right brand investments build a moat around the business. Else, every new player in the category will deplete profitability.

That a good brand can elevate price, was proven by an interesting experiment conducted by Rob Walker and Joshua Glenn in 2010. They bought random flea market items for an average of $1.25, gave each of the items a purpose-written narrative and resold them on eBay for an average price of over $36. Thus, proving the power of the brand / the narrative to charge a premium.

According to a study by Milward Brown, strong brands can capture, on an average, three times the sales volumes vs weak brands at a 13% premium.

- Brands build a word-of-mouth engine

How you position your business make a BIG difference to your brand and how it builds a loyal fan base.

Here’s one way of doing it.

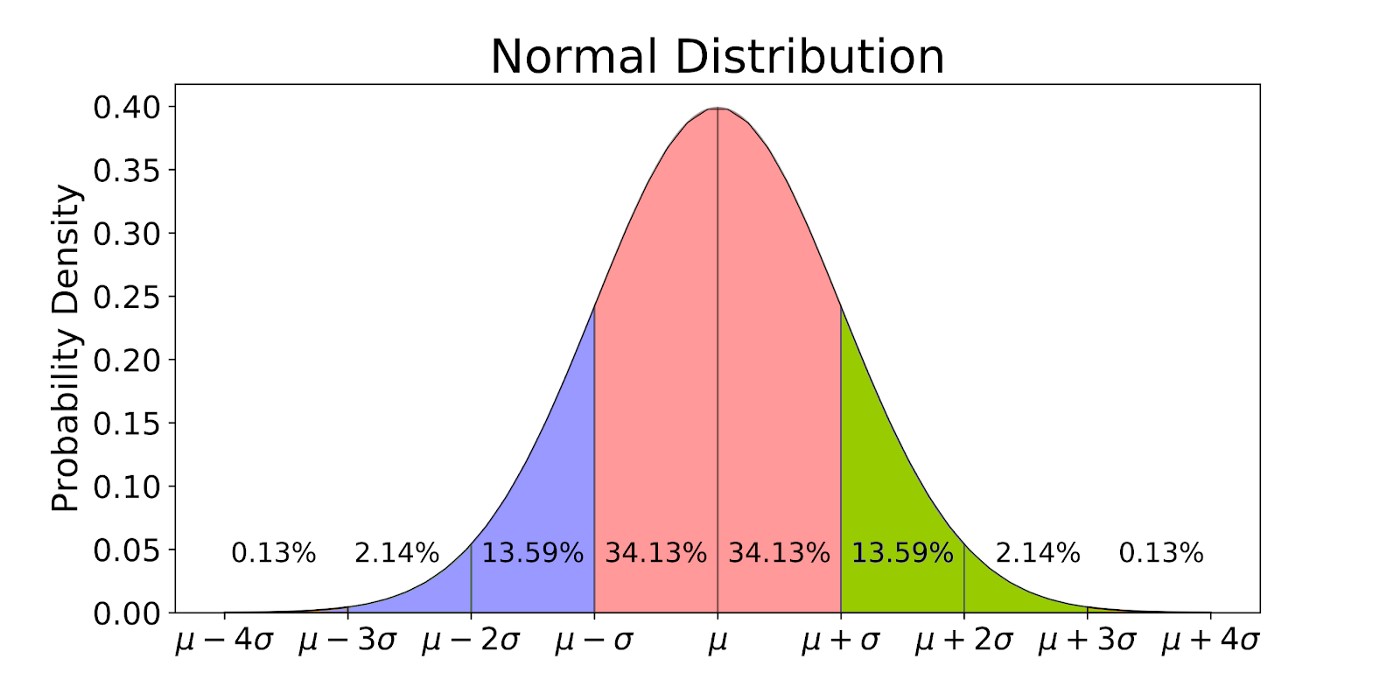

Look at the graph above. The purple parts make up the innovators and the early adopters of an innovation. Then the early majority, the late majority and the last 16% are the laggards.

Most businesses focus on the meaty middle because they think of customer acquisition as the funnel. The more you feed the funnel the merrier. But the wider the audience you look to cover, the more compromises you make and the more ‘average’ your brand becomes.

Instead, when you focus on the early 16%, you build fans for life. They are on the lookout for change. They champion the brand and bring in the others. They are the ones who contribute the most to the brand.

The number of early adopters a brand has is a great way to measure its strength. They are the ones who can’t wait for the next release, line up at the store before it’s open and are constantly buzzing with ideas on how to make the product/service even better.

- Reduction in CAC

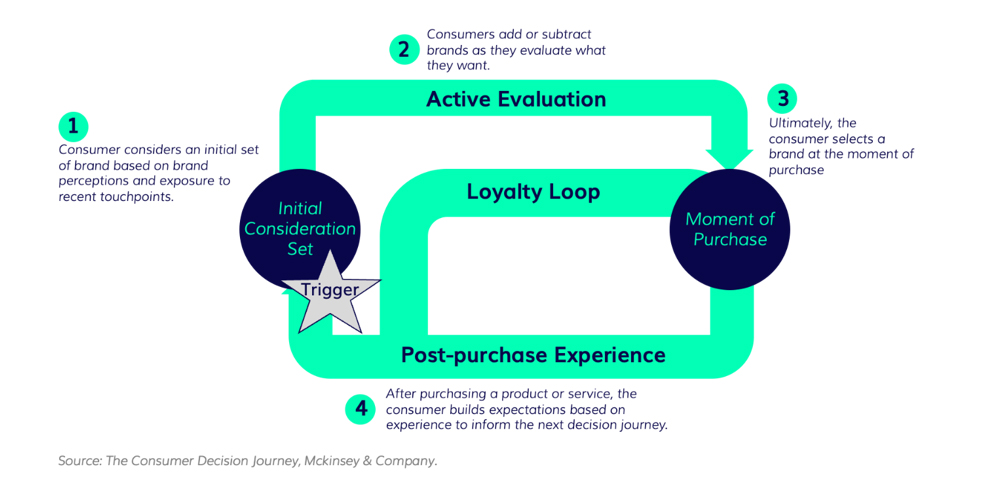

In the traditional funnel metaphor, consumers start with a set of potential brands and methodically reduce that number to make a purchase.

In reality, decision making isn’t linear. It isn’t mandatory that a brand enters the consideration set at the awareness stage. A brand can enter the mix as consumers evaluate their requirements through their journey across multiple touchpoints. In fact, the later the brand enters the consideration set, higher the chance of conversion.

Direct marketing only drives awareness. Consideration beyond the awareness stage is completely driven by the brand-building investments across the consumer journey touchpoints.

When we chase sales exclusively with direct marketing, every transaction starts from a zero-base.

If you purposefully invest in building a strong brand, then it will significantly reduce CAC over time and, more importantly, grow the Lifetime Value (LTV) of the acquired customers.

Final Takeaway

While it isn’t easy to measure the Return on Brand Spends, it is definitely possible to measure it.

Marketers will agree on the inherent strengths of building a strong brand. They only need the leeway and the consistency to demonstrate the real benefits of it.

Brand Spends are Investments that clearly help the company grow its bottom line over time. Measuring it requires patience and a willingness to reconsider the importance of immediate metrics.

Article is authored by Sharavana Raghavan – Founder, Vitral Innovations