New Delhi: Market Xcel, among India’s top 5 market research firms and a joint venture with Nomura Institute, today unveiled the findings from its extensive survey of consumer and retailer sentiments. The survey was done by the firm with 2500 consumers and 100 retailers (including MBO and SBOs) across 15 cities to understand the market pulse and prevailing sentiments ahead of Diwali. The survey covered Kitchen Appliances, Mobile, Edibles, Jewellery, Automotive, consumer durables, real estate, and apparel.

Commenting on the survey’s findings, Vishal Oberoi, CEO, Market Xcel, said, “It’s very important to understand the consumer sentiment as we approach diwali2021 in a couple of days. The pandemic has led to multiple generational consumer shifts and behavioral changes some of which are permanent while the rest will cover a period crawl back to normal. We are definitely seeing some tentativeness among consumers as they remain wary of what is ahead, not just on the pandemic but macro-economic factors like rising inflation. what that means for brands and businesses is to engage/assure the customer in newer, deeper ways. And fully convince them on the economic value/rationale of their purchase decisions.”

Added, Ashwani Arora, Executive Director, Market Xcel, “Diwali 2021 is unique in that it comes at a time when the world and India are crawling or attempting to get back to the normal unlike 2019 which was pre-pandemic and 2020 which was bang in the middle of the pandemic. We believe the findings call for brands and businesses to spend more time in understanding the new consumer who is emerging across categories with changing needs and different expectations. The success ahead as much depends on how well and quickly brands and businesses tune themselves to the above. Finally, we chose Diwali to study the sentiment as we believe, not just the stock market, but even beyond its’ the single national festival that is celebrated nationally, spurring huge economic activity across sectors.”

Key findings:

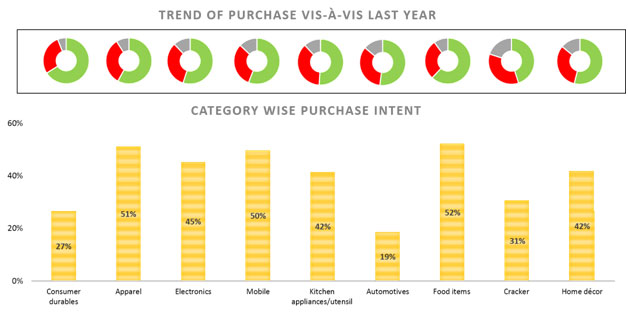

1/4th consumers looking at increased spending while 2/3rd are not so positive; rising inflation and waning income and career security is still playing on many consumer minds; many consumers require more time to completely put behind the numbing pandemic experience; diwali 2021 is certain to accelerate the return to normalcy and relatively higher economic activity but it won’t be a jackpot; the accelerated move to online is here to stay; apparel has seen a surge while real estate remains mixed; automotive growth hampered by supply-side issues like semiconductor shortages while mobile phones – the category that reflects consumer sentiment the most still not on all-out demand mode due to limited stock availability and other issues; gold is seeing some pick-up in jewelry over diamond despite its price weakness in recent past; jewelers are betting on marriage season to make up the deficit; in consumer durables many consumers are looking at repair over replace seeking to extend the appliances’ durability; there’s growth in austerity among consumer who got accustomed to work at home lifestyle; little consumer appetite for impulse shopping besides heightened price sensitivity.