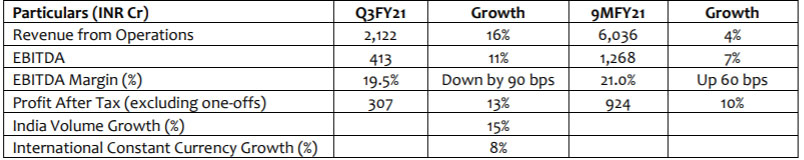

Mumbai: In Q3FY21, Marico’s Revenue from Operations grew by 16% YoY to INR 2,122 crores (USD 287 million) on the back of a strong domestic volume growth of 15% and a constant currency growth of 8% in the international business. Amidst steadily improving consumer confidence and the receding impact of the pandemic, the India business witnessed robust demand trends across more than 95% of its portfolio.

During the quarter, as key raw materials saw inflationary trends, the Company increased effective consumer pricing in select portfolios, while continuing to absorb the cost hit to a certain extent. Meticulously driven cost saving initiatives and rationalized advertising in discretionary categories enabled an EBITDA margin delivery of 19.5%. Overall, EBITDA and PAT grew by 11% and 13%, respectively, on a year-on-year basis.

Marico’s India Business recorded a turnover of INR 1,627 crore, up 18% on a year-on-year basis, on the back of a strong underlying volume growth of 15%. The operating margin was lower year-onyear at 21.6% in Q3FY21 vs 23.2% in Q3FY20, owing to the residual impact of inflationary raw material cost. The Company increased effective consumer pricing in select portfolios to counter the input cost-push to a certain extent, in addition to rationalizing advertising spends in non-core portfolios and driving a host of cost saving initiatives.

Marico’s International business clocked a constant currency growth of 8% in Q3FY21. The operating margin in the international business expanded to 21.3% in Q3FY21 vs 20.5% in Q3FY20, given tighter overhead cost management across all geographies.

Saugata Gupta, MD & CEO commented “The Company had a stellar quarter with a very healthy growth in both the India and International businesses. With the core franchises exhibiting strength and new bets in Foods also trending well, we expect the domestic business to deliver much ahead of medium term aspirations over the next few quarters. The International business is also poised to maintain steady growth over the next few quarters. Despite a challenging input cost backdrop, the Company pulled in a resilient margin performance on the back of focused spends and aggressive cost control. Over the medium term, the Company aims to grow the core and build sizeable new franchises through premiumisation, foods and digital brands.”