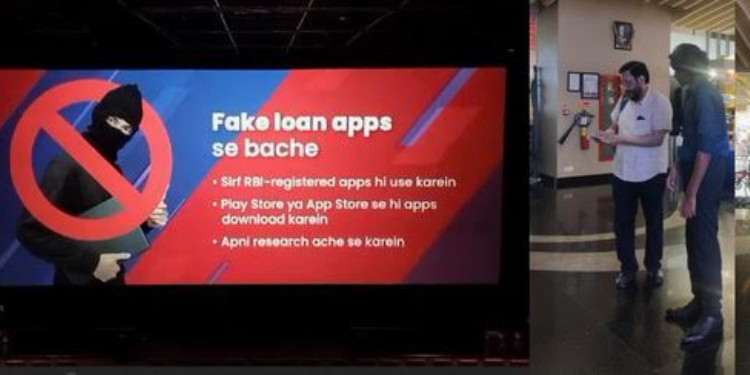

LoanTap, an innovative digital lending platform in India, raised awareness about fake loan applications and predatory lending through a video campaign shown in PVR cinemas, supported by volunteers answering viewer questions.

Amid rising reports, consumers face scams from unregistered loan apps charging high fees, resorting to harassment and privacy violations for repayments.

The campaign showcases SMS clickbaits and warns about the dangers of clicking unsecured links. It stresses verifying lenders with the RBI and reveals how fake lending apps use high interest rates, complex terms, and unauthorized data access.

After the videos, LoanTap volunteers handed out materials, answered questions, and helped individuals with legal options against fake loan apps.

The rise of fake loan apps is a growing menace in India. The RBI has identified more than 600 illegal loan apps available on various app stores for Android users in 2021 alone. The government has already blocked 27 such apps, and the Google Play Store removed over 205 illegal loan apps as of November 2021.

The RBI has compiled a comprehensive booklet titled “BE(A)WARE,” which provides practical information to help people safeguard themselves against fraudulent transactions. The booklet covers various fraud scenarios, including fake loan advertisements, SMS/email/call scams, OTP-based frauds, fake loan websites, and loans with forged documents. It emphasizes the importance of keeping personal and financial information confidential, being cautious about unknown calls/emails/messages, and practicing due diligence during financial transactions.

“In the growing digital lending space, we’ve unfortunately seen an unprecedented increase in players trying to exploit consumers’ vulnerabilities. As a responsible and ethical lender, we felt it was critical to educate people and help them identify the red flags of fake loan apps before they get entrapped in vicious debt cycles,” said Satyam Kumar, Co-founder and CEO of LoanTap.

“While the digital lending landscape has grown considerably, it has also given rise to illegal lending apps preying on the vulnerabilities of unsuspecting borrowers. At LoanTap, we uphold the highest ethical standards and prioritize customer protection. This awareness campaign is a crucial step in empowering individuals to recognize the warning signs of fraudulent loan apps before they fall victim to their deceptive tactics and find themselves trapped in a cycle of debt,” stated Rajeev Das, Chief Risk Officer of LoanTap.