There has been enough evidence about how the print industry is unable to cope up with the modern business models that have been introduced by the so called digital evolution. We have seen examples with numerous publications closing down their print businesses such as DNA in Mumbai, and Deccan Chronicle in Bengaluru to adapt to the online version.

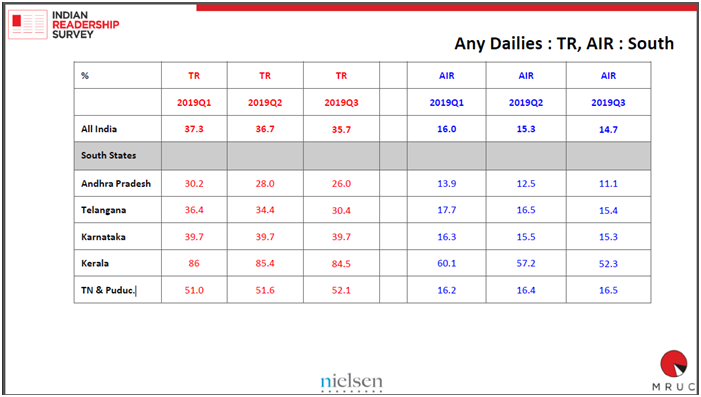

According to the latest IRS data, the entire south Indian print market has not seen growth. Most of the numbers across the South Indian states have seen no growth in readership in the last couple of quarters. The only state that has seen any growth in AIR and that too marginally is TN.

AIR of Karnataka was at 16.3 percent in the first quarter of 2019 which slipped down to 15.5 percent in the second quarter of 2019 and was finally reported as 15.3 percent in last quarter. Similarly, Andhra Pradesh saw AIR numbers slipping from 13.9 percent in 2019Q1 to 12.5 percent in 2019Q2 and reached 11.1 percent in 2019Q3.

Telengana was not very different. The state saw AIR slipping down from 17.7 percent in 2019Q1 to 15.4 percent in 2019Q3. TN however saw marginal growth from 16.2 percent in 2019Q1 to 16.5 percent in 2019Q3.

However, Kerala stands out as the state which has seen the maximum amount of decline in readership. The decline in AIR happened from 60.1 percent in 2019 Q1 to 57.2 percent in 2019Q2 and further declined to 52.3 percent in 2019Q3. If one was to see the difference of the first quarter to the third quarter the decline is a staggering 7.8 percent in AIR.

Many media reports and experts suggested that the readership and print publications in the state of Kerala has been stable and the dip was due to monsoon that hit the state.

Take Malayala Manorma’s AIR in the three quarters from 9677(000s) dropped to 9530 and in the third quarter went further down to 8874. The total difference from Q1 to Q3 was 803. Mathrubhumi in Kerala also saw a drop in AIR of 1174(000s) from Q1 to Q3.

If one looks at the TR of Malayala Manorma’s, Q1 was reported at 17264(000s), Q2 was at 17867 and Q3 was at 17596. This shows that the TR of the publication was not impacted by any of the reasons that experts cite as reasons for the drop.

Madhyamam daily saw a marginal drop in AIR. The total difference between Q3 and Q1 was at 98 (000s) AIR. Q1 had 853 and Q3 had 774.

What lies ahead for the publications for Kerala? How can the industry foster growth in readership? Well, Most of the top publications like Manorama and Mathrubhumi are well placed in digital space and they have been buckling up for the digital onslaught for the past couple of years. Now, its all about enhancing their digital revenues.

The GroupM TYNY advertising expenditure forecasts for 2020 released yesterday has revealed that the Print Media in India will be witnessing negative growth with the total share in ad spend dropping from 24 percent in 2018 to 22 percent in 2019 and further will drop to 20 percent in 2020 with the Volume of Ad Spend dropping from 18,383 Cr in 2018 to 18,164 Cr in 2019 which is estimated to drop further to 18140 Cr in 2020.