Mumbai: The Indian subscription video-on-demand (SVOD) market is undergoing a significant transformation with the launch of JioHotstar, the newly formed streaming platform resulting from the merger of JioCinema and Disney+ Hotstar under JioStar, a joint venture between Viacom18 and Star India.

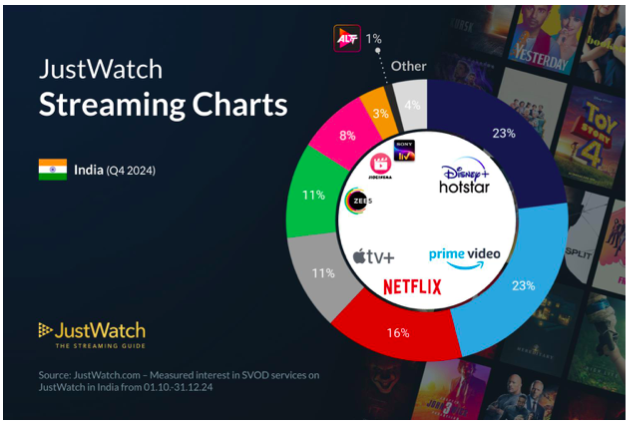

According to the JustWatch Q4 2024 data report, Disney+ Hotstar held 23% market share, while JioCinema accounted for 8%. With their consolidation, JioHotstar is projected to open with a commanding 31% SVOD market share, positioning itself as the largest streaming platform in India at the start of 2025.

Market Leadership Shift

The JustWatch report revealed that Disney+ Hotstar, the long-standing leader in India’s SVOD space, experienced a 2% decline in market share in Q4 2024, dropping from 25% to 23%. This decline saw it lose its solo leadership position, bringing it level with Amazon Prime Video, which held a stable 23%.

The merger with JioCinema, however, provides JioHotstar with a significant boost, surpassing Amazon Prime Video and Netflix, which ended 2024 with 16% market share after a 2% quarterly gain.

Competitive Implications

With a 31% share, JioHotstar’s launch reshapes India’s OTT market, intensifying competition among global and domestic players. Netflix, which gained 3% market share in 2024, will now need to contend with an even stronger local rival.

Apple TV+, which saw a modest 1% gain in Q4, reaching 11%, and ZEE5, holding steady at 11%, will also face increased competition as JioHotstar expands its content strategy.

Meanwhile, Sony LIV (3%) and ALT Balaji (1%) experienced 1% market share losses in Q4, reflecting the challenges faced by smaller platforms in a consolidating industry.

JioHotstar’s Market Strategy

JioHotstar is launching with subscription plans starting at ₹149, targeting both premium and mass-market audiences. Existing JioCinema and Disney+ Hotstar users will be transitioned seamlessly, allowing for an immediate market presence.

Commenting on the launch, Kiran Mani, CEO – Digital, JioStar, stated: “At the core of JioHotstar is a powerful vision—to make premium entertainment truly accessible to all Indians. Our promise of Infinite Possibilities ensures that entertainment is no longer a privilege but a shared experience for all.”

JioHotstar will offer a broad content library, including exclusive rights to:

- Hollywood studios like Disney, NBCUniversal Peacock, Warner Bros. Discovery HBO, and Paramount.

- Indian originals, TV programming, and reality content across 10 languages.

- Extensive live sports coverage, including IPL, ICC events, WPL, Premier League, and Wimbledon.

Outlook for 2025

The merger positions JioHotstar as the dominant player in the Indian SVOD space, significantly altering market dynamics.

With Amazon Prime Video, Netflix, and ZEE5 continuing to expand their presence in India, the competition for subscribers will intensify in 2025. The market will be closely watching whether JioHotstar can maintain its leadership, whether Netflix’s upward trajectory continues, and if Amazon Prime Video strengthens its position.

JioHotstar’s impact on advertising revenues, content investments, and subscription models will be key areas of focus in the coming quarters as India’s digital entertainment sector continues to evolve.