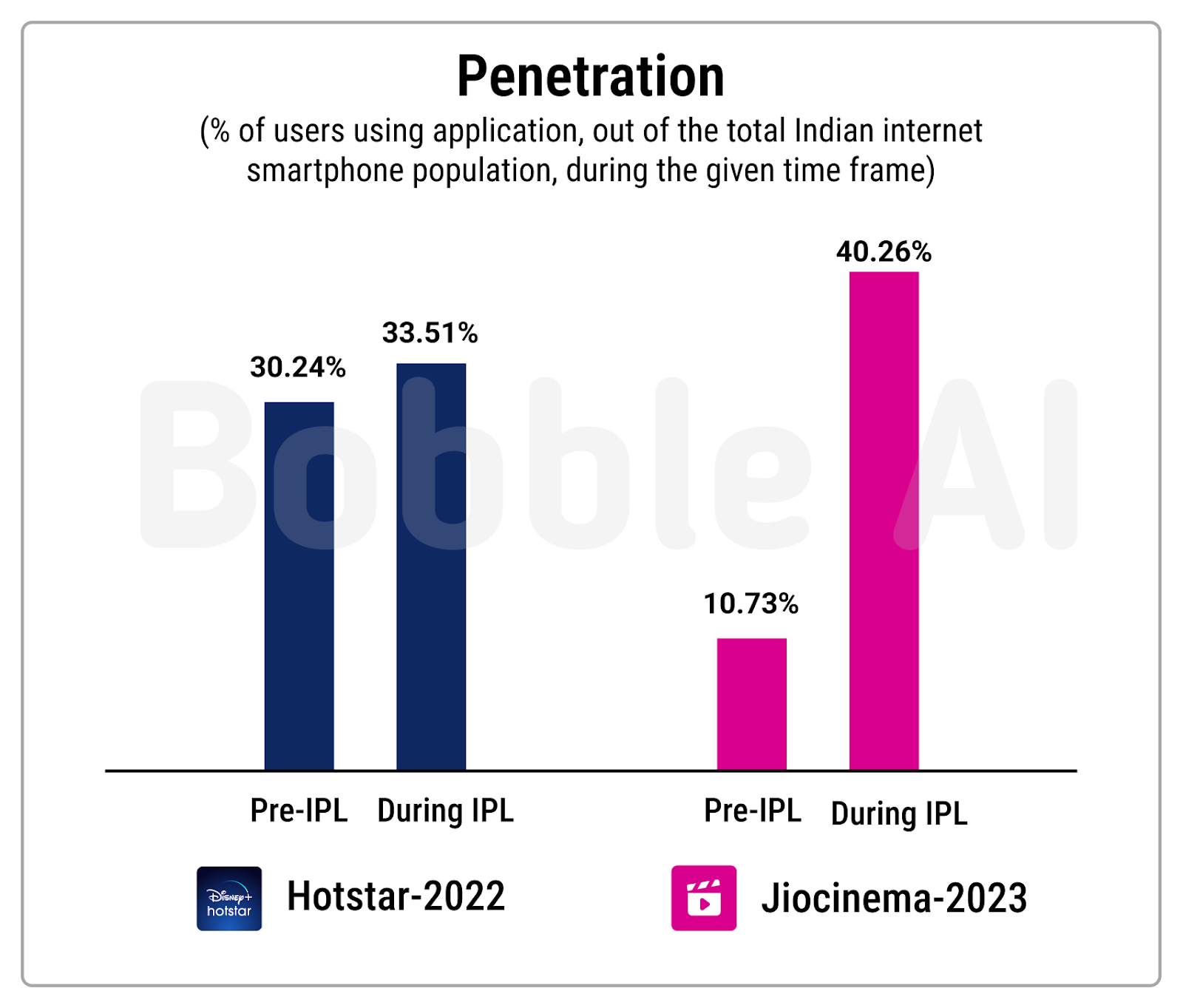

JioCinema’s market share has increased nearly fourfold, rising from 10.73% to 40.26%, compared to last year’s IPL where it was only 3%, according to data report released by Conversation Media Platform Bobble AI.

As per the latest data report, JioCinema’s free subscription model for IPL broadcast with an aim to scale the user base of JioCinema has paid off with the engagement of the app increasing manifold due to IPL and digital engagement of the platform reaching heights that have never been seen before in its history.

Bobble AI’s Market Intelligence (MI) unit conducted a study to analyze the digital viewership of IPL on JioCinema and compared it with IPL 2022, which was streamed on Disney+Hotstar. The study examined the engagement and reach of both apps and the impact of paid and free subscription models. Bobble AI announced that the research was conducted with privacy compliance in mind, using its first-party data from over 85 million individuals and devices. The study analyzed data from different periods, including the pre-IPL 2022 and 2023 periods, as well as the IPL 2022 and 2023 periods.

According to Bobble AI’s latest report, JioCinema experienced a 4X increase in penetration during the IPL, rising from under 3pc to 40.26pc. It initially gained traction during the FIFA World Cup 2022, reaching a penetration rate of 9pc. In comparison, the IPL 2022 contributed a modest 3.5pc boost to Disney+Hotstar’s penetration, increasing it from 30.24pc to 33.51pc. Interestingly, Disney+Hotstar had high penetration even before the IPL due to its popular shows and movies in India, as indicated by an Ormax survey. JioCinema had low penetration during the pre-IPL period, reflecting the lack of highly ranked content. Nonetheless, the rise in JioCinema’s penetration during the IPL highlights the event’s ability to attract viewers.

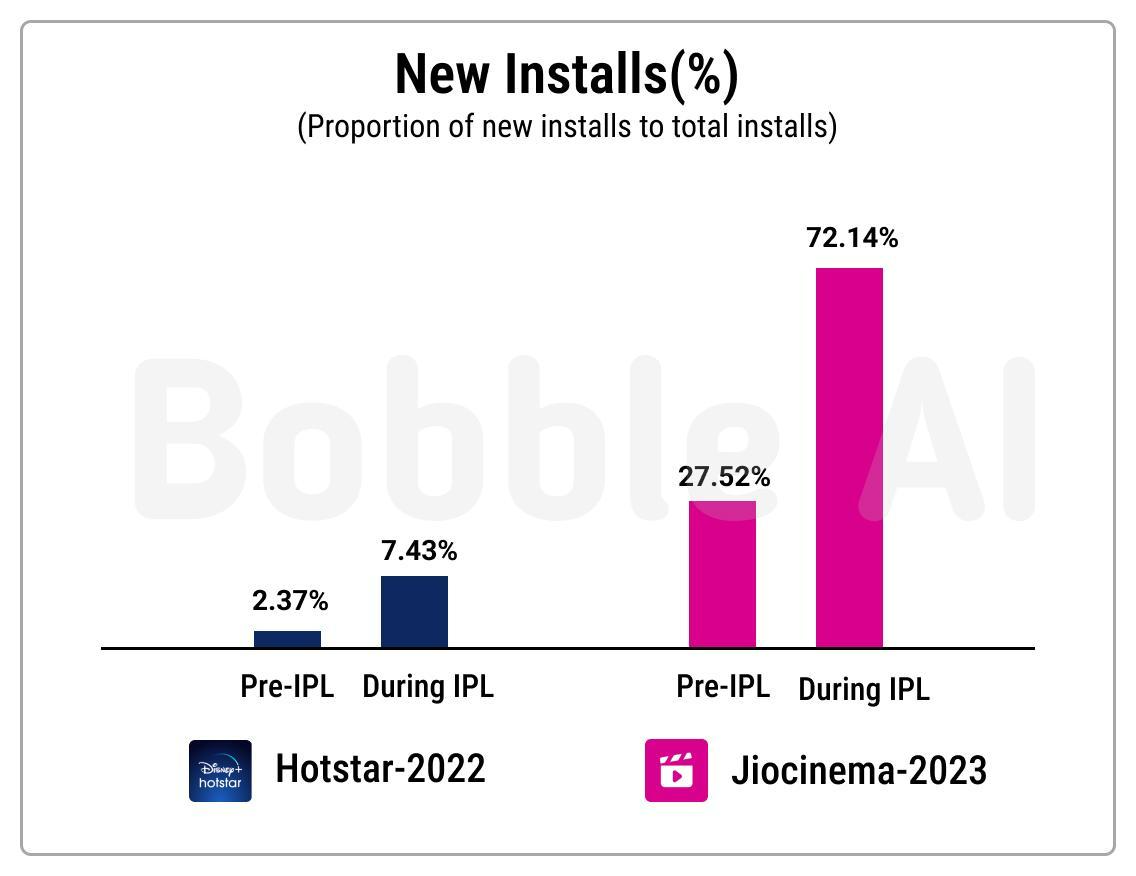

The data report highlights that the comparison of the new installs of the two apps during IPL also follows a trend similar to penetration. The proportion of new installs to total installs was approx 72pc for JioCinema during IPL 2023, which shows that IPL and the free subscription model of JioCinema brought in more than two third of the total users of JioCinema, whereas, the same figure for Hotstar during the IPL 2022 was 7.43pc, reflecting that a majority of their users had already been using Hotstar before the IPL. Hence, the data shows that the free subscription model had a remarkable impact, which was not observed in the case of the paid subscription model of Disney+Hotstar during IPL 2022.

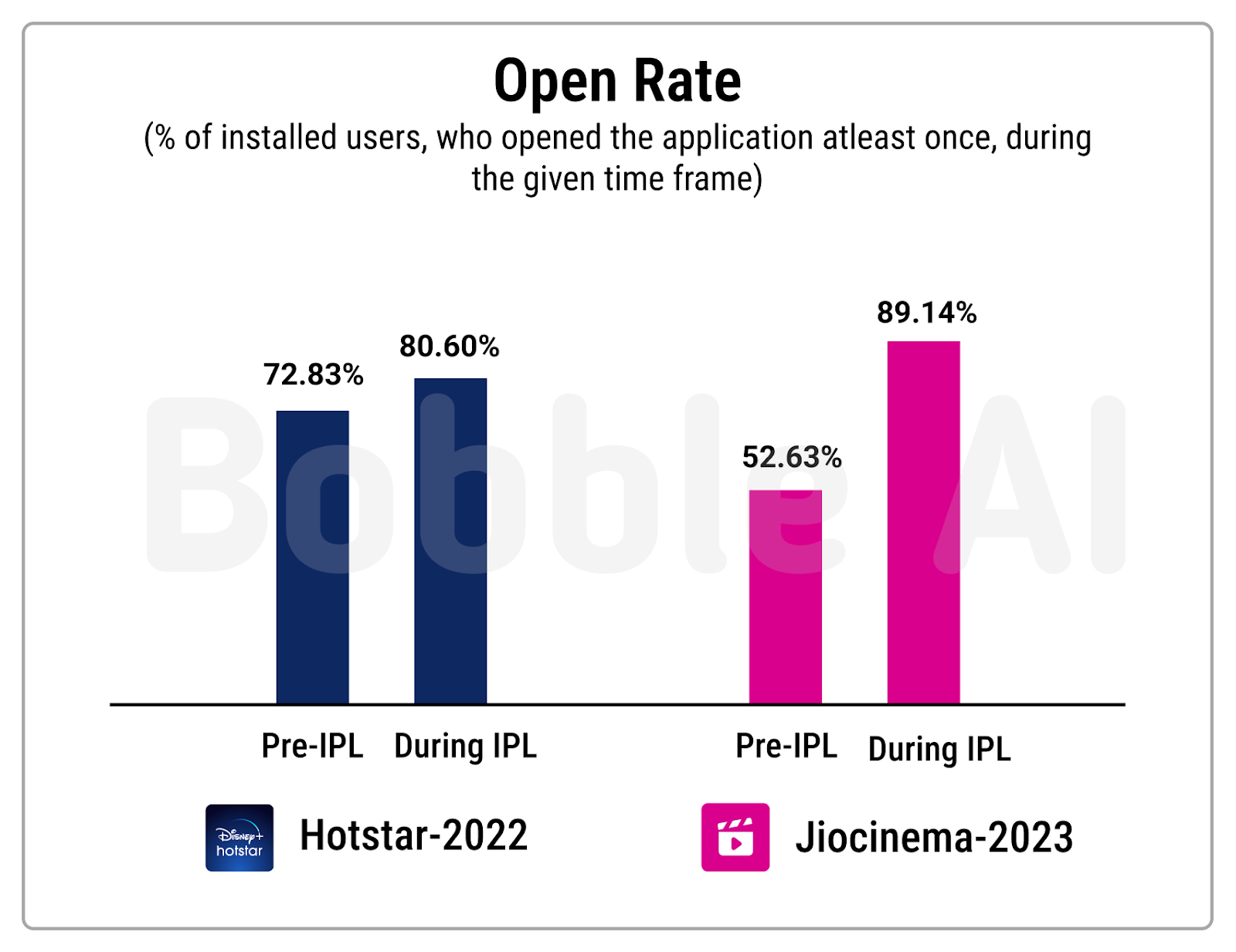

The rise of penetration and new installs were found to be substantial, however, downloading an app doesn’t necessarily mean that the app is being used, so, in the Bobble AI report the open rate was studied to understand the activity of the app. As per Bobble AI’s first party data, the Disney+Hotstar did witness a rise in open rate during the IPL 2022, and so did JioCinema in the current season, however, the increase for JioCinema was way more substantial (53pc to 89pc), the open rate for JioCinema also got an initial push during the FIFA World Cup, before which the Open Rate was under 40pc. The increase in the open rate during IPL showed that even the people who had the app installed on their phones got active on the app during the IPL.

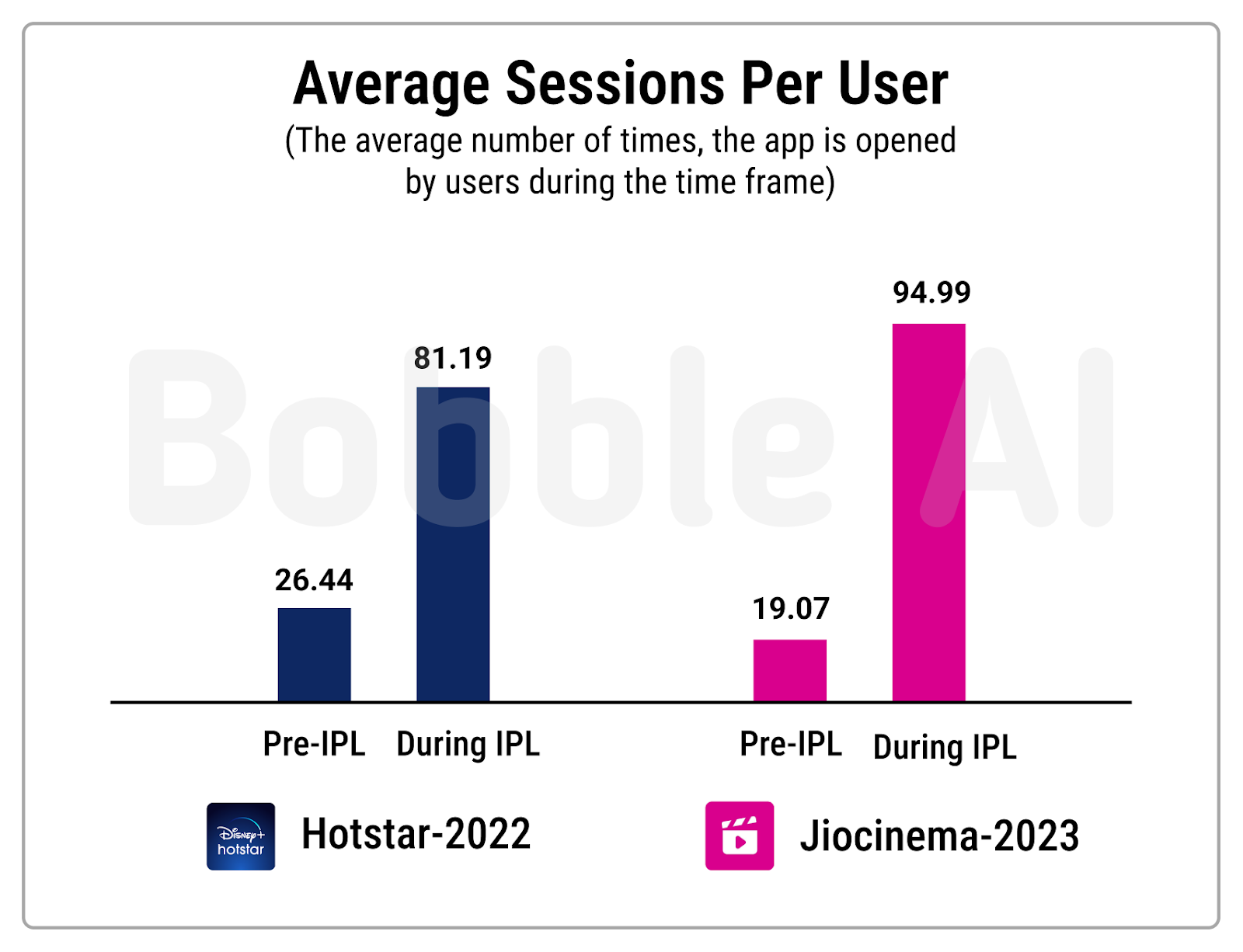

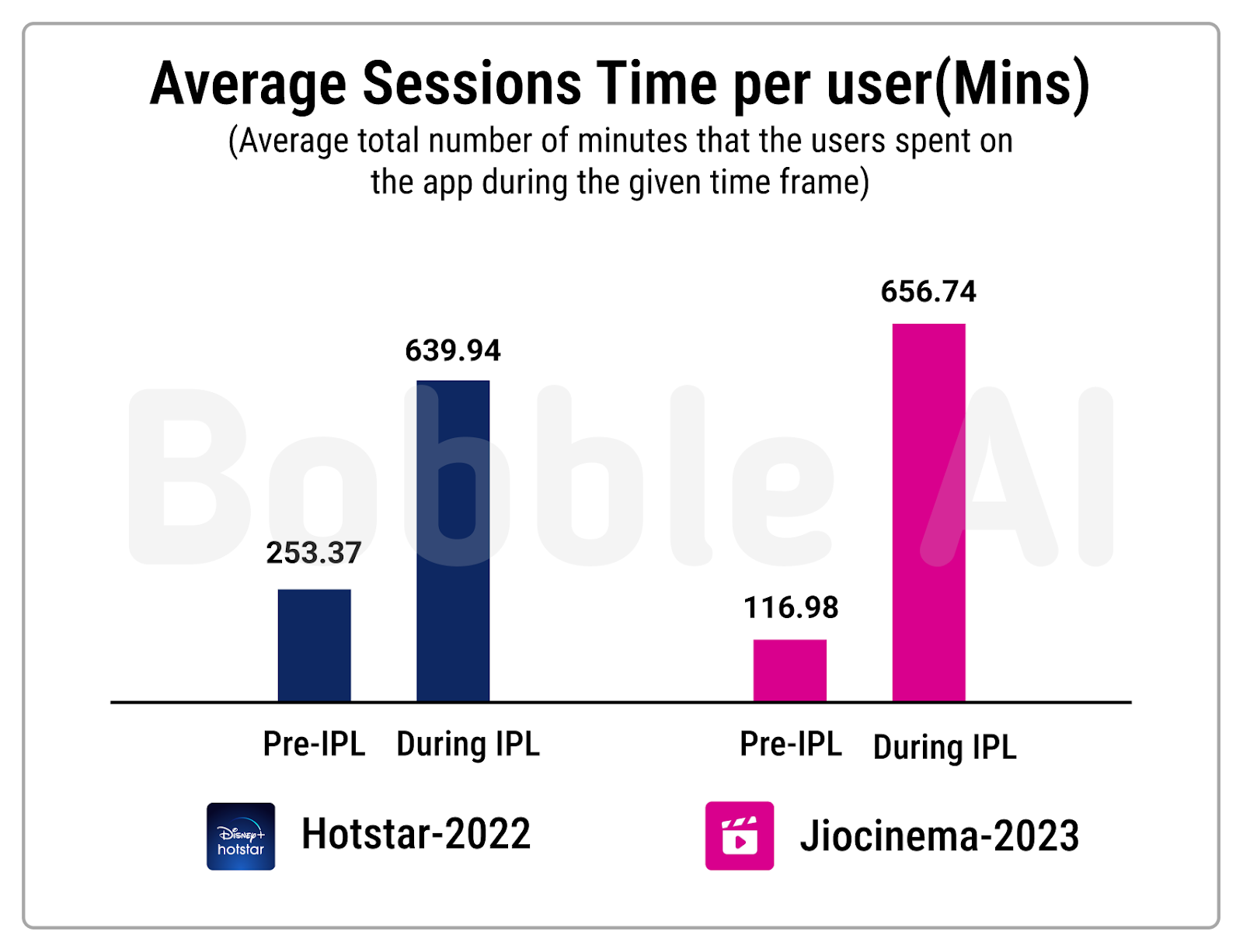

According to the report, the growth in the number of sessions during the IPL was much higher for JioCinema (19 to 95) in 2023 as compared to Disney+Hotstar (26 to 81) in 2022. Even in the case of the average session time (during the entire IPL season), the growth for JioCinema (117 mins to 657 mins) was higher than Disney+Hotstar (253 mins to 640 mins) in the current IPL season. This shows that even before IPL 2022, a considerable amount of content was being consumed on Disney+Hotstar, but for JioCinema, people discovered the other content due to the onboarding that happened due to the IPL, confirmed by the fact that the number of sessions even during IPL was higher for JioCinema as compared with Disney+Hotstar, whereas the number of sessions was higher for Disney+Hotstar in the pre-IPL period.