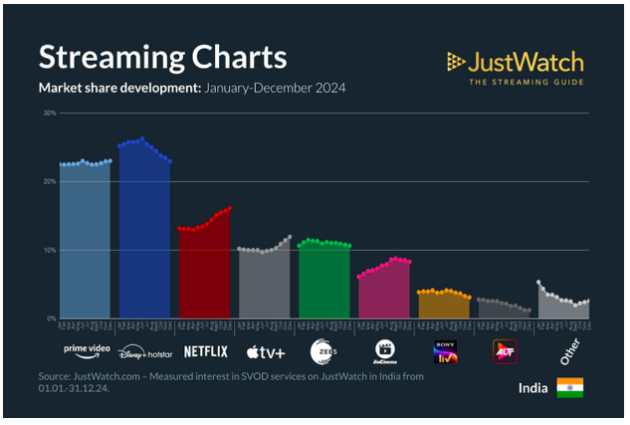

The subscription video-on-demand (SVOD) market in India experienced notable shifts in Q4 2024, as revealed by the latest JustWatch data report. Analyzing the viewing patterns of 5.3 million users, the report highlights changing consumer preferences, significant platform gains, and emerging challenges for market leaders.

Market Overview: Leadership Transition

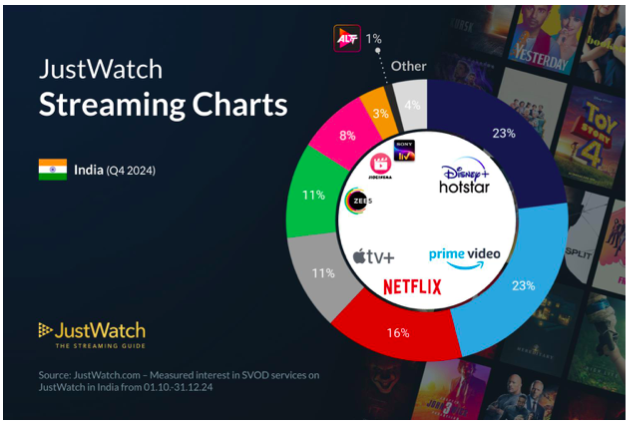

Disney+ Hotstar, the longstanding leader in India’s SVOD market, experienced a substantial 2% decline in market share during Q4 2024, falling from 25% in Q3 to 23% by year-end. This slip eroded its solo leadership position, placing it on par with Amazon Prime Video, which maintained a steady 23% market share. The decline signals a potential shift in consumer loyalty and content preferences.

Netflix on the Rise

Netflix emerged as the biggest beneficiary of Disney+ Hotstar’s decline, recording a 2% market share gain in Q4 and closing the year at 16%. This marks a cumulative 3% increase for Netflix in 2024, solidifying its growth trajectory in the Indian market. The platform now holds a 5% lead over Apple TV+ and ZEE5, reflecting its aggressive content strategy and expanding subscriber base.

Apple TV+ See Modest Gains

Apple TV+ also made strides, adding 1% to its market share and reaching 11% by the end of Q4. This steady growth highlights its appeal in a competitive landscape, despite being a relatively new entrant compared to established players.

Static and Declining Players

ZEE5 and Jio Cinema remained stable at 11% and 8% respectively in Q4, maintaining its mid-tier position in the market. Jio Cinema has achieving a 2% increase since January 2024. Meanwhile, Sony Liv and ALT Balaji struggled, each losing 1% of market share in the quarter, falling to 3% and 1%, respectively. The stagnant or declining numbers for these platforms underscore the challenges of competing in a rapidly evolving digital entertainment ecosystem.

Annual Trends: Winners and Losers

Over the course of 2024, Netflix, Apple TV+, and Jio Cinema emerged as the strongest performers, each growing their market shares. In contrast, Disney+ Hotstar and ALT Balaji faced declines of 3% and 2%, respectively, compared to their January 2024 standings. This raises questions about their content strategies, user engagement efforts, and long-term sustainability in the Indian market.

Looking Ahead

As 2025 unfolds, competition in the Indian SVOD market is poised to intensify further. Disney+ Hotstar and Amazon Prime Video’s neck-and-neck race for leadership, coupled with Netflix’s steady climb, sets the stage for a dynamic year. Platforms that prioritize adaptability, content innovation, and audience insights will likely thrive in this rapidly evolving landscape.

The battle for dominance in India’s streaming space is far from over, and the coming quarters will reveal whether Disney+ Hotstar can reclaim its solo leadership or if Netflix will continue its ascent.