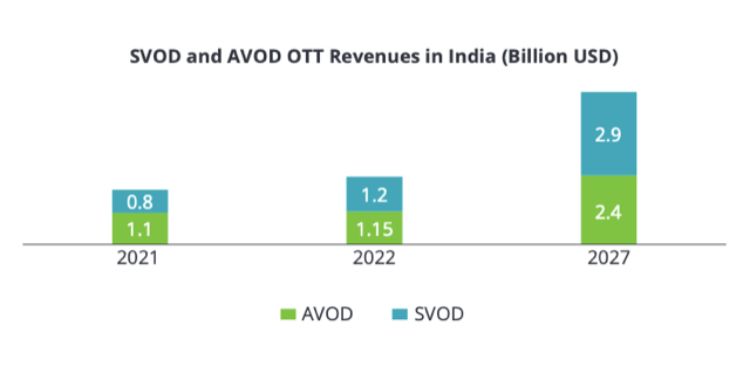

India’s OTT market revenue is expected to reach almost US$5.3 bn by 2027 from about US$2.35 bn in 2022. According to Deloitte’s 2023 TMT predictions, India’s OTT audience universe has grown to 428.3 mn viewers in 2022. Of this, 30pc, i.e., 130.2 mn viewers are SVOD subscribers.

The report estimated that OTT accounts for 7-9pc of the overall media and entertainment industry, and this share will continue to accelerate in the foreseeable future. In addition, SVOD revenues are expected to grow at a CAGR of 19pc to reach US$2.9 bn in 2027 from US$1.2 bn in 2022.

AVOD revenues in India grew much faster than in developed markets, as customers were willing to opt for the flexibility to watch content across multiple platforms at a lower price. AVOD is expected to increase from US$1.15 bn in 2022 to US$2.42 bn in the year 2027.

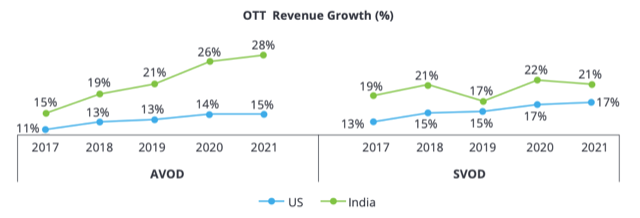

Contradicting the trend in US, Indian AVOD revenues grew steadily from 15pc in 2017 to 28pc in 2021. However, the SVOD revenue graph has been on a rollercoaster ride with 19pc share in 2017 dropping down to 17pc in 2019 and hitting 21pc in 2021 while the US SVOD market witnessed a steady growth from 13pc in 2017 to 17pc in 2021.

The Indian market is home to over 40 OTT service providers catering to mainstream and niche content needs. Key players are now focusing on capturing a wide market by delivering English, Hindi, and regional content through hybrid AVOD and SVOD models, with 83pc of video consumption occurring on mobile device.

Attracting and retaining demands from a wide range of audience leads to a constant influx of engaging, refreshing, refined and unique content, which is an increasingly expensive proposition. Smaller regional platforms typically invest US$0.4- 0.5 mn per season of content, whereas larger multi-national players invest US$5-7 mn in marquee shows. In total, OTT platforms in India invested roughly US$500 mn in original content in India in 2021.

OTT players are also exploring aggregation to enable access to a larger customer base while reducing customer acquisition and operational costs. More than 50pc of India’s 73 mn SVOD subscriptions in 2021 were from OTT aggregators. It is estimated that aggregators can add at least 20-30pc of subscribers to the existing base of the streaming platforms.

Jehil Thakkar, Partner, Media and Entertainment Sector Leader, Deloitte India, said, “This year’s 2023 TMT predictions highlight how the Indian entertainment industry has embraced the OTT ecosystem with open arms, leading to a surge in hybrid models. The hybrid model offers a balancing act, providing access to a high-monetization user base and a wider audience that may eventually convert into monetizable users.”