Bengaluru: AppsFlyer, the global attribution leader, today released The State of Shopping App Marketing 2020 report highlighting a paradigm shift in shopping habits amid the COVID-19 pandemic.

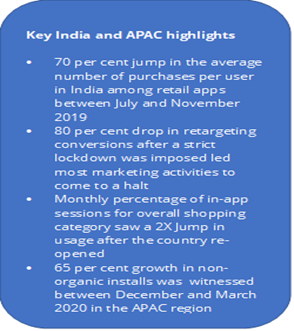

As India started unlocking businesses post lockdown, a massive jump was witnessed in the fashion and e-commerce apps. The region saw a 55 per cent surge in Android revenue and a 40 per cent increase in revenue for iOS during April 2020. While the holiday season usually sees a surge in shopping apps, 85 per cent higher share of buying users in Shopping apps in India during May-June was seen as compared to double the rate in general retail apps in March-April.

“2020 will be remembered as a year of managing seismic shifts across businesses. Given that in-app shopping activity skyrocketed during the Covid-19 pandemic in Q2, surpassing even the 2019 Q4 rush, we can expect the upcoming 2020 holiday season to do just as reasonably well.

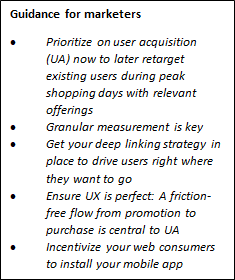

Going forward, marketers need to prepare well for this festive season, backed with the most robust and accurate data insights. As India is gearing up to embrace the much-awaited IPL season, marketers would also need to focus on messaging that delivers a sense of empathy and rekindles the holiday and festival spirit during troubled times. India is fast becoming a mobile-first economy, and having the right measurement infrastructure is the most critical requirement to succeed in this space” said Sanjay Trisal, Country Manager, AppsFlyer India.

Indian consumers embraced the mobile-first shopping trend with ease and was validated through a 250 per cent spike in non-organic app installs after re-opening of the Indian economy. Experts in the region predict the need for brands and marketers to devise a platform agnostic shopping app strategy to keep consumers engaged.

The data report indicated that the last holiday season saw consumers in APAC preferring more traditional shopping apps, buying gifts and goods from familiar e-commerce apps, rather than from marketplace exchanges. A slight shift in trend could be witnessed this holiday season, with an increase in marketplace app users (especially during the pandemic). APAC also showed a 42 per cent growth in In-app sessions of all shopping apps, clearly accelerating the mobile-first economy. Also, there was a 36 percent surge in eCommerce app installs when lockdown was eased between April and July 2020.

In-app session growth emphasises the increased interest in shopping apps among APAC consumers, using them more often to buy products or to window-shop. But what is more interesting is the increase in Average Revenue Per User (ARPU), with a leap of 104 per cent seen in fashion apps between March and May 2020, following the lifting of restrictions in India— a pattern that’s echoed across other APAC regions.

Globally, the Q4 holiday rush for mobile apps has always peaked on Singles Day, Black Friday, and Cyber Monday. Given that in-app shopping activity skyrocketed during the pandemic in Q2, the 2020 holiday shopping season is expected to be one for the record books. This year,more than ever, marketers must prepare for Q4 with a carefully-planned strategy that is backed by accurate data and insights.

The State of Shopping App Marketing 2020 is available at- https://www.appsflyer.com/resources/shopping-app-marketing-trends/