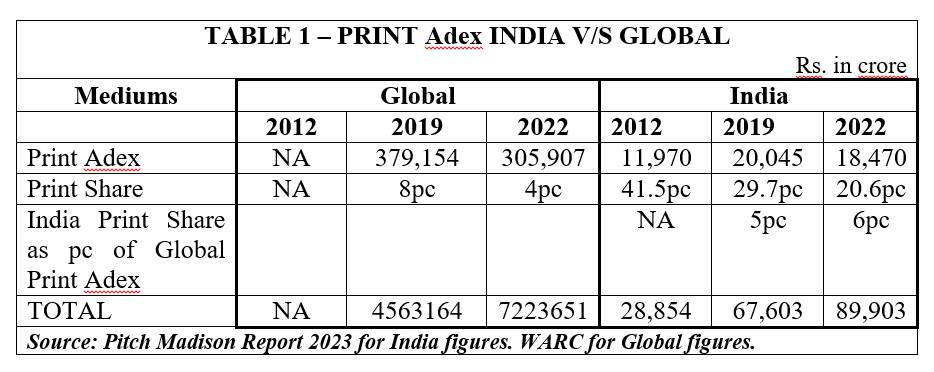

Did you know that whilst Indian Adex contributes only 1.2pc to the Global Adex, the Indian Print Adex contributes 6pc to the Global Print Adex. Whilst the share of Print in Global Adex is 4pc, in India it is an unbelievable 21pc and India enjoys the unique distinction of having the highest Print Adex share of all countries. Contrast this with China where Print Adex has a zero pc share and , US and UK has about 3 pc share. The only exception is Germany with a 18pc share for Print.

They say there are always two sides to a coin and each side tells a different story. First the bad news. Print Adex in 2012 in India was 42pc of Adex, but in 2022 Pitch Madison Report estimates it to be only 21pc. But this 21pc is not a small figure. It is Rs 20,133 crores and guess what it was in 2012? A little under Rs.12,000 crores. So, the good news is that Print Adex has grown by over 50pc in the last 10 years, when Digital was overshadowing all other Media in almost all parts of the world. During the same time total Adex has grown 10 times, thus resulting in halving of the share of Print.

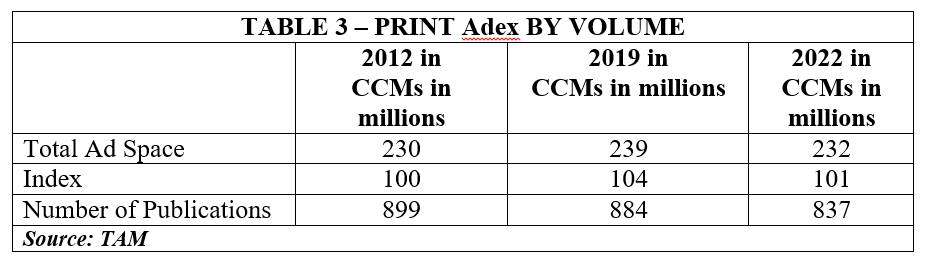

If I look at the volume of space consumed by Advertisers in Print, it has more or less remained the same. FMCG, Real Estate, Automobiles, and Education have more or less remained the top four categories, who cannot seem to do without Print.

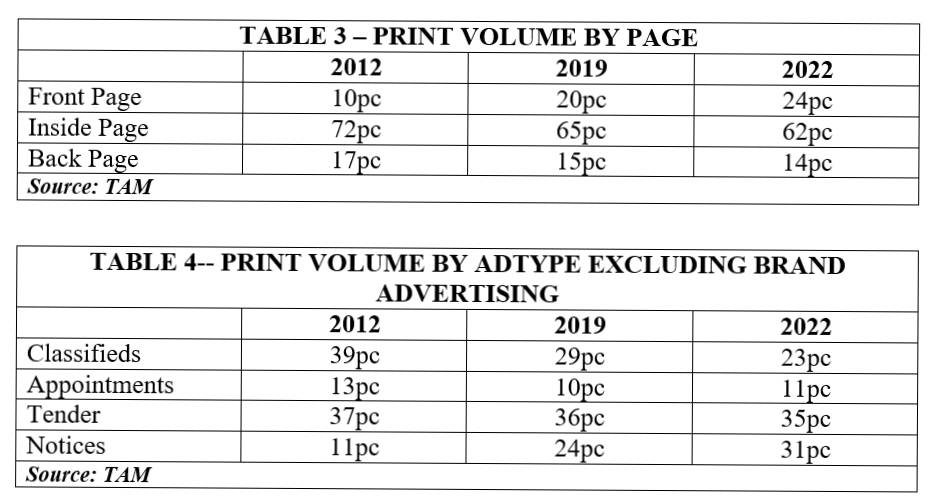

If you look at the figures by language you can see that over the decade not much has changed and Hindi, English and Marathi continue to be the 3 top languages for Advertisers. One significant change though that I noticed is that space consumed on the front pages has dramatically increased from 10pc to 24pc, showing the Advertiser’s desire to make a big impact through the use of Print or not use it at all. One not-so-surprising fact is that percentage of space occupied by Classifieds and Appointments, has dramatically come down from 39pc to 23pc but the contribution of Public Notices has gone up dramatically from 11pc to 31pc.

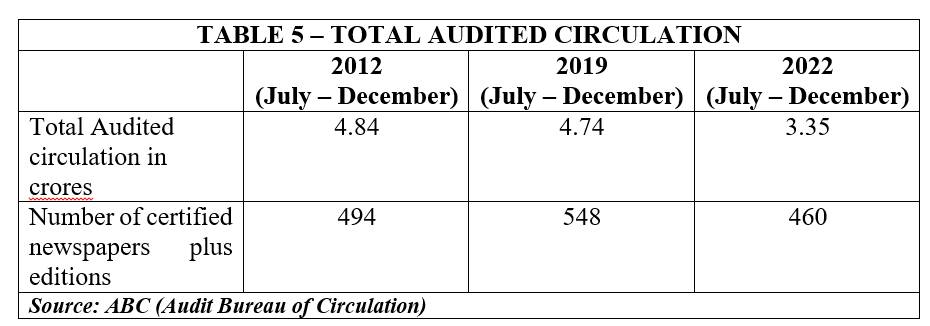

If I look at Audited Circulation figures provided, I see a rather sharp decline from 4.84 crores a decade ago to 3.35 crores today. Whilst the number of publications covered by this circulation have only marginally dropped, this steep drop may not be an accurate reflection of the true state of affairs, since many of my large Publisher friends go in and out of ABC as it suits them. I will not be able to comment on Readership, because IRS has still not appeared post Covid. Hearsay evidence seems to suggest that Readership which had declined drastically during the early months of Covid, is now almost back to its pre-covid level.

The question that arises in my mind is, why has India become the Global Capital for Print and what is it that makes our Advertisers flock to Print, whilst many other countries have deserted it.

- Print gives you instant high Reach in a day.

- Print seems to be indispensable when an Advertiser launches a new major brand, a new variant or wants to announce a special promotion or offer a greeting to its consumers on an auspicious day and of course our government loves Print to boast its achievements and flag off new roads, airports and public sector projects.

- Print is recognised by the reader as a more credible source for news, more credible than TV and Digital.

- Print is generally the entry point for new small Advertisers and there are lakhs of them in India and more appearing every day.

- The cost of entry into Print is relatively low, unlike in the Audio-Visual medium.

- For a TV plan with a high Reach objective, addition of Print can add significant Reach points by reaching Light TV viewers at lower cost.

A follow-up question that arises in my mind is what should Print do to continue the unique position it enjoys in India, compared to the rest of the world.

- A long time ago the ratio between Circulation Revenue and Advertising Revenue was 50:50. With a view to dominate the market and increase Readership to attract all the Advertising, some Publications began to alter the ratio, till it reached a ratio of 90:10 in favour of Advertising Revenue. Publishers must pull back on this ratio gradually to 60:40. Readers must be trained or persuaded to pay for credible news. Profit is for real. Circulation or Readership is for vanity. Some regional publications like Mumbai Samachar are doing this quite well.

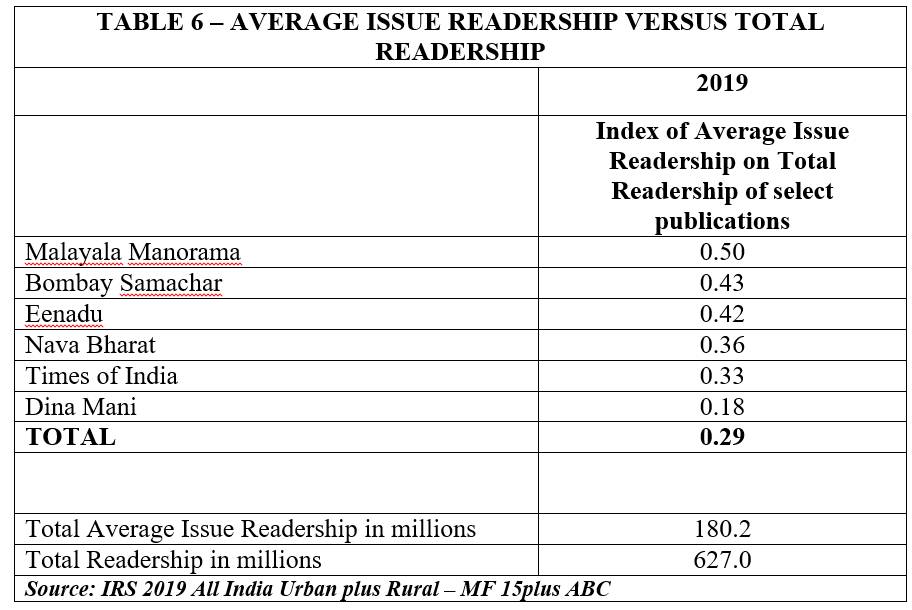

- Publishers are not able to give the benefit of their substantial Total Readership to Advertisers, since most Advertisers take only one or two insertions and thus get the benefit of only Average Issue Readership. To take advantage of the total Reach provided by the Publisher, an Advertiser needs to take at least 3-4 insertions. According to 2019 IRS, whist Average Issue Readership (AIR) for 229 publications is 180 million, the total Readership of all these publications is 627 million. This is because all Readers don’t read the same newspaper every day. So to persuade Advertisers to take 3-4 insertions for every campaign, publishers must incentivise them by giving them progressively increasing discounts for 2nd, 3rd and 4th insertion of the same Ad. This would persuade Advertisers to take more insertions, increase Reach of their message substantially and hopefully therefore increase sales, which in turn would lead to higher Advertising budgets in subsequent years. This is what I call an Upward Spiral which is necessary to keep the Publisher and the Advertiser growing.

- Most large Advertisers believe that newspapers are too expensive as a medium on a Cost per thousand to take multiple insertions and newspapers’ basic parameters are not suited to brand building. They argue that the Audio-Visual medium is a far more powerful Brand Builder that can tug at the consumer’s heart much better, which makes Brand message retention better. Yet, there are cases of many local and regional brands that have been built mainly with multiple insertions in Print, if not daily, at least weekly or fortnightly. These Brands have gone on to be bought by larger Companies making a small fortune for the Promoter. Publishers need to publicize and circulate such case studies among Advertisers.

- The fact of the matter is that every sphere of our lives, personal, professional, business, entertainment is getting digitised at a fast pace and whilst India was a late starter, it is now leading the world in Digitisation in many functions. So, the further rapid growth of Digital Adex is inevitable, though probably at a slower rate of growth than what we have seen in the last five Our publishers have already done a good job of launching digital versions of their newspapers and many web versions. The time has now come to promote them aggressively, offer a joint package for Print and Digital, offer Digital not on a CPM basis but on the same basis as Print edition, i.e. Universe basis and secure and further build on the Brand Equity of the newspaper title built over decades. This would also help them retain 100pc of what the Advertiser pays. Many print buyers (both Advertisers and Agency buyers), when they buy Print, buy it on the assumption that anybody who sees the newspaper will see their ad or have an opportunity to see it. Buying it for a selective target audience based on number of Impressions does not appeal to them. They will be happier to buy the web version on the same basis. IPL 2023 on Connected TV was sold on the same basis as Linear TV and it was a commercial success, despite the low Reach. Publishers should make available this option to their print sellers to sell to Traditional Print buyers at Agencies. This basis of selling would be more acceptable to the Print buyer and the not so savvy Advertiser.

Newspapers today are unable to monetise the huge number of Impressions generated by their web versions. Whilst there is wide variation between Comscore numbers and TAM numbers, even if you take the lower Comscore numbers they are mind boggling. Real or not, difficult to say. Compared to the reported astronomical number of Impressions, the Revenue they generate for the publishers is abysmally low. One estimate puts the total revenue gained by newspapers from their Digital version as Rs 423 crores which is a mere 2.3pc of Print Adex.

| Impressions | Impressions | Adex | |

| Comscore | TAM | Rs. | |

| 2019 | 2042 crore | 10,714 crore | 188 crore |

| 2022 | 4658 crore | 61,267 crore | 423 crore |

| Source: Comscore and TAM | |||

I expect Print Adex in India to continue its low growth trajectory over the next five years, as more and more new advertisers enter the fray and more new Brands get launched specially in Consumer Durables, Auto and Services. I would advise Advertisers to take an independent decision on when to use Print to take advantage of the Quick Reach and Impact it offers and take an independent view of Print in the Indian context and not avoid Print because it’s not the cool thing to do. Publishers need to get more innovative and bold and take risk in making commercial offers to Advertisers that they find attractive.

(The author is Chairman, Madison World. This article was penned for WARC. Reproduced with the author’s permission.)