The TAM AdEx-Television Advertising Report-XII, the twelfth report in the series of Television Advertising Report focuses on overall Advertising Snapshot in Jul-Aug’20*

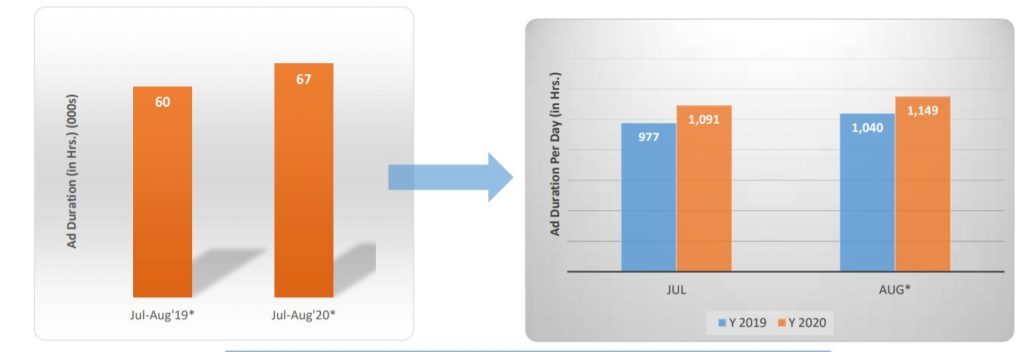

Advertising Volumes on Television: Jul-Aug’19* & Jul-Aug’20

11% rise in Ad Volumes on Television during Jul-Aug’20* compared to Jul-Aug’19*, in Jul’20 & Aug’20*, more than 10% growth seen compared to same period in year 2019.

New Categories and Advertisers on TV: Jul-Aug’20* compared to Jul-Aug’19*

Out of Top 10 new advertisers, 3 belonged to Ecom-Education category, Ecom-Payment Banks and Piccadily Agro were top new Category and Advertiser respectively.

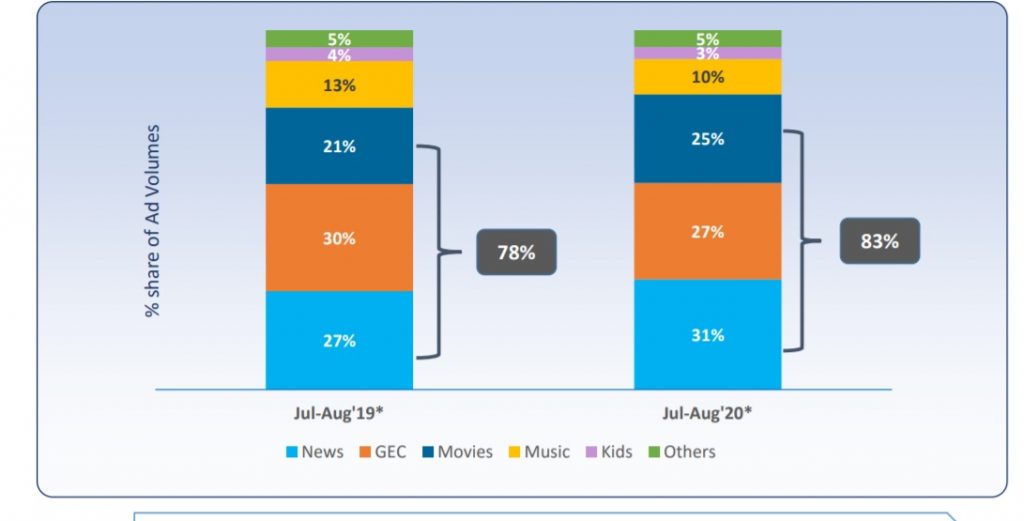

Channel Genres: Jul-Aug’20* vs. Jul-Aug’19*

Share of News and Movies genres grew in Jul-Aug’20* compared to Jul-Aug’19*, GEC, Music & Kids genre saw a decline in Ad Volumes’ share during Jul-Aug’20* over Jul-Aug’19*

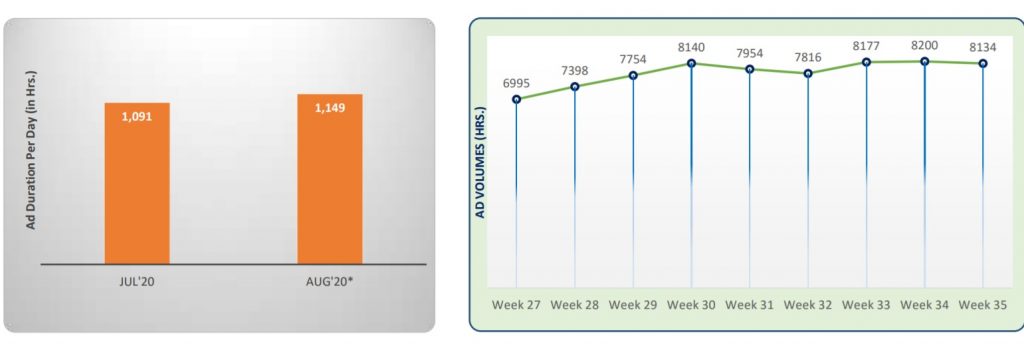

Y 2020: Last 2 month trends in TV Advertising

Advertising on Television during Jul’- Aug’20*

Highlights

3,000+ Advertisers and 4,600+ Brands visible across 370+ Categories, 67,000+ hrs. of advertising volumes on Television in Jul-Aug’20* and Ad Volumes per Day for Aug’20* grew by 5% over Jul’20

Week on Week Ad Volumes during Jul-Aug’20*

Ad Volumes almost stabilized during last 6 weeks; witnessed rise of 16% in week 35 compared to week 27, Ad Volumes per Day for Aug’20* grew by 5% over Jul’20.

Top Sectors and Categories: Jul-Aug’20

Sector ‘Personal Care/Personal Hygiene’ topped with 21% share followed by F&B Sector, the list of top 10 categories was dominated by FMCG sector and Top 50 categories holds 75% share of TV Ad Volumes

Leading Advertisers: Jul-Aug’20*

During Jul-Aug’20*, the Top 10 advertisers added nearly 50% share of TV Ad Volumes, HUL alone had almost 22% of the Ad Volumes’ share followed by ‘Reckitt’ with 10% share

Count of New^ Categories, Advertisers and Brands: May’20, Jun’20, Jul’20 and Aug’20*

Tally of new Advertisers and Brands had an increasing trend during Jul’20 to Aug’20*, while Aug’20* registered highest number of new Categories, Advertisers and Brands.

New^ Categories and Advertisers on TV: Jul-Aug’20* compared to May-Jun’20

Total 40+ New Categories & 1550+ New Advertisers seen in Jul-Aug’20* over May-Jun’20, Shaving System/Razor and Facebook Inc. were top new Category and Advertiser

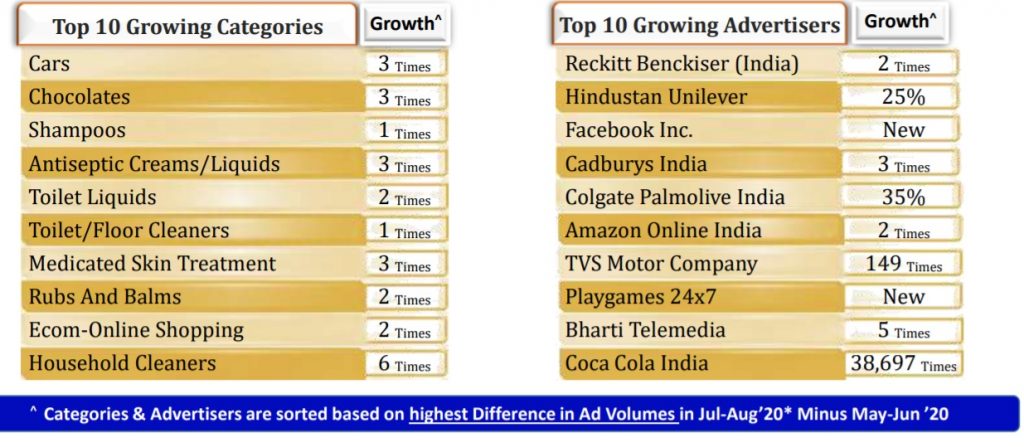

Top Growing Categories & Advertisers: Jul-Aug’20* vs. May-Jun’20

Category ‘Cars’ saw highest growth of 3 Times in terms of Ad Volumes closely followed by ‘Chocolates’. In list of top 10 growing Advertisers, Coca Cola India witnessed massive surge in Ad Volumes

Channel Genre wise exclusive Categories: Jul-Aug’20

News Genre topped with 31% of Ad Volumes followed by GEC (27%) and Movies Genre (25%), Total 50+ exclusive Categories were present in News Genre and 10+ in GEC genre

Advertising Trends on Retail Sector

Ad Volumes of Retail: Jun-Aug’20*

Ad Volumes on Retail Sector rose by nearly 3 Times in Aug’20* compared to Jun’20, Retail advertising saw an increasing trend during week 24-30 after which it declined for 2 consecutive weeks and peaked in week 33

Channel Genres: Retail (Jul-Aug’20*)

For Retail Sector, News Genre dominated the advertising with 59% share followed by GEC with 20% share during Jul-Aug’20*

Retail: Count of New^ Advertisers and Brands: Jun’20, Jul’20 and Aug’20*

Tally of new Retail Advertisers and Brands had an increasing trend during Jun’20 to Aug’20*

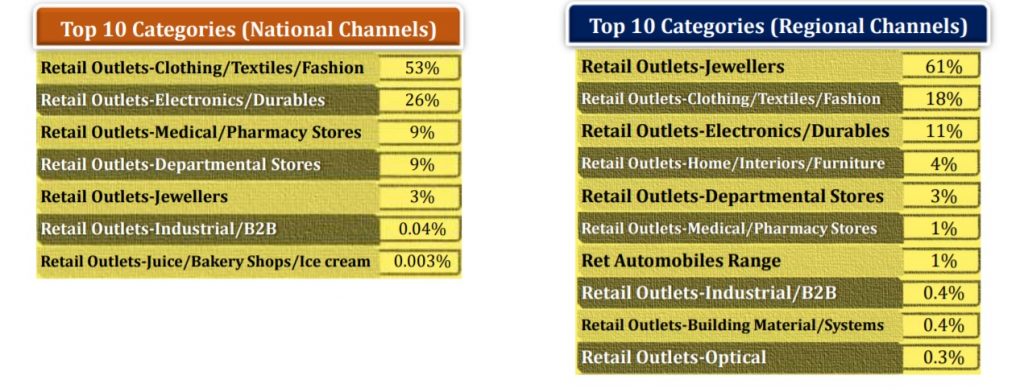

Leading Categories in Retail Sector- Jul-Aug’20* [For National and Regional Channels]

Category ‘Retail Outlets-Clothing/Textiles/Fashion’ topped with 53% share for National Channels, for Regional Channels, Retail Outlets-Jewellers led with 61% share of advertising volumes.

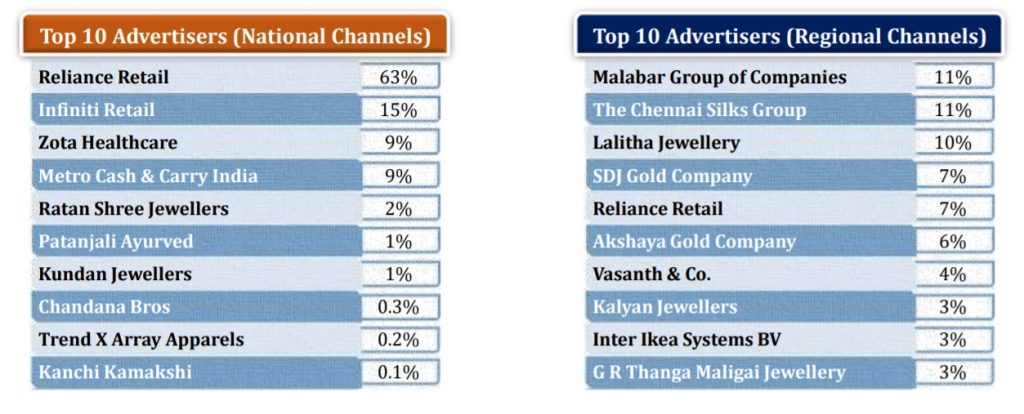

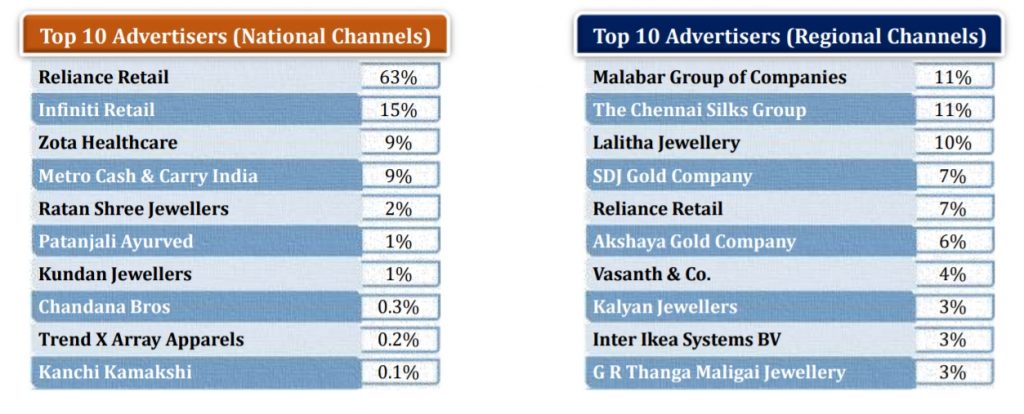

Leading Advertisers in Retail Sector- Jul-Aug’20 [For National and Regional Channels]

Reliance Retail dominated Retail advertising on National Channels with 63% share, for Regional Channels, Malabar Group and The Chennai Silks were neck to neck on Top 2 positions with 11% share each.

New^ Advertisers and Brands on Retail: Jul-Aug’20* compared to May-Jun’20

Total 120+ New Advertisers & 130+ New Brands seen in Jul-Aug’20* over May-Jun’20 Reliance Retail was the top new Retail Advertiser and its brand Reliance Trends topped in the new brands’ list.