DigiXpressions offers digital advertising and marketing solutions. Driven by its vision to fuel business growth, the company offers a comprehensive host of services, ranging from digital intelligence and performance marketing to branding assistance, MarTech, and hyperlocal solutions. Specialising in Fintech, E-commerce, banking, and Edtech, DigiXpressions has clientele including RBL Bank, Shrekhan, ICICI Bank, UpGrad, Angel Broking, and Kotak Securities, to name a few.

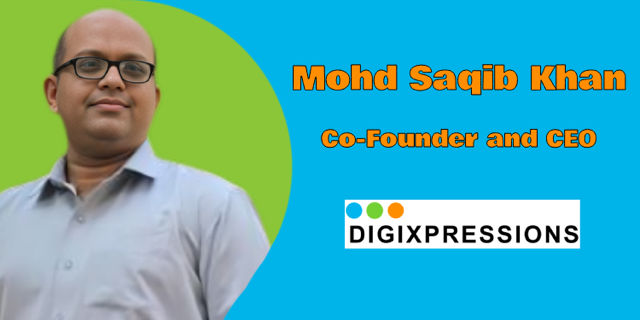

The company is the brainchild of Vinay Singh and Mohd Saqib Khan. Two individuals have been working on their dream project, together making strides in digital advertising and marketing domain. Within a span of less than five years, the team size has increased to more than 100 employees working for more than 50 clients across 10 sectors. The team comprises of strategic thinkers, technology enthusiasts, and seasoned marketers, bringing years of professional expertise to the

With a focus on small to mid-sized businesses across diverse industries, the company explains that it caters to those aspiring for accelerated growth and a fortified digital presence, Digixpressions has carved a niche in data analytics and insights.

Medianews4u.com caught up with Mohd Saqib Khan, Co-Founder and CEO of DigiXpressions:

What factors have led to DigiXpressions growing its client list to over 50 in five years?

DigiXpressions has grown its client list over the last five years by delivering innovative digital marketing solutions tailored to each client’s unique needs. The agency’s expertise in Technical SEO, Intent based content marketing, performance marketing, influencer marketing, Mid Funnel Buying and data analytics has allowed it to drive significant growth for clients across industries like fintech, e-commerce, healthcare and edtech. Thus, our marketing campaigns have been channelised in a way that it leads to new consumer acquisition and deepening relations with consumers, along with lending growth and brand building.

Our marketing campaigns have led to asset creation for data, offering insights into customer behaviour, preferences, and trends.

In 2024 what are the focus areas?

In 2024, DigiXpressions’ focus areas include expanding its presence in the fintech, e-commerce, healthcare and edtech sectors, using hyper-personalisation, customised marketing strategies, creating meaningful messaging and leveraging emerging technologies like AI and AR/VR to create immersive experiences for clients. We envision our clients to stay ahead of the curve in a cookie less world, by helping brands comply with evolving privacy regulations.

Is hyper personalisation a key theme being played out in 2024?

Yes, hyper-personalisation is a key theme for DigiXpressions in 2024, as the agency helps clients tailor their strategies to best their consumers. Targeted consumer marketing today is the best way to reach out to consumers in a more focused way, which leads to better results in lesser turn around time.

By utilising AI and machine learning to analyse customer data, we craft highly targetted and relevant content that creates deeper connections between brands and consumers. This approach enhances engagement, conversion rates, and customer loyalty, allowing businesses to deliver personalised experiences that resonate with individual preferences and needs across social media platforms.

What are the other themes being seen in digital marketing?

Other key themes in digital marketing that DigiXpressions is addressing include the rise of social commerce through “Social Selling Strategies”, the growth of regional social media platforms alongside giants like Facebook and WhatsApp through “Regional Reach”, and the surge in digital ad spending expected in India by 2030 through “Digital Dominance”

The agency among other things works in the financial influencer area. With strict SEBI guidelines how do you see finfluencers being impacted?

With stringent SEBI guidelines in place, financial influencers are becoming increasingly cautious in their social media activities. Influencers with large followings are making extra efforts to comply with SEBI’s recent restrictions on their practices.

Many consumers have faced difficulties in wealth creation due to the influence of these finfluencers, prompting a need for greater responsibility. Consequently, finfluencers must now exercise greater care and adhere strictly to SEBI’s regulations to avoid potential issues.

How does the agency help brands across categories like edtech, e-commerce, fintech, healthcare tailor and adapt their strategy to best suit a social media platform like Instagram, YouTube?

Our expertise in SEO, performance marketing, influencer marketing, and data analytics enables brands in sectors such as edtech, healthcare, e-commerce, and fintech to develop highly targeted and impactful social media strategies that deeply resonate with their target audiences.

We provide innovative, data-driven, and customised digital marketing solutions that enhance a company’s online presence. Additionally, we help in designing impactful websites and campaigns that align with brand objectives and business goals.

As we move to a cookieless world how is the agency helping clients comply and not intrude on consumer privacy?

As the digital landscape evolves towards a cookieless future, DigiXpressions is guiding its clients to navigate this transition effectively. By using first-party data and advanced contextual targeting, the agency is helping businesses deliver personalised experiences while ensuring compliance with evolving privacy regulations.

DigiXpressions’ strategies emphasise comprehensive data collection, privacy-safe measurement, and AI-powered optimisation across channels like paid search. This holistic approach enables clients to thrive in the post-cookie era by maximising the value of their first-party assets and adapting to the new realities of digital marketing.

How is the agency using AI to deliver better solutions to clients?

DigiXpressions is maximising advanced AI and machine learning technologies to enhance its data analytics capabilities. By harnessing the power of generative AI, we analyse vast amounts of data from multiple sources, identify patterns and connections, and generate customised insights to optimize marketing strategies and deliver better results for its clients.

Could you give examples where the agency has used AR, VR to deliver immersive experiences for clients?

AR/VR is still in its early stages in India, but it holds the potential to revolutionise digital marketing in the coming years. Although it will take some time for AR/VR to become a substantial segment in marketing, it is already gaining traction in the real estate and e-commerce sectors.

However, in finance and edtech, it will take longer to see significant adoption. When the time is right, Digixpressions will seamlessly integrate AR/VR into fintech marketing, staying ahead of the curve and enhancing the digital marketing experience.

What strategies work best to counter ad fraud in fintech?

As digital integration in financial services increases, so does the incidence of fraud in the fintech sector. It is crucial for companies to adhere to regulatory guidelines, maintain transparency, and handle consumer data with utmost care.

To combat ad fraud in fintech, DigiXpressions employs robust strategies, including third-party verification, advanced fraud detection algorithms, and stringent brand safety measures, ensuring the integrity of our clients’ campaigns.

In fintech is long form content usually more effective that short form content in demystifying complex concepts?

In the fintech sector, DigiXpressions has found that long-form content is often more effective than short-form content in demystifying complex financial concepts and building trust with consumers. By providing in-depth, informative articles and guides, we help Fintech clients educate our audience on topics like investment strategies, personal finance, and financial planning.

This approach allows a more comprehensive explanation of intricate topics, addressing common pain points and concerns in a transparent manner.