Recently TAM shared its report on Mirroring 2020 for Advertising in Music Genre. The report talked about, Advertising Trends in Music Genre, the Share of Music genres in overall TV Advertising, Top 5 Subgenres of Music, Leading Sectors, leading categories in the music genre, and many more.

Advertising trend in Music genre witnessed 7% drop in 2020 compared to 2016. Drop increased to 14% when compared to Y 2019. Highest growth in Ad Volumes observed in Y 2018 compared to Y 2016. Resurgence in Ad Volumes seen on Music during 3rd and 4th quarter i.e., Unlockdown period after a drop in the 2nd quarter due to Lockdown.

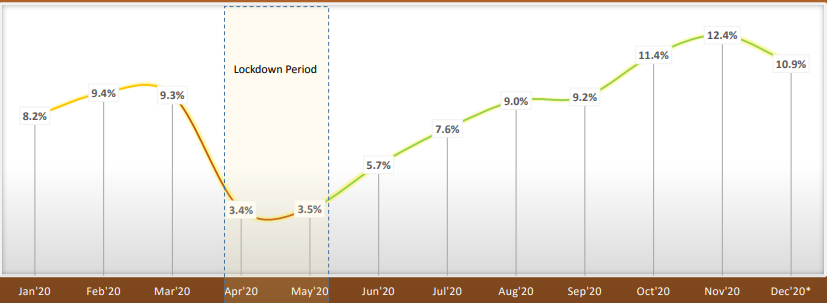

Whereas in the monthly Trend of Avg. Ad Volumes/Day on Music genre reached to Pre-Lockdown level just within 4 months of post Lockdown period. During festive period i.e., Oct-Dec’20, average Ad Volumes/Day on Music genre had double-digit share. Dettol Antiseptic Liquid was the top brand during Sep’20, Oct’20 & Nov’20 in Music Genre. In 2016 we saw highest share of Ad Volumes i.e., 14% in Music genre followed by 2017 & 2018 with 13% share respectively.

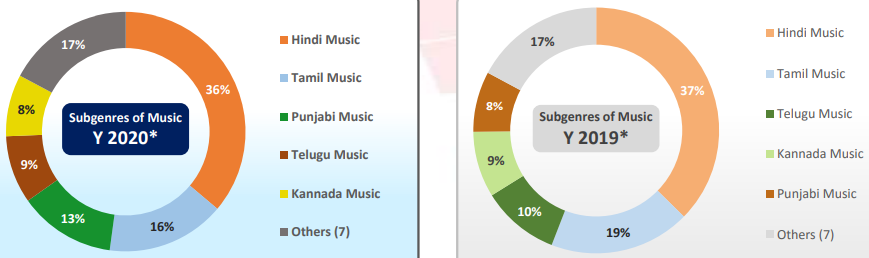

In the Top 5 Subgenres – Hindi Music & Tamil Music were the Top 2 subgenres during both 2019-20. Among the Top 5 subgenres, Punjabi Music observed positive rank shift in 2020. whereas Top 5 channels genres accounted for more than 80% share of Ad Volumes during both the periods.

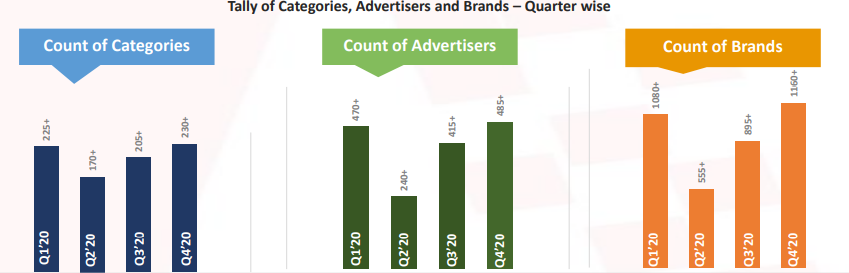

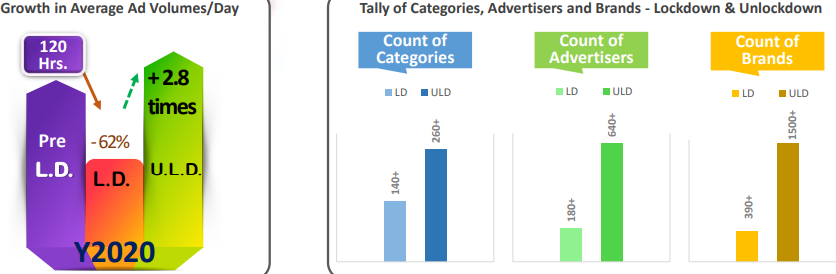

The Tally of Categories, Advertisers and Brands in Music genre Count of Advertisers and Brands dropped by 51% in Q2’20 which recovered by more than 2 Times respectively in Q4’20 over Q2’20. And the Tally of categories, advertisers and brands started increasing during unlock down period (Jun-Dec’20) after deep in Apr-May’20 due to lockdown.

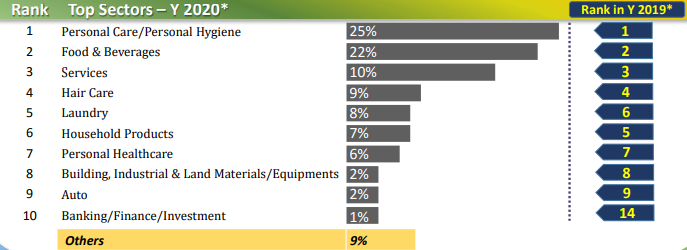

In the Leading Sectors of Music genre, Personal Care/Personal Hygiene sector topped with 25% share of Ad Volumes followed by F&B with 22% share. The top 3 sectors together added 57% share of Ad Volumes in 2020 which were also on top during 2019. Among the Top 10, the Banking/Finance/Investment sector was the new entrant and Laundry observed a positive rank shift.

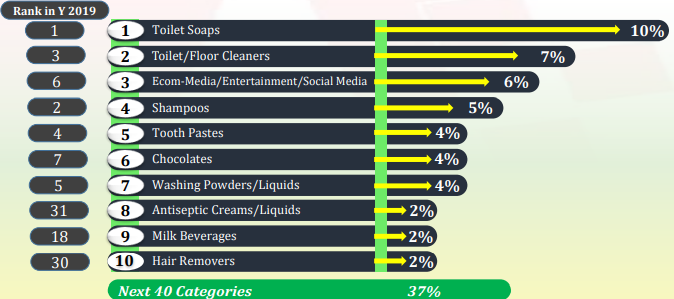

Whereas in leading categories, the Toilet Soaps category led the Music genre with 10% share of Ad Volumes in Y 2020. It was also 1 st in Y 2019. 3 out of Top 10 categories belonged to Personal Care/Personal Hygiene sector. Antiseptic Creams/Liquids, Milk Beverages & Hair Removers were the new entrants in the Top 10 categories’ list. Toilet/Floor Cleaners, Ecom-Media/Entertainment/Social Media & Chocolates observed Positive rank shift.

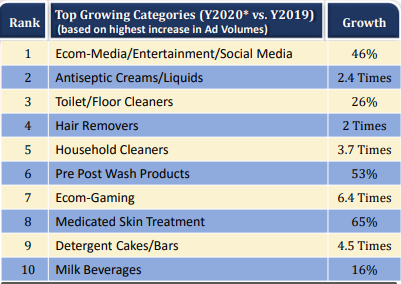

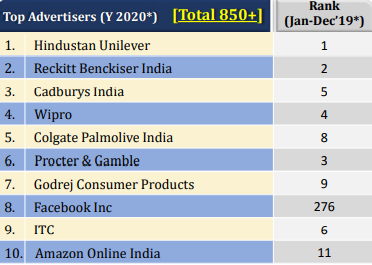

In the Top Growing Categories, 105+ Categories registered Positive Growth. Where Ecom-Media /Entertainment /Social Media saw highest increase in Ad secondages, followed by Antiseptic Creams/Liquids during Y 2020 compared to Y 2019 in Music Genre. And in leading advertisers HUL topped among the Music genre advertisers followed by Reckitt Benckiser on 2nd position during Y 2020. Both were also Top 2 in Y 2019. Facebook & Amazon were the new entrants in Top 10 advertisers’ list.

In the Exclusive^ Advertisers in the Music Genre 70+ advertisers advertised exclusively in Music genre during Y 2020; Hoichoi Technologies being the top among them followed by Sri Ram Tutorial College. And in Leading Brands, Dettol Antiseptic Liquid was the top brand in the Music genre during Y 2020 followed by Dettol Toilet Soaps. Top 10 brands together added 15% share of Ad Volumes during Y 2020. 6 out of the Top 10 brands were from Reckitt Benckiser, viz Dettol (2 brands), Lizol, Vanish, Harpic and Veet.

National TV Advertisements means airing or telecasting of an advertisement on a National television channel – that is visible nationwide and are broadcast in national or international languages like Hindi or English. Regional and National channels had 63% and 37% share of Ad Volumes during Y 2020. HUL & Reckitt Benckiser were among the Top 2 advertisers on both Regional and National channels during Y 2020. Share of Ad Volumes on Regional Music channels marginally increased by 1% in Y 2020.

Unlockdown Period saw 120+ Hours of Average Ad Volumes/Day 2.8 times more compared to Lockdown Period. The Tally of Categories grew by 86% whereas that for Advertisers and Brands rose by more than 3 times during the Unlockdown period.