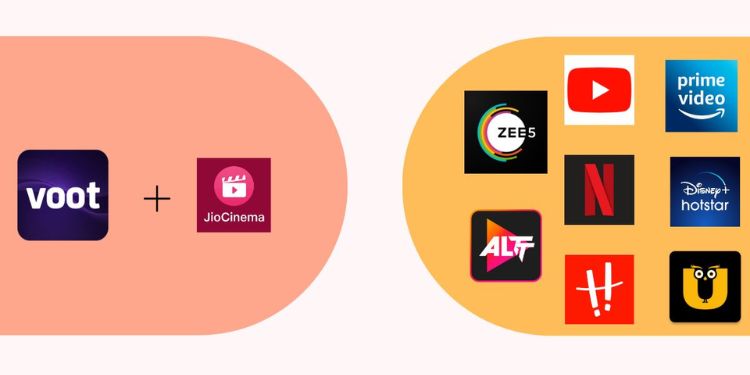

The digital content marketplace in India is likely to witness the entry of an aggressive OTT player in the second half of 2023, according to a recent Media Partners Asia (MPA) report. The proposed SVOD brand from Reliance Industries will be an outcome of a merger of existing platforms Jio Cinema and Voot.

Presently the OTT space in India is dominated by international streaming giants like Amazon Prime Video, Disney+ Hotstar, Netflix, desi players like ZEE5, SonyLIV, MX Player and regional platforms like hoichoi, aha and neestream.

According to Statista, revenue in the SVOD segment is projected to reach US$1.7 bn in 2023 with an annual growth rate (CAGR 2023-2027) of 13.03 pc, resulting in a projected market volume of US$ 2.77 bn by 2027.

In terms of market share, Justwatch estimated that Disney Hotstar stood on top of the OTT charts with 28 pc as of the fourth quarter of 2022, followed by Prime Video at 21 pc, while Netflix and ZEE5 had 11 pc each. The combined share of Voot and Jio Cinema stood at 11 pc, which does not account for Jio Cinema’s growth via IPL 2023 that has just kicked off.

Could the new entity trigger a new OTT content war? Can the OTT industry, which is already under cost pressures following intense customer and content acquisition battles, accommodate one more giant? Is consolidation inevitable?

We asked some experts: Will the entry of Jio’s new SVOD platform (expected in H2 2023) impact the ARPU of streaming platforms? Will they be able to overcome the challenges of growing content cost? Will AVOD be able to fill revenue gaps?

Expect consolidation in the long term

Jio with the kind of access to content it has through Network 18, Viacom and across different genres be it originals, movies, sports, reality shows is going to be a strong contender in the SVOD space. At the same time, the consumer has a finite wallet and is price conscious so he will subscribe to only those few platforms who fulfil his/her content consumption needs. In the long term a bit of consolidation is expected.

On growing content cost

Jio is in the game of digital content dissemination long term and they should be able to navigate the initial cost which won’t be proportionate to revenues. Also, with economies of scale across media businesses they should be able to control their content creation costs.

Will AVOD fill revenue gap?

The AVOD funnel is the entry funnel. The current growth of video streaming is due to increasing internet usage by news users from Tier 2/3/rural markets and for that reason currently advertisers pay more than subscribers. This AVOD model will further grow as penetration increases and consumers sample streaming platforms. Will it fully fill the revenue gap or not will depend on the content creation and acquisition cost, which if kept in balance a hybrid model should work.

– Girish Upadhyay, CMO, Axis My India.

ARPUs of current players should not be impacted

Reliance is known to disrupt markets by very aggressive pricing in whatever category they enter. So it’s expected that they would enter the market at rock bottom subscription prices. However, when it comes to streaming platforms, they are subscribed to by consumers because of the content they provide. So it’s unlikely that consumers who are already subscribing to certain platforms will unsubscribe them just because another platform is offering a lower subscription rate. The possibility that people will subscribe to Reliance Jio SVOD over and above their current subscription is higher. This means that ARPUs of current players should not be impacted too much.

Will AVOD fill revenue gap?

AVOD revenues should be on the rise with more people getting onto them. To what extent is a difficult question to answer as there is no third party currency available at the moment to check RoI. So the revenue depends on how well the sales teams are able to monetise basis first party measurement.

– Ashish Karnad, EVP – Media & Digital Practice, Hansa Research.

Jio may look to have a two-pronged model

Cricket has been a crowd puller in India. However with the marquee property IPL being offered free of cost by Jio, it remains to be seen if Jio is able to convert a part of the consumers of its AVOD platform to SVOD, when they are ready to launch in H2 2023.

Viacom is steadily picking up broadcast rights across other sporting events like Laliga, 2022 FIFA World Cup and Abu Dhabi T10 cricket, among others.

In telecom, after a period of free usage to attract subscribers, Jio converted to charging for the use of telecom services. We are likely to see something similar here with OTT, where Jio will try to round up a larger base of users for the free streaming of IPL across the different town classes in India. It however remains to be seen how many they will convert to subscriptions with the kind of content they are able to offer.

As a mantra to win in a country like India, Jio may look to have a two-pronged model of AVOD & SVOD, with some special content access on SVOD. This will likely help offset some of the rising content costs needed to retain customers.

– Jyoti Malladi, Group Service Line Leader Brand Health Tracking (BHT) and Creative Excellence, Ipsos India.

May drive down ARPUs initially, but will benefit ecosystem in long run

India has a thriving OTT market with over 40 active players that cater to diverse tastes and preferences, offering content in various languages and genres. However, the market is overcrowded and already under revenue pressure, and Jio’s new SVOD platform may exacerbate this by driving down ARPU for other players.

According to some reports, Jio, along with Amazon Prime, is a front-runner to secure HBO’s content library after Disney+ Hotstar’s deal with Warner Bros. Discovery ended. With access to content from Paramount+, Voot’s local content and streaming rights for IPL, Jio’s offering is incredibly attractive to consumers.

Subscription fees for OTT services in India are relatively lower compared to western markets, with most services priced at less than Rs.200 per month. This has resulted in price becoming a key differentiator in the Indian OTT market. As per the Ormax OTT Audience Sizing Report 2022, each OTT paying customer in India subscribes to an average of 2.4 services.

Therefore, Jio’s entry into the market may decrease the market share for existing OTT players as consumers switch to the new service. However, in the long run, Jio’s offering (of free IPL streaming) could bring more customers to the overall market, some of whom may migrate to SVOD, thereby benefiting the entire ecosystem.

On growing content cost

As the OTT market continues to grow, an increasing number of platforms are competing for viewers’ attention. To remain competitive, these platforms must create high-quality and distinct original content that stands out from the rest.

However, this often requires large production budgets, which is challenging to sustain in an environment where production costs are rising while revenues are not keeping pace.

To overcome these, I anticipate two developments in the near future.

Firstly, we are likely to see consolidation in the OTT space as companies seek to combine resources and content libraries to attract and retain customers. Although this may not significantly reduce production costs, it can help companies better compete with larger players in the market.

Secondly, OTT platforms will need to identify alternative monetisation strategies beyond the traditional subscription and advertising models (SVOD and AVOD). For instance, an OTT player could license their original content to a TV network or another company as a means of generating additional revenue. This would not only increase the platform’s revenue stream but also provide an opportunity to reach new audiences and expand their brand reach.

Will AVOD fill revenue gap?

AVOD allows OTT players to generate revenue by displaying advertisements to users while they stream content, which can be a more accessible model for users who are not willing to pay for subscriptions or individual content.

However, AVOD can be a challenging revenue model to implement effectively, as OTT players must balance the need to display ads with the user experience and the risk of driving users away with too many ads.

Furthermore, AVOD may not be a viable option for all OTT players, as it requires a large and engaged user base to generate significant advertising revenue.

– Vishal Rupani, Ex Co-founder and CEO, mCanvas.

India doesn’t have the problem of paying for quality content

There is a very high likelihood of the ARPU getting impacted. However, it is also dependent on the quality and range of content Jio X Voot offers on the SVOD platform. The recent rise of Hotstar, Netflix, and Prime Video subscriber base goes on to establish that India doesn’t have the problem of paying for quality content. So ARPU on the streaming platform is influenced by marquee properties and shows that attain virality.

On growing content cost

The growing cost is hampering the ability to produce a fresh and exciting line of content. However, currently, Voot has content IPs like Roadies, Splitsvilla, Bigg Boss, and India’s Top Model which can attract SVOD consumers. If they balance monetising existing content and the production of new exciting content, they will be able to overcome the challenge with the help of a rich content base of Voot.

Will AVOD fill revenue gap?

India is a country that enjoys free streaming – in 2019 streaming on Jio and Hotstar for free was the most viewed IPL till date.

AVOD opens the door for ad revenue thus supporting content production of other genres.

Ad revenue has been a major income for OTTs. Hence opening up AVOD will help fill the revenue gap.

– Aruni Panda, Vice President – Digital, Carat India.

Feedback: [email protected]