The COVID-19 pandemic has been a stressful time and as we navigate the new normal, anxiety about health, social isolation, working remotely, dealing with home-schooling children, life after lockdown, job security, and not to mention the day-to-day financial worries are top causes of stress and it’s today taking a toll on people’s physical and mental well-being more than ever.

The Insurance Sector has been in the forefront when it comes to launching of new schemes which have used an emotional connect to connect with their customers.

‘Tension se Azadi’ by Aegon Life and ‘Shagun- Gift an Insurance’and other insurance plans targeted at kids were launched by SBI General Insurance during this Pandemic.

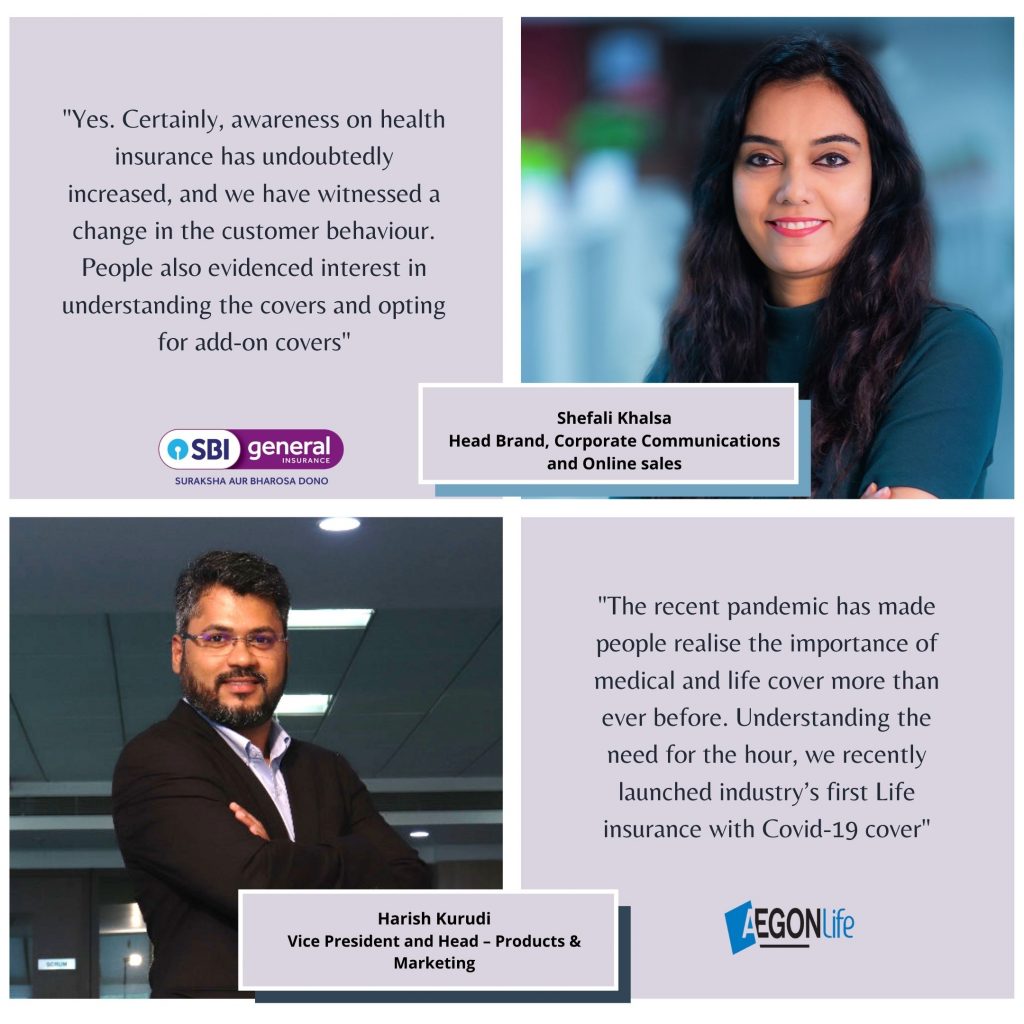

MediaNews4U spoke exclusively to Harish Kurudi, Vice President and Head – Products & Marketing, Aegon Life Insurance & Shefali Khalsa, Head Brand, Corporate Communications and online sales of SBI General Insurance Company on the general trend in the Insurance Sector and specifically on the launch of their new schemes…….

In this pandemic are we seeing a spike in people buying Insurance not only for self but family as a whole. Is there a spike in Medical Insurance as well?

Harish: The recent pandemic has made people realise the importance of medical and life cover more than ever before. Understanding the need for the hour, we recently launched industry’s first ‘Life insurance with Covid-19 cover’. The Life insurance with Covid-19 cover covers the hospitalization expenses of up to 5 lakhs if the policyholder tests positive for Covid-19. In case of the unfortunate demise of the policyholder due to Covid-19, life cover can be availed from the base term life insurance plan. Life insurance with Covid-19 cover is exclusively available on Flipkart and Flipkart customers can buy the cover with just a click of the button in the safety and security of their homes. Yes, people are buying and also recommending this product to their families and friends alike.

Shefali: Yes. Certainly, awareness on health insurance has undoubtedly increased, and we have witnessed a change in the customer behaviour. People also evidenced interest in understanding the covers and opting for add-on covers. During the initial period there was an increase in the number of queries received on the coverage under the policy.

During this crisis how have you stayed engaged with your customers, agents and business partners?

Harish: Aegon Life is the pioneer of digital insurance in India. Most of our sales and customer engagement activities were online even before the pandemic hit us. Hence, during this crisis we did not have to adopt new strategies to suite the new normal. Our processes are online, from buying the policy, claim settlement, medical tests, contacting our customer care executives, etc.

Shefali: Being part of the essential services segment and as a responsible player, there are huge expectations from us and fulfilling those mandates for our employees, customers, distributors, intermediaries, vendors, and society at large is the foremost challenge.

At SBI General, People First and Customer-Centricity are at the core of everything that we do. Amongst all other stakeholders, they continue to be at the centre of our robust Business Continuity Plan (BCP) as well.

The primary mantra has been simple: Communicate; communicate; Communicate.

We got in touch with all our stakeholders, customers, agents and partners, reassured them of our presence. We shared all the digital touch points that we were available on. We were already at the forefront of digitization and ramped up our digital infrastructure to help BAU remain uninterrupted.

Overall, in the first quarter, the entire industry witnessed an overall business loss. However, the health insurance segment had seen an accretion in business numbers.

On the other hand, the Ministry of Home Affairs /government also made it mandatory for all business entities to have mandatory health insurance for its employees as a part of the unlock down plan. Arogya Sanjeevani, a standardized health product was launched at an appropriate time. These are providing the necessary boost needed for the traction in health insurance.

How have you engaged your employees to keep themselves motivated and on a personal level what was your motivation and go to activity?

Harish: The new normal has not been easy on the employees. The line between personal and professional life has diminished due to WFH, the employees need better policies to maintain the work-life balance. At Aegon Life we are evaluating WFA (Work from Anywhere), which enable the employees to work at the environment of their ease post pandemic too. We also do not encourage employees to schedule meetings post 6:30 PM, to maintain the work-life balance. We also ask our employees to not be apologetic for the background noise at home, while on the call or meeting.

We recently organized our first virtual Red Carpet Awards, to commemorate and celebrate the hard work of Aegon Life employees, which is usually organized at a physical venue each year.

Shefali: We as an organisation have been sensitive to such situations in the current context and have taken some proactive steps to ensure seamless transition to the new situational demands. Again for our employees, be believed in Care, Communicate & Engage. We have provided our people with all the required tools and facilities to work effectively in the Work from Home scenario. We have created a structured web engagement framework to keep employees engaged. While we were early adopters of online learning and mobile engagement and already had a robust utilisation background, we have upgraded the same to ensure that it caters seamlessly to the challenging demands of the times.

We also enhanced the engagement quotient of our L&D interventions keeping in mind the Work from Home situation and the monotony that it might slowly breed. We clearly defined work streams and productivity expectations and all these efforts were and still are motivating the workforce positively in coping with the transitioned environment more effectively.

In the new normal where digital has become a way of life will you focus more on going digital? Will traditional mediums also have a play in these campaigns?

Harish: As mentioned earlier, digitalization has always been the centre of focus. We had digitized all our processes way before the pandemic. We were never too reliant on the traditional means for our marketing campaigns, our marketing campaigns are the mirror image of our focus on digitalization. Most of our marketing campaigns are on the digital platforms, as it reaches the intended target audiences. Digitalization has always been the way of life at Aegon Life.

Shefali: From a Marketer’s point of view, the marketer’s will continue advertisements on all possible platforms with a right media mix. While the market may take time to get back to normal, but eventually, everyone is craving for normalcy. In just 2 months down, we have seen quite a change in the push and pull advertisements by several e-commerce brands. For GI, usually DJFM is the key period to cascade any campaigns, and we shall soon see a spike in media spends around this period. However, I would say, with the learning’s of these couple of months, all brands will certainly be leaned towards digital marketing and non-face-to-face sales modules.

All brands have been able to strengthen their digital assets and presence, as the world has now been connected just virtually.

Interestingly, all social media platforms have their own DNA and while Instagram is more pictorial along with content. SBIG has taken up the route of usually posting creative that interest netizens, and stories as UGC content. Live videos on Instagram has also seen good traction. In fact, the best thing about all social media platforms is that there is a constant improvement/addition of features.

Even Instagram has evolved from only creative to 15 seconder videos, to full 60 seconds videos, and now live videos. This allows the brands to take up newer campaigns. We did see a rise in the number of followers last month by 21%, purely because of campaigns. Also, some topical posts as well as a product launch has seen an engagement of about 50-60% rate. Facebook, Instagram& Twitter are the most common platforms to connect our customers and prospects.

What is going to be your strategy for the coming festive season?

Harish: The festive season is around the corner, lifestyle choices play a major part in the health and wellbeing of a person. This has led to the increase in the number of cases for lifestyle diseases. To ease out the financial burden off our customers, we will soon launch a new critical illness cover, which will cover the majority of lifestyle diseases. The healthcare expenses for such illnesses is exuberant, we aim to ease out the financial liability which arise due to critical illnesses.

Shefali: October month is full of festivities and which brings positive vibes. We usually align our social media campaigns with festivities and topical days. Apart from that, OND being the third quarter is usually a very important period to cascade campaigns for customers as well as channel partners.

Aegon Life has launched many campaigns during this crisis, also special campaigns for Mother’s Day, No Tobacco Day, what led to these campaigns?

Harish: Oh yes, during the lockdown, we also saluted the selfless efforts of our doctors and healthcare workers for the fight against the virus through our campaign ‘An ode to the doctors’ The present social scenario has always been a big influence on our marketing campaigns and these times of crisis has not been any different. During the time of this pandemic, with our marketing campaigns we have tried to spread information on how one can safeguard them from the present prevalent pandemic. Quit smoking clause is a big part of our flagship product iTerm life insurance, through which a policyholder can opt for lower premiums once he/she quits smoking. Through our products and campaigns, we try to encourage people to opt for a healthy lifestyle and stay fit.

Your campaign talks about psychological stress faced by young children, how is it linked to insurance?

Shefali: Soon after the pandemic, we noticed that working parents were confronted with a number of challenges. The line between work and personal life had blurred. During stringent lockdown, besides 8 hours of work, parents were also challenged to do household chores. We were well aware about the mental stress that the ‘new normal’ had created for everyone. It was obvious that if parents were undergoing stress then so were their children. Young children may not be articulate enough to speak about their stress; but instead vent it through their actions. In absence of nurturing an ecosystem of friends and play time, their emotional well-being was strained.

Keeping all these in mind, for our internal as well as external stakeholders, we had organised an engagement talk with Dr. Shefali Batra, Founder and Psychiatrist, MINDFRAMES. She shared insights on the likely psychological stress that kids were undergoing during lockdown and how it can be responded to.

This did help our working parents to keep check on their emotional thermometer, while also help their kids to process the external environment and adapt to different routine. (Source – https://www.youtube.com/watch?v=QbNuHMr0ybY Shefali Batra YouTube video)

It was not related to business but empathy was the need of the hour and we thought of doing our bit in the domain.

Was there a survey or research and who is your Target Audience?

Shefali: Yes, we strongly believe in taking the ground reality in consideration by a detailed survey. Even for the new brand identity we had conducted a detailed research to understand our brand’s perception at ground level.

Overall, with the reach and brand identity of SBI, we have witnessed high affinity in metros, tier I, tier 2, tier 3 and beyond cities as well.

Your product – ‘Shagun- Gift an Insurance’, your thoughts on this?

Shefali: Shagun is a unique offering by SBI General. In our Indian culture, we often celebrate our milestones or auspicious occasions by gifting either something or an envelope of money. This gesture is synonymous with well wishes and good luck. At SBIG, we ideated “Shagun” as a valued gift of security to be positioned for such kinds of gestures. The premium of the product has also been designed at Rs. 501, 1001, 2001. Thus, not just the name “Shagun” but also the premium amount has a touch of our Indian tradition. Shagun can be gifted to anyone viz your family, friends, extended family and even domestic helpers, drivers, cooks etc., and on any occasion like passing an exam, buying a new car, new home, birthdays, marriage, anniversary, buying a new bike, college admission, etc.

Shagun is a unique product that allows you to give insurance as a gift, which otherwise is not allowed as per insurance guidelines. This product was shaped as a part of Sandbox Idea approved by the regulator.